Question: please give me the right answer my work mode : This shows what is correct or incorrect for the work you have completed so far.

please give me the right answer

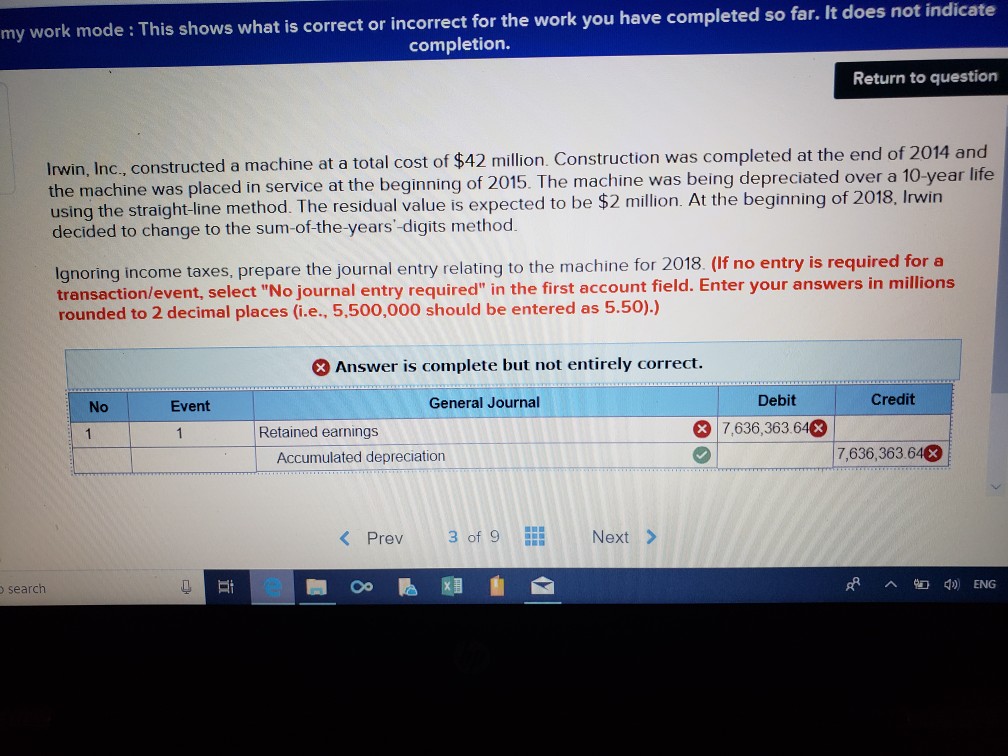

my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicat completion. Return to question ucted a machine at a total cost of $42 million. Construction was completed at the end of 2014 and Irwin, Inc., cons the machine was placed in service at the beginning of 2015. The machine was being depreciated over a 10-year life using the straight-line method. The residual value is expected to be $2 million. At the beginning of 2018, Irwin decided to change to the sum-of the-years-digits method. tr lgnoring income taxes, prepare the journal entry relating to the machine for 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Answer is complete but not entirely correct. General Journal Debit Credit No Event Retained earnings 7,636,363643 Accumulated depreciation 7,636,363.64 search Ei ENG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts