Question: please give step by step answer Suppose that the LIBOR/swap curve is flat at 6% with continuous compounding and a five-year bond with a coupon

please give step by step answer

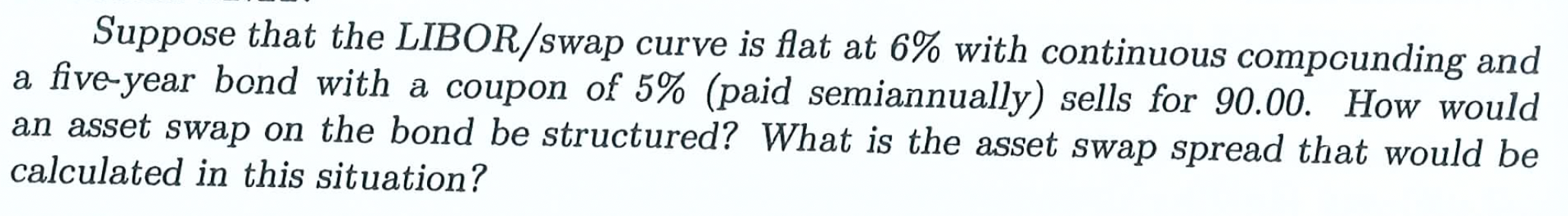

Suppose that the LIBOR/swap curve is flat at 6% with continuous compounding and a five-year bond with a coupon of 5% (paid semiannually) sells for 90.00. How would an asset swap on the bond be structured? What is the asset swap spread that would be calculated in this situation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts