Question: Please give the calculation process. Using the adjusted trial balance below for P&P Factory at January 31, 2020, calculate the requested amounts. Debit Credit 92,615

Please give the calculation process.

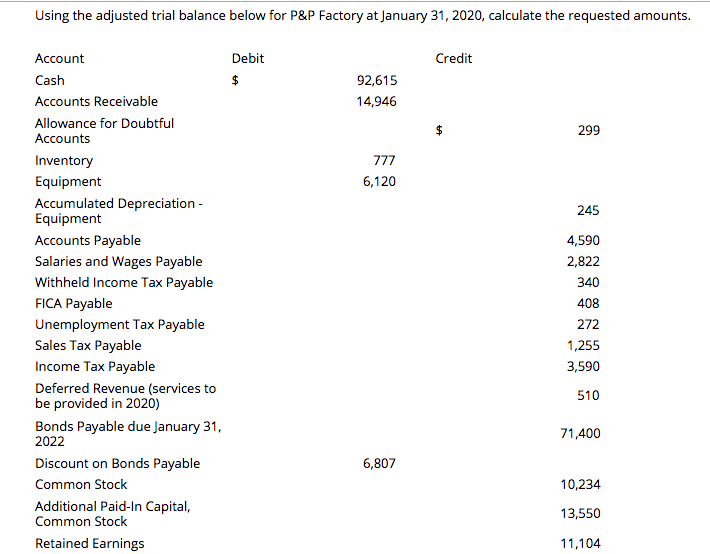

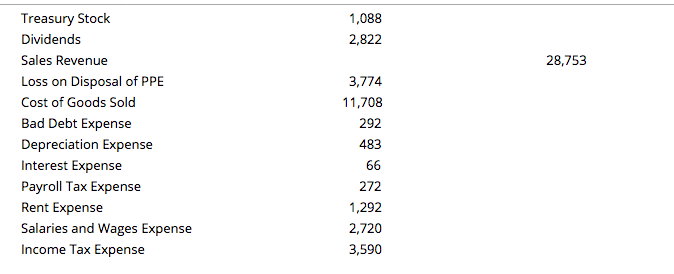

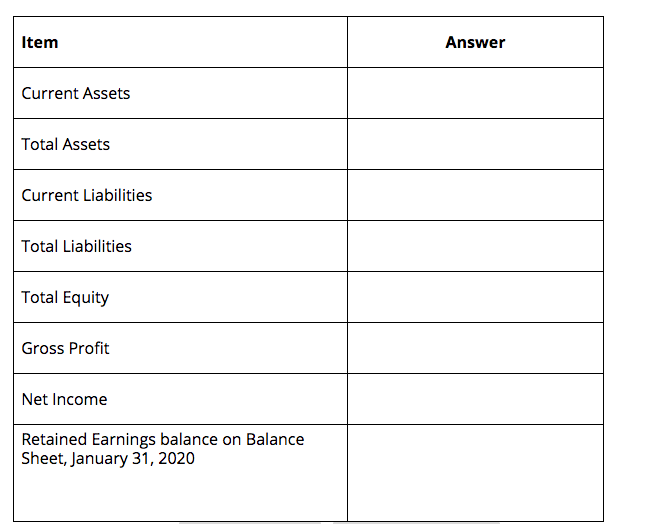

Using the adjusted trial balance below for P&P Factory at January 31, 2020, calculate the requested amounts. Debit Credit 92,615 14,946 299 777 6,120 245 Account Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries and Wages Payable Withheld Income Tax Payable FICA Payable Unemployment Tax Payable Sales Tax Payable Income Tax Payable Deferred Revenue (services to be provided in 2020) Bonds Payable due January 31, 2022 Discount on Bonds Payable Common Stock Additional Paid-In Capital, Common Stock Retained Earnings 4,590 2,822 340 408 272 1,255 3,590 510 71,400 6,807 10,234 13,550 11,104 1,088 2,822 28,753 Treasury Stock Dividends Sales Revenue Loss on Disposal of PPE Cost of Goods Sold Bad Debt Expense Depreciation Expense Interest Expense Payroll Tax Expense Rent Expense Salaries and Wages Expense Income Tax Expense 3,774 11,708 292 483 66 272 1,292 2,720 3,590 Item Answer Current Assets Total Assets Current Liabilities Total Liabilities Total Equity Gross Profit Net Income Retained Earnings balance on Balance Sheet, January 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts