Question: Please give the explanation and how to solve this question. I need a more detailed explanation, thank you. ABC Partnership has a profit of $1

Please give the explanation and how to solve this question. I need a more detailed explanation, thank you.

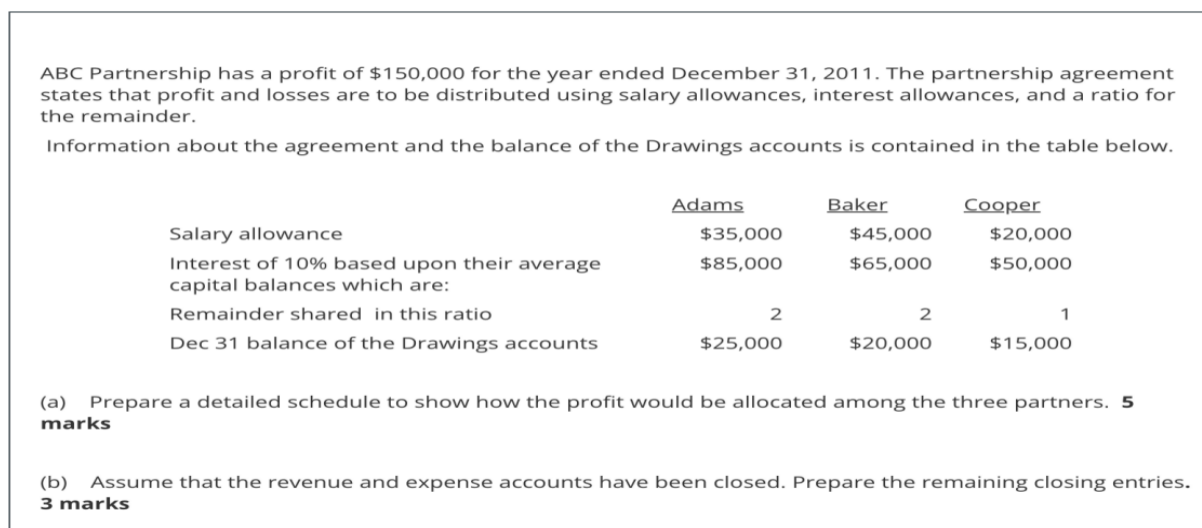

ABC Partnership has a profit of $1 50,000 for the year ended December 31, 201 1 . The partnership agreement states that prot and losses are to be distributed using salary allowances. interest allowances, and a ratio for the remainder. Information about the agreement and the balance of the Drawings accounts is contained in the table below. Adams 3.31591: QQQFLQE Salary allowance $35,000 $45,000 $20,000 Interest of 10% based upon their average $85,000 $65,000 $50,000 capital balances which are: Remainder shared in this ratio 2 2 1 Dec 31 balance of the Drawings accounts $25,000 $20,000 $15,000 (a) Prepare a detailed schedule to show how the prot would be allocated among the three partners. 5 marks ([3) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts