Question: Please, give the final answer just that is false. Write TRUEFALSE. Write T if the statement is true and F if the stat your answers

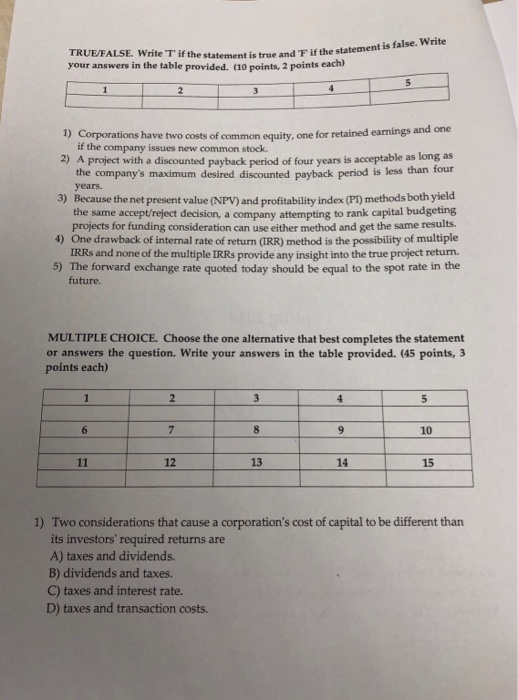

is false. Write TRUEFALSE. Write T if the statement is true and F if the stat your answers in the table provided. (10 points, 2 points each) 1) Corporations have two costs of common equity, one for retained earnings and one if the company issues new common stock. 2) A project with a discounted payback period of four years is acceptable as long as the company's maximum desired discounted payback period is less than four years. 3) Because the net present value (NPV) and profitability index (P) methods both yield the same accept/reject decision, a company attempting to rank capital budgeting projects for funding consideration can use either method and get the same results. 4) One drawback of internal rate of return (IRR) method is the possibility of multiple IRRs and none of the multiple IRRs provide any insight into the true project return. 5) The forward exchange rate quoted today should be equal to the spot rate in the future MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. Write your answers in the table provided. (45 points, 3 points each) 10 12 13 14 15 Two considerations that cause a corporation's cost of capital to be different than its investors' required returns are A) taxes and dividends. B) dividends and taxes. C) taxes and interest rate. D) taxes and transaction costs. 1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts