Question: Please give workings for each part. Eugene is a member of the Asset and Liability Committee of ANZ Bank Ltd. An extract of the Asset

Please give workings for each part.

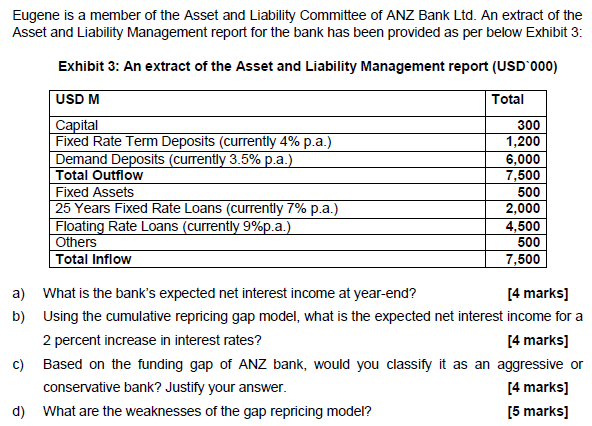

Eugene is a member of the Asset and Liability Committee of ANZ Bank Ltd. An extract of the Asset and Liability Management report for the bank has been provided as per below Exhibit 3: Exhibit 3: An extract of the Asset and Liability Management report (USD 000) Total USD M Capital Fixed Rate Term Deposits (currently 4% p.a.) Demand Deposits (currently 3.5% p.a.) Total Outflow Fixed Assets 25 Years Fixed Rate Loans (currently 7% p.a.) Floating Rate Loans (currently 9%p.a.) Others Total Inflow 300 1,200 6,000 7,500 500 2,000 4,500 500 7,500 a) What is the bank's expected net interest income at year-end? [4 marks] b) Using the cumulative repricing gap model, what is the expected net interest income for a 2 percent increase in interest rates? [4 marks] c) Based on the funding gap of ANZ bank, would you classify it as an aggressive or conservative bank? Justify your answer. [4 marks] d) What are the weaknesses of the gap repricing model? [5 marks] Eugene is a member of the Asset and Liability Committee of ANZ Bank Ltd. An extract of the Asset and Liability Management report for the bank has been provided as per below Exhibit 3: Exhibit 3: An extract of the Asset and Liability Management report (USD 000) Total USD M Capital Fixed Rate Term Deposits (currently 4% p.a.) Demand Deposits (currently 3.5% p.a.) Total Outflow Fixed Assets 25 Years Fixed Rate Loans (currently 7% p.a.) Floating Rate Loans (currently 9%p.a.) Others Total Inflow 300 1,200 6,000 7,500 500 2,000 4,500 500 7,500 a) What is the bank's expected net interest income at year-end? [4 marks] b) Using the cumulative repricing gap model, what is the expected net interest income for a 2 percent increase in interest rates? [4 marks] c) Based on the funding gap of ANZ bank, would you classify it as an aggressive or conservative bank? Justify your answer. [4 marks] d) What are the weaknesses of the gap repricing model? [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts