Question: Please go off my work because its correct. I just need help finishing the last 25% The names of the employees of Hogan Thrift Shop

Please go off my work because its correct. I just need help finishing the last 25%

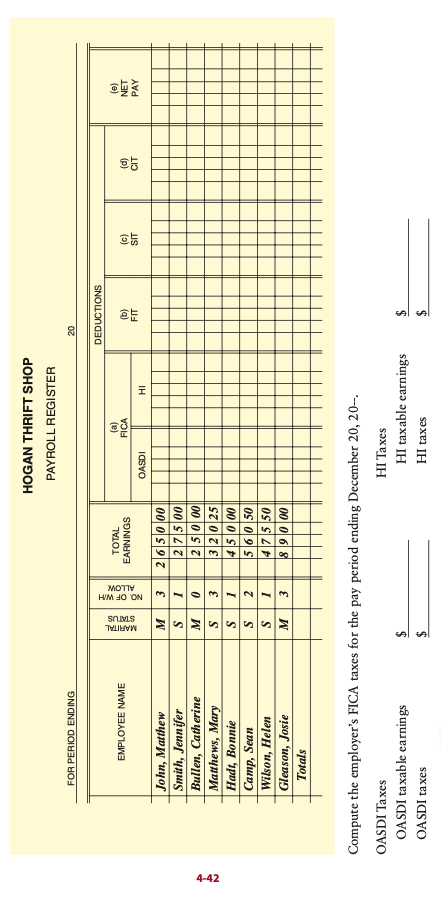

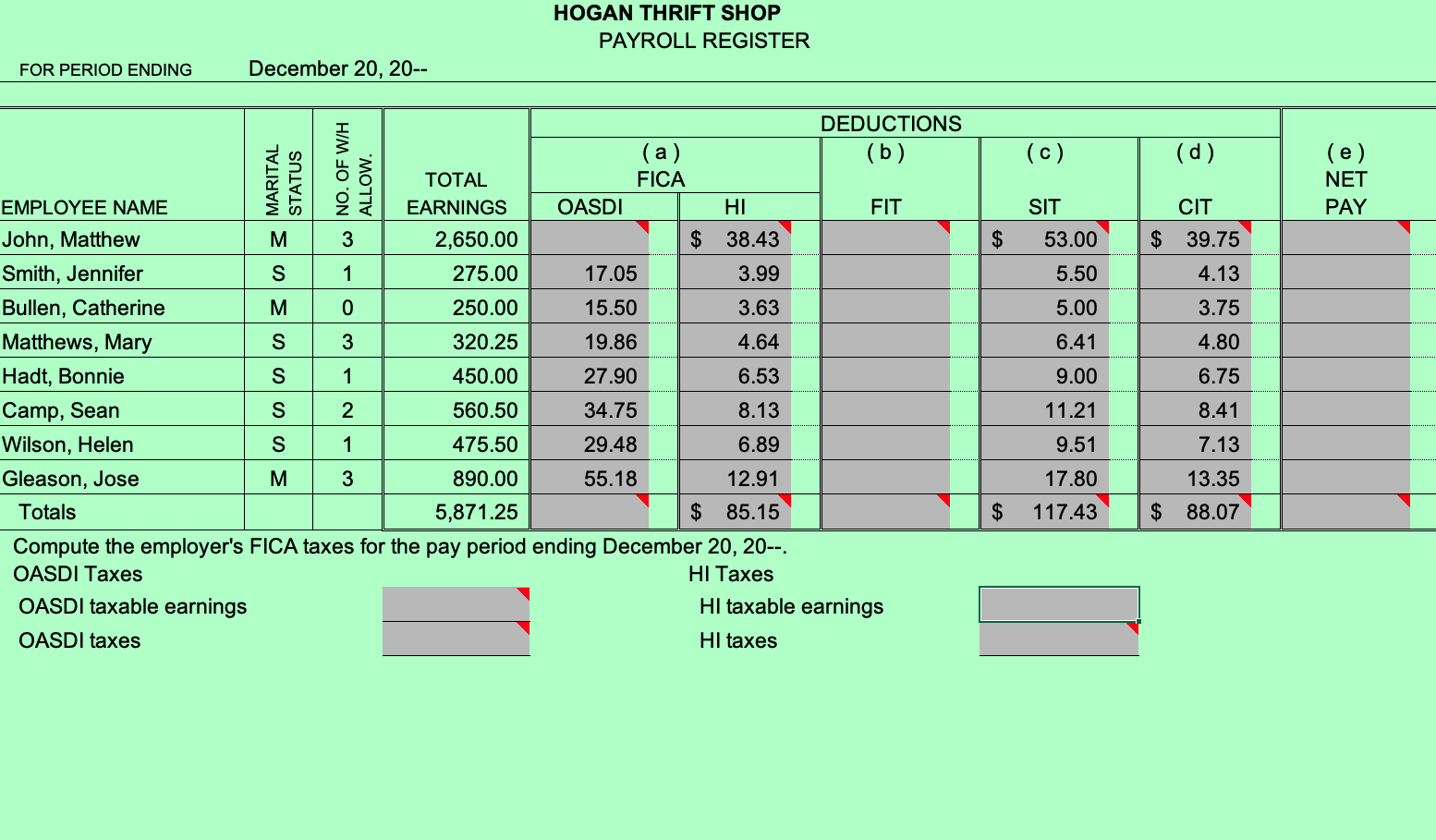

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The marital status and the number of allowances claimed are shown on the payroll register, along with each employees weekly salary, which has remained the same all year. Complete the payroll register for the payroll period ending December 20, 20--, the 51st weekly payday. The state income tax rate is 2% of total earnings, the city income tax rate is 1.5% of the total gross earnings, and the wage-bracket method is used for federal income taxes.

HOGAN THRIFT SHOP PAYROLL REGISTER FOR PERIOD ENDING 20 DEDUCTIONS EMPLOYEE NAME MARITAL STATUS NO. OF WH ALLOW TOTAL EARNINGS (a) FICA (6) FIT (c) SIT (e) NET PAY CIT OASDI HI 3 M S M S 1 0 3 4-42 John, Matthew Smith, Jennifer Bullen, Catherine Matthews, Mary Hadt, Bonnie Camp, Sean Wilson, Helen Gleason, Josie Totals 2 6 5 000 2 7 500 2 50 00 3 2 0 25 1450.00 5 6 0 50 47 5 50 8 90 00 S S S M 1 2 1 3 Compute the employer's FICA taxes for the pay period ending December 20, 20- OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes HI taxes AA HOGAN THRIFT SHOP PAYROLL REGISTER FOR PERIOD ENDING December 20, 20-- (c) (d) (e) NET PAY SIT CIT $ 53.00 $ 39.75 5.50 STATUS 3 3 3 MARITAL ALLOW. N - wo - W NO. OF W/H 5.00 DEDUCTIONS (a) (b) TOTAL FICA EMPLOYEE NAME EARNINGS OASDI HI FIT John, Matthew 3 2,650.00 $ 38.43 Smith, Jennifer S 1 275.00 17.05 3.99 Bullen, Catherine . 250.00 15.50 3.63 Matthews, Mary S 3 320.25 19.86 4.64 Hadt, Bonnie S 1 450.00 27.90 6.53 Camp, Sean S 560.50 34.75 8.13 Wilson, Helen S 1 475.50 29.48 6.89 Gleason, Jose 3 890.00 55.18 12.91 Totals 5,871.25 $ 85.15 Compute the employer's FICA taxes for the pay period ending December 20, 20--. OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes Hl taxes 4.13 3.75 4.80 6.41 9.00 6.75 11.21 8.41 7.13 9.51 17.80 13.35 $ 88.07 $ 117.43 HOGAN THRIFT SHOP PAYROLL REGISTER FOR PERIOD ENDING 20 DEDUCTIONS EMPLOYEE NAME MARITAL STATUS NO. OF WH ALLOW TOTAL EARNINGS (a) FICA (6) FIT (c) SIT (e) NET PAY CIT OASDI HI 3 M S M S 1 0 3 4-42 John, Matthew Smith, Jennifer Bullen, Catherine Matthews, Mary Hadt, Bonnie Camp, Sean Wilson, Helen Gleason, Josie Totals 2 6 5 000 2 7 500 2 50 00 3 2 0 25 1450.00 5 6 0 50 47 5 50 8 90 00 S S S M 1 2 1 3 Compute the employer's FICA taxes for the pay period ending December 20, 20- OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes HI taxes AA HOGAN THRIFT SHOP PAYROLL REGISTER FOR PERIOD ENDING December 20, 20-- (c) (d) (e) NET PAY SIT CIT $ 53.00 $ 39.75 5.50 STATUS 3 3 3 MARITAL ALLOW. N - wo - W NO. OF W/H 5.00 DEDUCTIONS (a) (b) TOTAL FICA EMPLOYEE NAME EARNINGS OASDI HI FIT John, Matthew 3 2,650.00 $ 38.43 Smith, Jennifer S 1 275.00 17.05 3.99 Bullen, Catherine . 250.00 15.50 3.63 Matthews, Mary S 3 320.25 19.86 4.64 Hadt, Bonnie S 1 450.00 27.90 6.53 Camp, Sean S 560.50 34.75 8.13 Wilson, Helen S 1 475.50 29.48 6.89 Gleason, Jose 3 890.00 55.18 12.91 Totals 5,871.25 $ 85.15 Compute the employer's FICA taxes for the pay period ending December 20, 20--. OASDI Taxes HI Taxes OASDI taxable earnings HI taxable earnings OASDI taxes Hl taxes 4.13 3.75 4.80 6.41 9.00 6.75 11.21 8.41 7.13 9.51 17.80 13.35 $ 88.07 $ 117.43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts