Question: please go through and show clearly how everything gets done in order. thank you 1. An investor can design a risky portfolio based on two

please go through and show clearly how everything gets done in order. thank you

please go through and show clearly how everything gets done in order. thank you

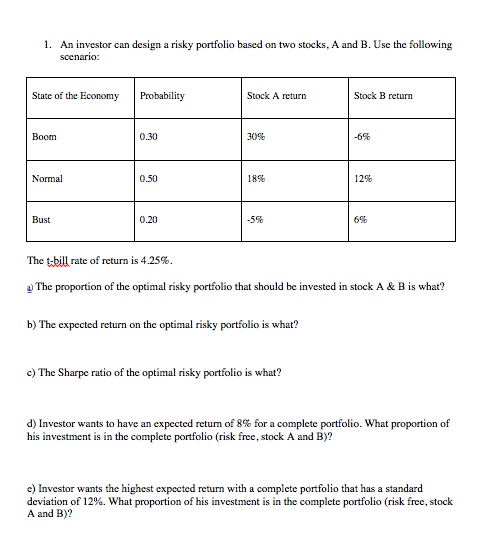

1. An investor can design a risky portfolio based on two stocks, A and B. Use the following scenario: State of the Economy Probability Stock A return Stock B return Boom 0.30 30% Normal 0.50 18% 12% Bust 0.20 -59 6% The t-bill rate of return is 4.25%. The proportion of the optimal risky portfolio that should be invested in stock A & B is what? a b) The expected return on the optimal risky portfolio is what? c) The Sharpe ratio of the optimal risky portfolio is what? d) Investor wants to have an expected retum of 8% for a complete portfolio. What proportion of his investment is in the complete portfolio (risk free, stock A and B)? c) Investor wants the highest expected return with a complete portfolio that has a standard deviation of 12%. What proportion of his investment is in the complete portfolio (risk free, stock A and B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts