Please guide me in the right direction. I think I know what to do.

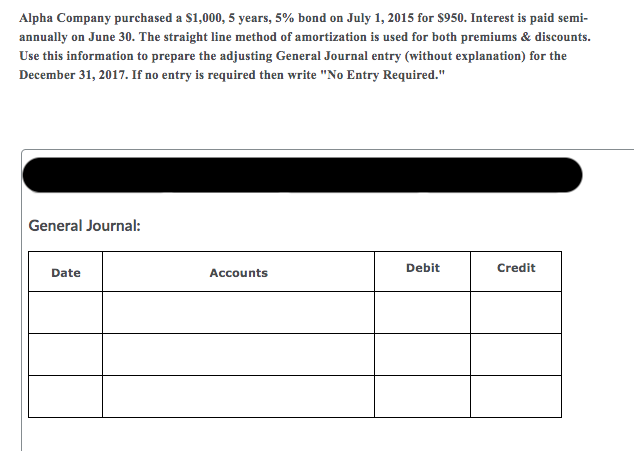

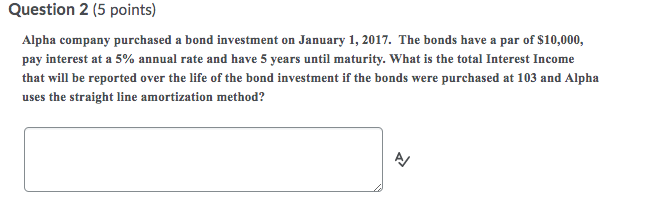

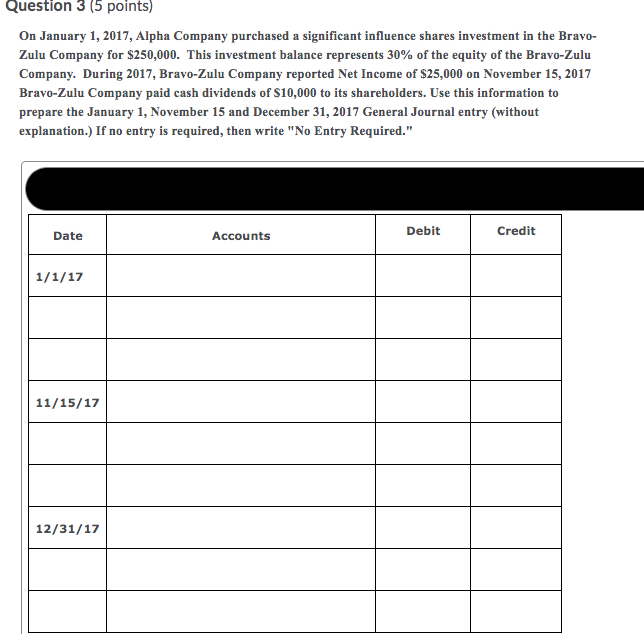

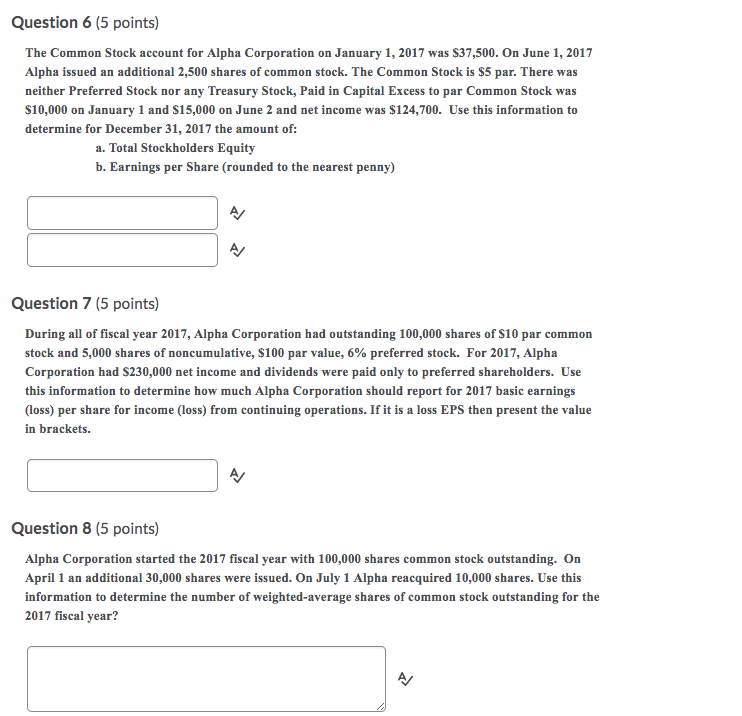

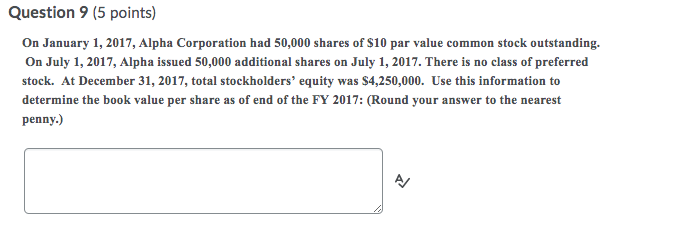

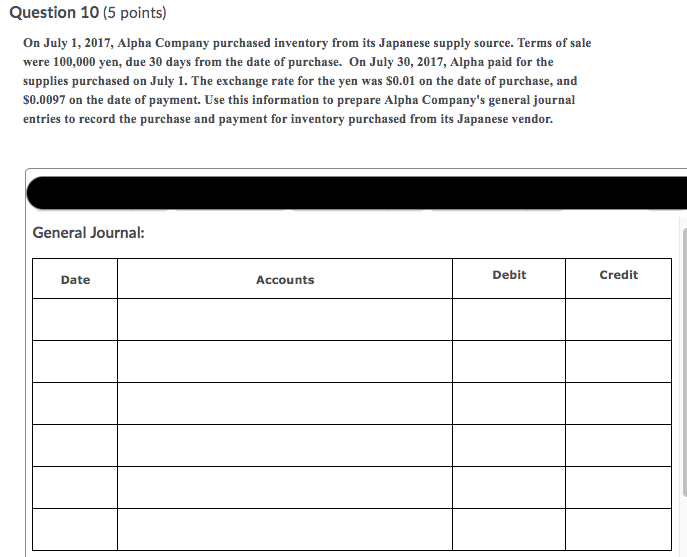

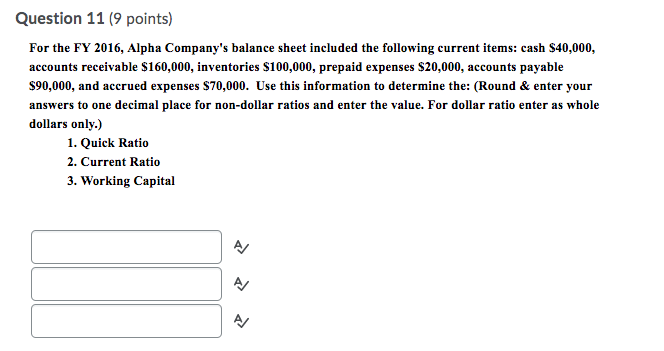

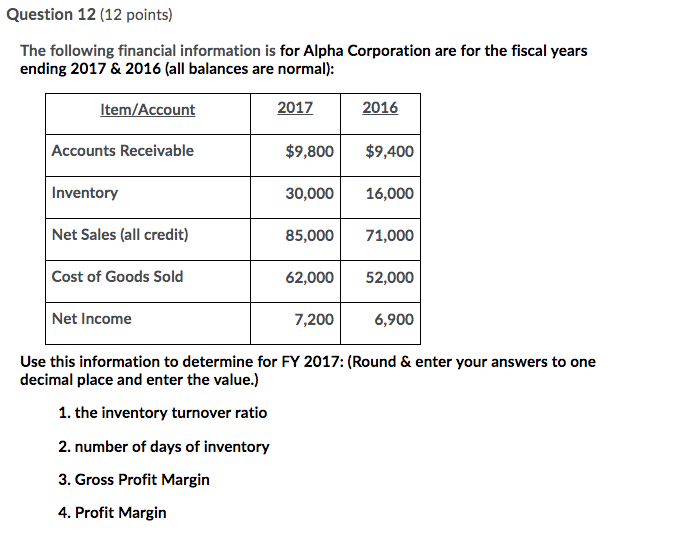

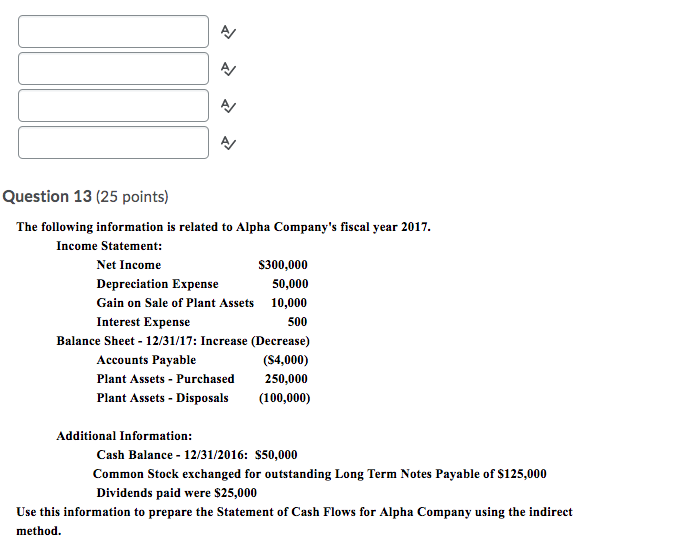

Alpha Company purchased a $1,000, 5 years, 5% bond on July 1, 2015 for $950. Interest is paid semi- annually on June 30. The straight line method of amortization is used for both premiums & discounts. Use this information to prepare the adjusting General Journal entry (without explanation) for the December 31, 2017. If no entry is required then write "No Entry Required." General Journal: Date Accounts Debit CreditQuestion 2 (5 points) Alpha company purchased a bond investment on January 1, 2017. The bonds have a par of $10,000, pay interest at a 5% annual rate and have 5 years until maturity. What is the total Interest Income that will be reported over the life of the bond investment if the bonds were purchased at 103 and Alpha uses the straight line amortization method?Question 3 (5 points) On January 1, 2017, Alpha Company purchased a significant influence shares investment in the Bravo- Zulu Company for $250,000. This investment balance represents 30% of the equity of the Bravo-Zulu Company. During 2017, Bravo-Zulu Company reported Net Income of $25,000 on November 15, 2017 Bravo-Zulu Company paid cash dividends of $10,000 to its shareholders. Use this information to prepare the January 1, November 15 and December 31, 2017 General Journal entry (without explanation.) If no entry is required, then write "No Entry Required." Date Accounts Debit Credit 1/1/17 11/15/17 12/31/17Question 4 (5 points) On January 1, 2017, Alpha Company purchased a significant influence shares investment in the Bravo- Zulu Company for $250,000. This investment balance represents 25% of the equity of the Bravo-Zulu Company. During 2017, Bravo-Zulu Company reported Net Income of $25,000 on November 15, 2017 Bravo-Zulu Company paid cash dividends of $10,000 to its shareholders. Using this information, what are the FY 2017 balances in Alpha Company's account balances for: a. Investment in Bravo-Zulu b. Investment Income A/ A/ Question 5 (9 points) On January 2, 2017, Alpha Company purchased 10,000 shares of the stock of Zulu Company, and did not obtain significant influence. The investment is intended as a long-term investment. The stock was purchased for $10 per share, and represents a 10% ownership stake. Zulu Company made $25,000 of net income in 2017, and paid dividends of $10,000 on December 15, 2017. On December 31, 2017, Zulu Company's stock was trading on the open market for $12 per share at the end of the year. Use this information to determine the dollar amounts that should be reported by Alpha Company during 2017 for the following items: 1. Dividend Income 2. Unrealized Gain/Loss - OIC (If a loss, enter the amount with dollar sign inside of brackets) 3. Available-for-Sales Securities A/ A/ AQuestion 6 (5 points) The Common Stock account for Alpha Corporation on January 1, 2017 was $37,500. On June 1, 2017 Alpha issued an additional 2,500 shares of common stock. The Common Stock is $5 par. There was neither Preferred Stock nor any Treasury Stock, Paid in Capital Excess to par Common Stock was $10,000 on January 1 and $15,000 on June 2 and net income was $124,700. Use this information to determine for December 31, 2017 the amount of: a. Total Stockholders Equity b. Earnings per Share (rounded to the nearest penny) Question 7 (5 points) During all of fiscal year 2017, Alpha Corporation had outstanding 100,000 shares of $10 par common stock and 5,000 shares of noncumulative, $100 par value, 6% preferred stock. For 2017, Alpha Corporation had $230,000 net income and dividends were paid only to preferred shareholders. Use this information to determine how much Alpha Corporation should report for 2017 basic earnings (loss) per share for income (loss) from continuing operations. If it is a loss EPS then present the value in brackets. Question 8 (5 points) Alpha Corporation started the 2017 fiscal year with 100,000 shares common stock outstanding. On April 1 an additional 30,000 shares were issued. On July 1 Alpha reacquired 10,000 shares. Use this information to determine the number of weighted-average shares of common stock outstanding for the 2017 fiscal year? A/Question 9 (5 points) On January 1, 2017, Alpha Corporation had 50,000 shares of $10 par value common stock outstanding. On July 1, 2017, Alpha issued 50,000 additional shares on July 1, 2017. There is no class of preferred stock. At December 31, 2017, total stockholders' equity was $4,250,000. Use this information to determine the book value per share as of end of the FY 2017: (Round your answer to the nearest penny.)Question 10 (5 points) On July 1, 2017, Alpha Company purchased inventory from its Japanese supply source. Terms of sale were 100,000 yen, due 30 days from the date of purchase. On July 30, 2017, Alpha paid for the supplies purchased on July 1. The exchange rate for the yen was $0.01 on the date of purchase, and $0.0097 on the date of payment. Use this information to prepare Alpha Company's general journal entries to record the purchase and payment for inventory purchased from its Japanese vendor. General Journal: Date Accounts Debit CreditQuestion 11 (9 points) For the FY 2016, Alpha Company's balance sheet included the following current items: cash $40,000, accounts receivable $160,000, inventories $100,000, prepaid expenses $20,000, accounts payable $90,000, and accrued expenses $70,000. Use this information to determine the: (Round & enter your answers to one decimal place for non-dollar ratios and enter the value. For dollar ratio enter as whole dollars only.) 1. Quick Ratio 2. Current Ratio 3. Working Capital PJ PJQuestion 12 (12 points) The following financial information is for Alpha Corporation are for the fiscal years ending 2017 & 2016 (all balances are normal): Item/Account 2017 2016 Accounts Receivable $9,800 $9,400 Inventory 30,000 16,000 Net Sales (all credit) 85,000 71,000 Cost of Goods Sold 62,000 52,000 Net Income 7,200 6,900 Use this information to determine for FY 2017: (Round & enter your answers to one decimal place and enter the value.) 1. the inventory turnover ratio 2. number of days of inventory 3. Gross Profit Margin 4. Profit MarginA/ A/ Question 13 (25 points) The following information is related to Alpha Company's fiscal year 2017. Income Statement: Net Income $300,000 Depreciation Expense 50,000 Gain on Sale of Plant Assets 10,000 Interest Expense 500 Balance Sheet - 12/31/17: Increase (Decrease) Accounts Payable ($4,000) Plant Assets - Purchased 250,000 Plant Assets - Disposals (100,000) Additional Information: Cash Balance - 12/31/2016: $50,000 Common Stock exchanged for outstanding Long Term Notes Payable of $125,000 Dividends paid were $25,000 Use this information to prepare the Statement of Cash Flows for Alpha Company using the indirect method.\f