Question: please hand write the answer, thank you! *2. Fioretti has EAT, depreciation expense, capital expenses and debt principal payments of $4m, S.4m, $.9m, and S.

please hand write the answer, thank you!

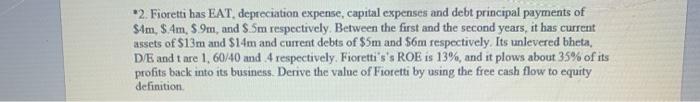

please hand write the answer, thank you! *2. Fioretti has EAT, depreciation expense, capital expenses and debt principal payments of $4m, S.4m, $.9m, and S. 5m respectively. Between the first and the second years, it has current assets of $13m and $14m and current debts of $5m and $6m respectively. Its unlevered bheta, D/E and tare 1, 60/40 and 4 respectively. Fioretti's's ROE is 13%, and it plows about 35% of its profits back into its business. Derive the value of Fioretti by using the free cash flow to equity definition *2. Fioretti has EAT, depreciation expense, capital expenses and debt principal payments of $4m, S.4m, $.9m, and S. 5m respectively. Between the first and the second years, it has current assets of $13m and $14m and current debts of $5m and $6m respectively. Its unlevered bheta, D/E and tare 1, 60/40 and 4 respectively. Fioretti's's ROE is 13%, and it plows about 35% of its profits back into its business. Derive the value of Fioretti by using the free cash flow to equity definition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts