Question: Please handwrite out instead of using excel. Outline proper finance formulas & give useful explanations. Thankss Problem 1 (23 marks) The Teenie Tiny Company is

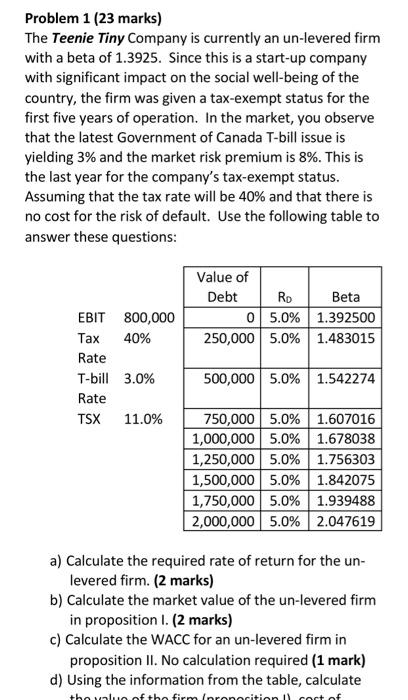

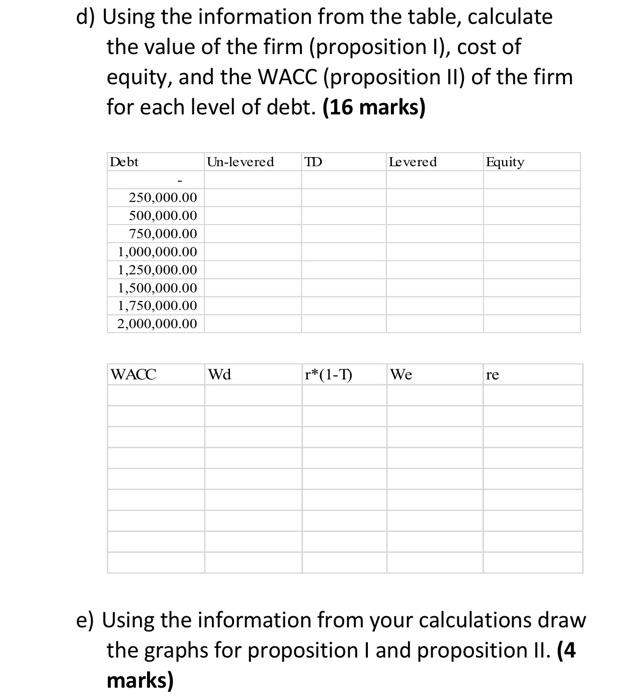

Problem 1 (23 marks) The Teenie Tiny Company is currently an un-levered firm with a beta of 1.3925. Since this is a start-up company with significant impact on the social well-being of the country, the firm was given a tax-exempt status for the first five years of operation. In the market, you observe that the latest Government of Canada T-bill issue is yielding 3% and the market risk premium is 8%. This is the last year for the company's tax-exempt status. Assuming that the tax rate will be 40% and that there is no cost for the risk of default. Use the following table to answer these questions: Value of Debt Ro Beta 05.0% 1.392500 250,000 5.0% 1.483015 EBIT 800,000 Tax 40% Rate T-bill 3.0% Rate TSX 11.0% 500,000 5.0% 1.542274 750,000 5.0% 1.607016 1,000,000 5.0% 1.678038 1,250,000 5.0% 1.756303 1,500,000 5.0% 1.842075 1,750,000 5.0% 1.939488 2,000,000 5.0% 2.047619 a) Calculate the required rate of return for the un- levered firm. (2 marks) b) Calculate the market value of the un-levered firm in proposition 1. (2 marks) c) Calculate the WACC for an un-levered firm in proposition II. No calculation required (1 mark) d) Using the information from the table, calculate the value of the firmioranocition cortof d) Using the information from the table, calculate the value of the firm (proposition I), cost of equity, and the WACC (proposition II) of the firm for each level of debt. (16 marks) Debt Un-levered TD Levered Equity 250,000.00 500,000.00 750,000.00 1,000,000.00 1,250,000.00 1,500,000.00 1,750,000.00 2,000,000.00 WACC Wd r*(1-1) We re e) Using the information from your calculations draw the graphs for proposition I and proposition II. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts