Question: please harry up .... i have an important exam now The management of Mando Inc. provides the following information: Sales are projected to grow by

please harry up .... i have an important exam now

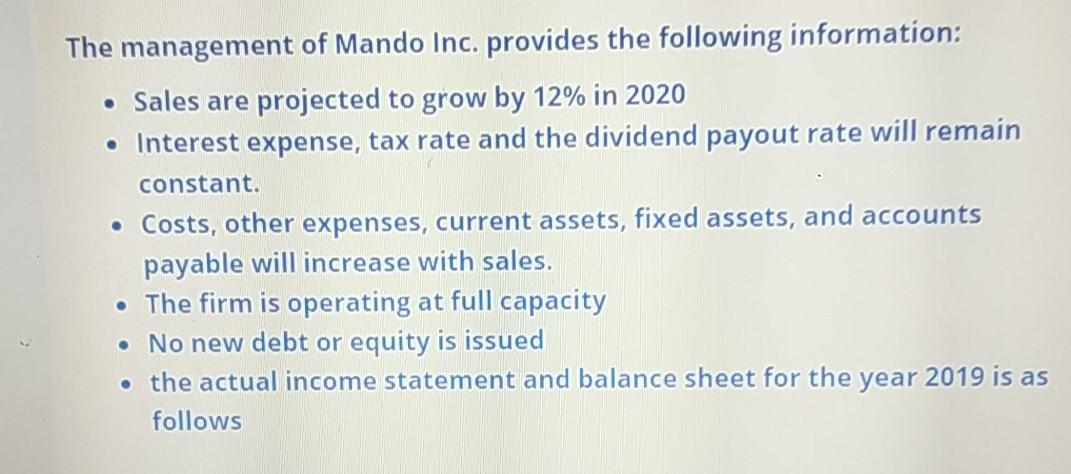

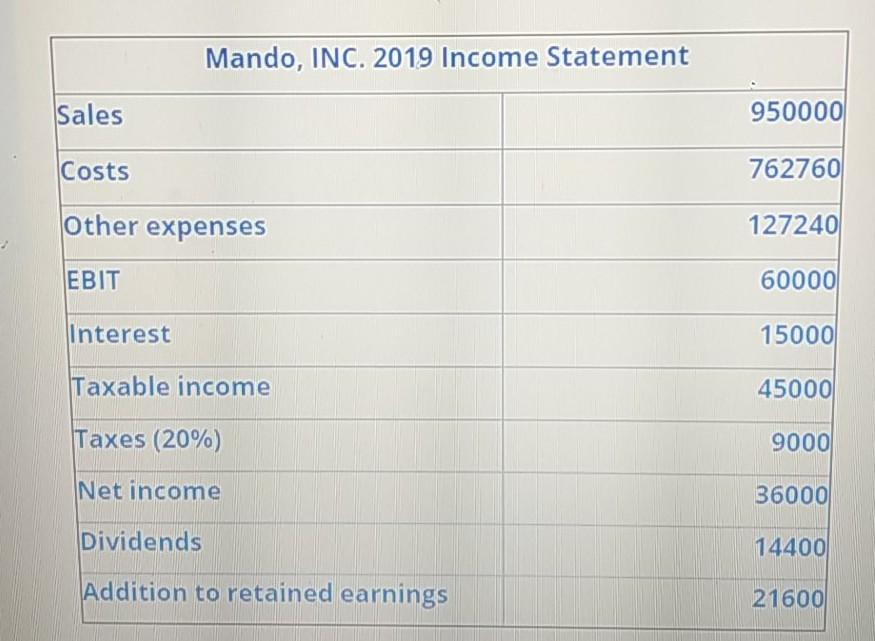

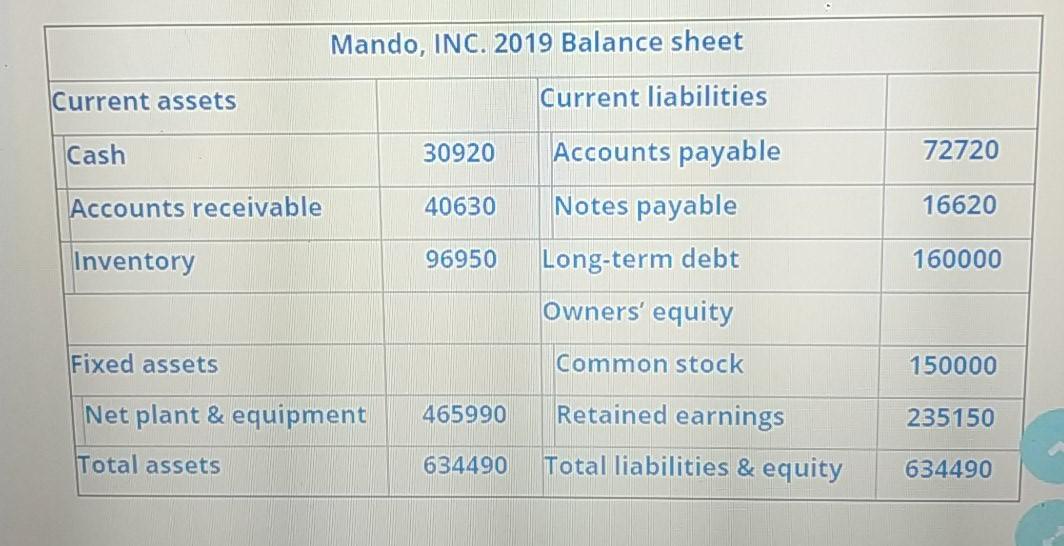

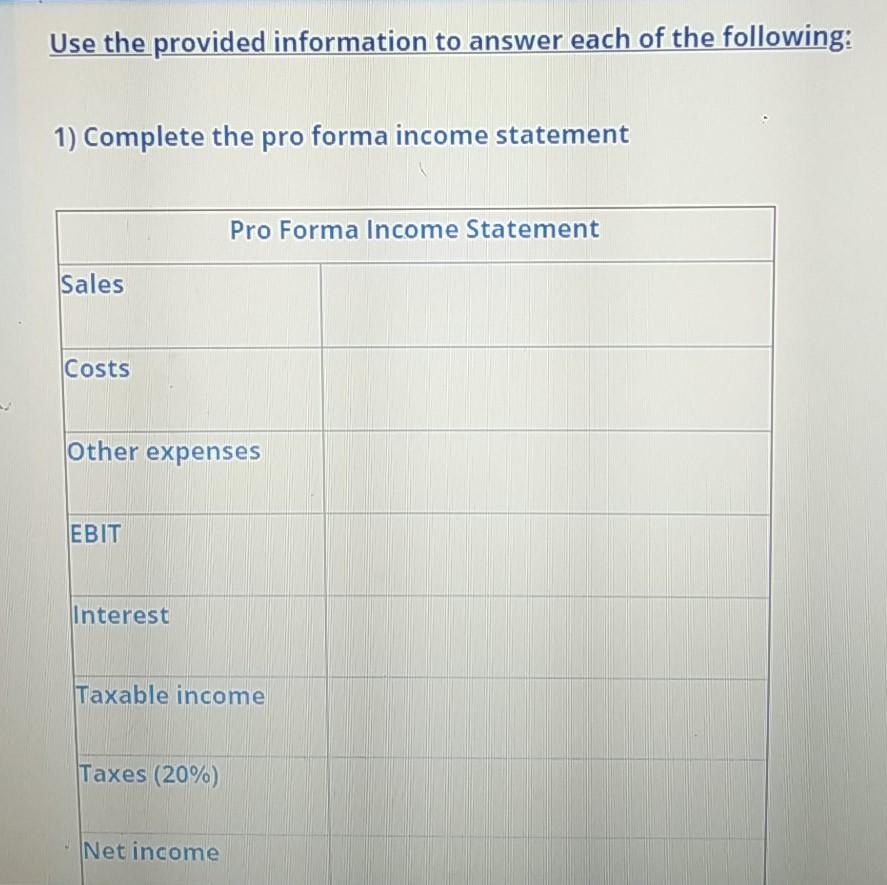

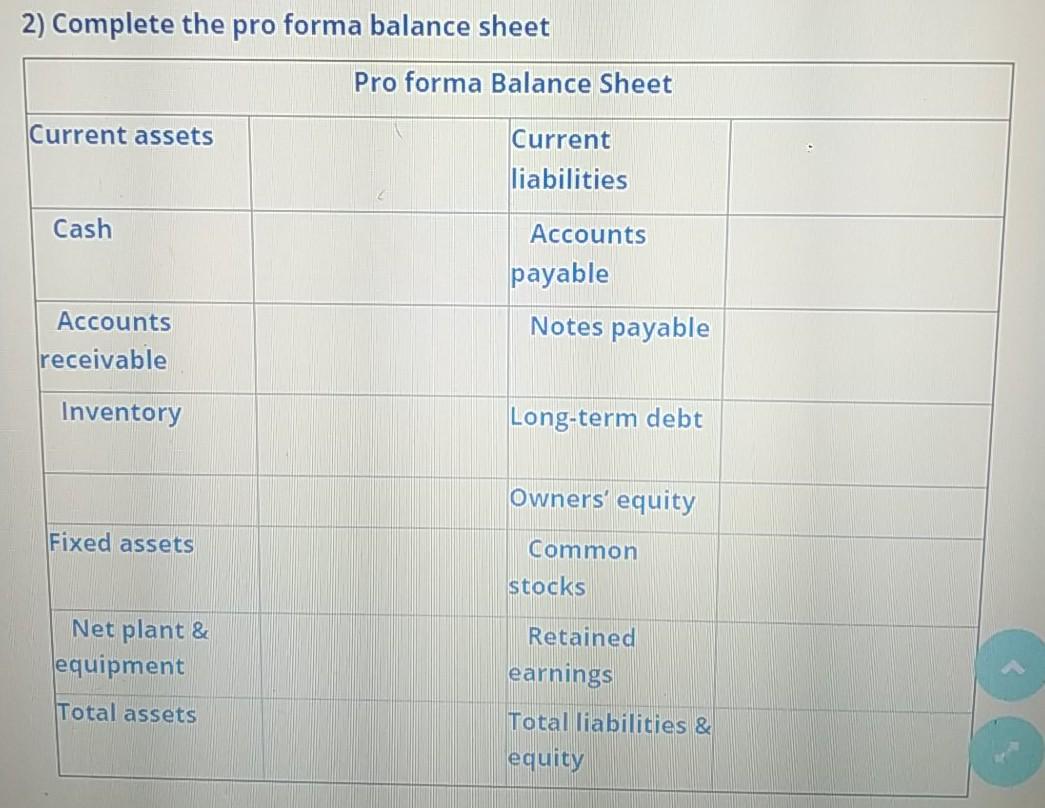

The management of Mando Inc. provides the following information: Sales are projected to grow by 12% in 2020 Interest expense, tax rate and the dividend payout rate will remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable will increase with sales. The firm is operating at full capacity No new debt or equity is issued the actual income statement and balance sheet for the year 2019 is as follows Mando, INC. 2019 Income Statement Sales 950000 Costs 762760 Other expenses 127240 EBIT 60000 Interest 15000 Taxable income 45000 Taxes (20%) 9000 Net income 36000 Dividends 14400 Addition to retained earnings 21600 Mando, INC. 2019 Balance sheet Current assets Current liabilities Cash 30920 72720 Accounts payable Notes payable Accounts receivable 40630 16620 Inventory 96950 Long-term debt 160000 Owners' equity Fixed assets Common stock 150000 Net plant & equipment 465990 235150 Retained earnings Total liabilities & equity Total assets 634490 634490 Use the provided information to answer each of the following: 1) Complete the pro forma income statement Pro Forma Income Statement Sales Costs Other expenses EBIT interest Taxable income Taxes (20%) Net income 2) Complete the pro forma balance sheet Pro forma Balance Sheet Current assets Current liabilities Cash Accounts payable Accounts receivable Notes payable Inventory Long-term debt Owners' equity Fixed assets Common stocks Net plant & equipment Retained earnings Total assets Total liabilities & equity 3) Calculate the external financing needed to support the suggested growth in sales. EFN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts