Question: please have a look exam rules. 9. The formula sheet is at the end of the paper. PLEASE TYPE YOUR ANSWERS IMMEDIATELY FOLLOWING EACH QUESTION

please have a look

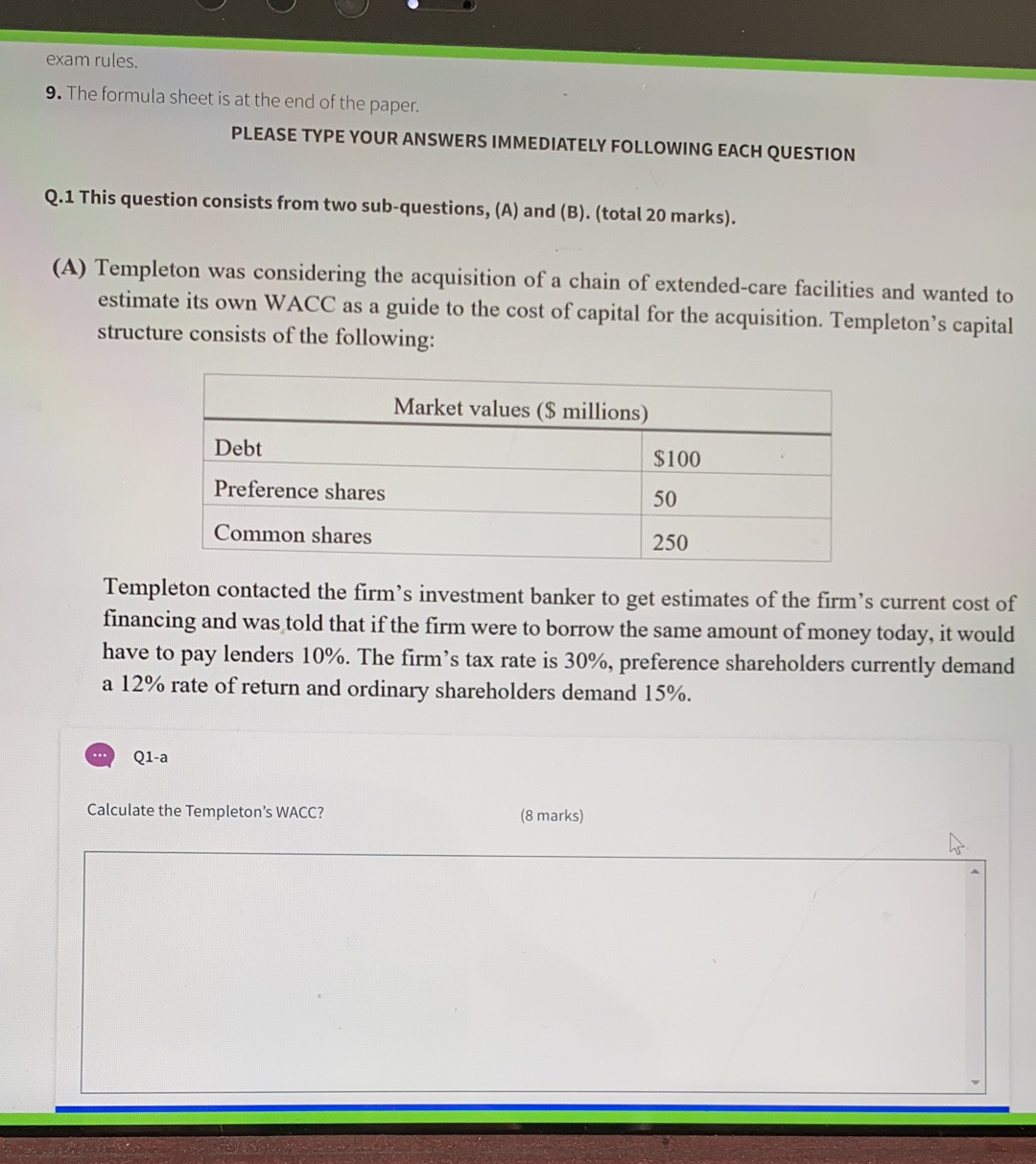

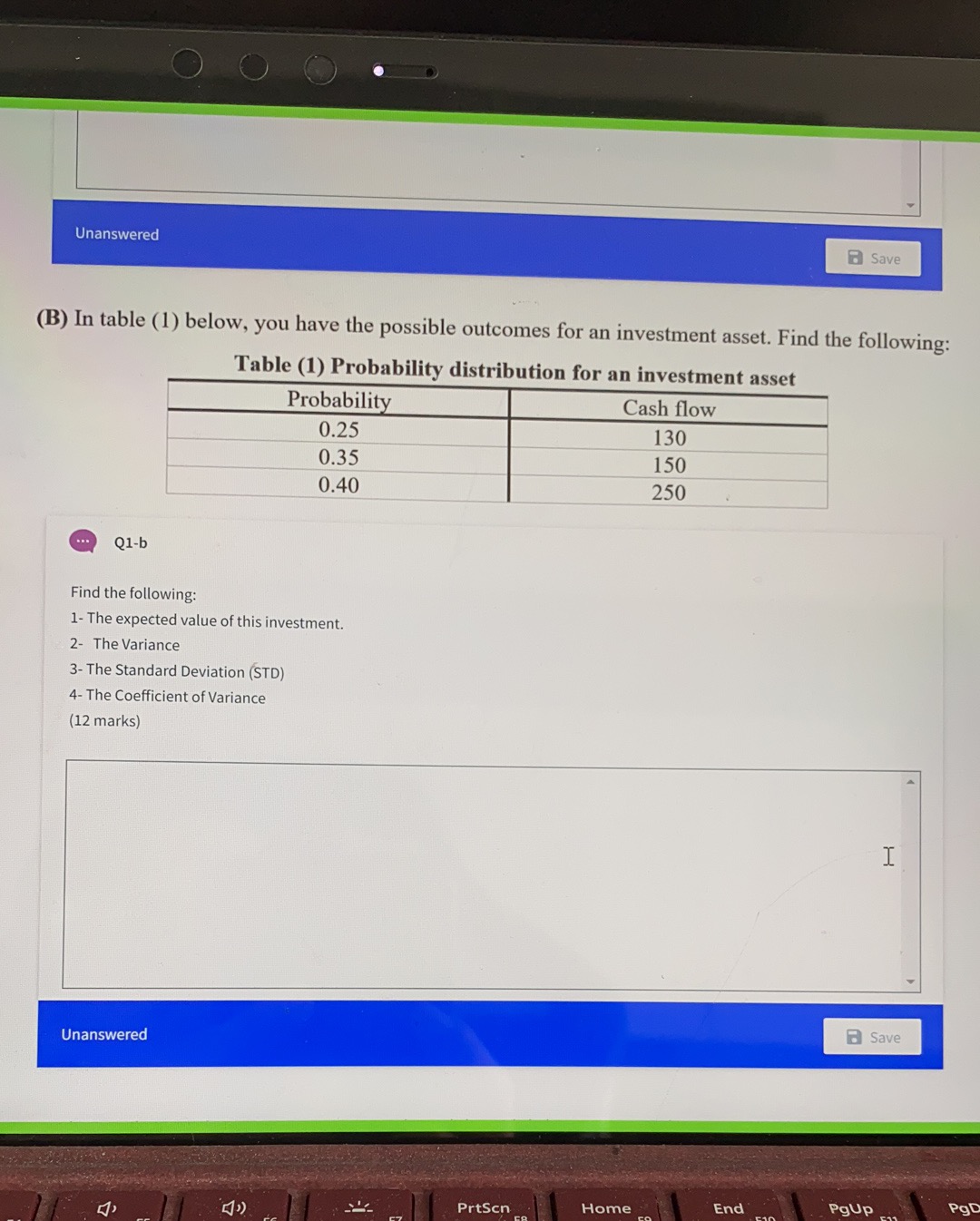

exam rules. 9. The formula sheet is at the end of the paper. PLEASE TYPE YOUR ANSWERS IMMEDIATELY FOLLOWING EACH QUESTION Q.1 This question consists from two sub-questions, (A) and (B). (total 20 marks). (A) Templeton was considering the acquisition of a chain of extended-care facilities and wanted to estimate its own WACC as a guide to the cost of capital for the acquisition. Templeton's capital structure consists of the following: Market values ($ millions) Debt $100 Preference shares 50 Common shares 250 Templeton contacted the firm's investment banker to get estimates of the firm's current cost of financing and was told that if the firm were to borrow the same amount of money today, it would have to pay lenders 10%. The firm's tax rate is 30%, preference shareholders currently demand a 12% rate of return and ordinary shareholders demand 15%. .. Q1-a Calculate the Templeton's WACC? (8 marks)(B) In table (1) below, you have the possible outcomes for an investment asset. Find the following: Table (1) Probability distribution for an investment asset Find the following: 1- The expected value ofthis investment. 2 The Variance 3-The Standard Deviation (STD) 4- The Coefficient of Variance (12 marks) Unanswered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts