Question: Please have an a real finance expert answer this question. I need a very accurate answer. This is my second time posting the same question.

Please have an a real finance expert answer this question. I need a very accurate answer. This is my second time posting the same question. Thank you in advance.

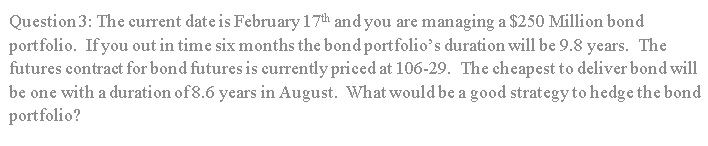

The current date is February 17th and you are managing a $250 Million bond portfolio. If you out in time six months the bond portfolios duration will be 9.8 years. The futures contract for bond futures is currently priced at 106-29. The cheapest to deliver bond will be one with a duration of 8.6 years in August. What would be a good strategy to hedge the bond portfolio?

This is the question straight from the book

Question 3: The current date is February 17th and you are managing a $250 Million bond portfolio. If you out in time six months the bond portfolio's duration will be 9.8 years. The futures contract for bond futures is currently priced at 106-29. The cheapest to deliver bond will be one with a duration of 8.6 years in August. What would be a good strategy to hedge the bond portfolio? Question 3: The current date is February 17th and you are managing a $250 Million bond portfolio. If you out in time six months the bond portfolio's duration will be 9.8 years. The futures contract for bond futures is currently priced at 106-29. The cheapest to deliver bond will be one with a duration of 8.6 years in August. What would be a good strategy to hedge the bond portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts