Question: please hell, will upvote Basic Stock Valuation: Free Cash Flow Valuation Model The recognition that dividends are dependent on earnings, so a reliable dividend forecast

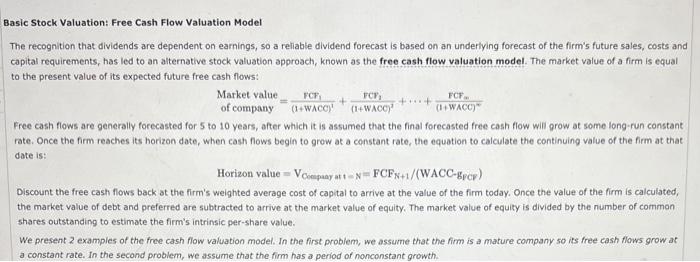

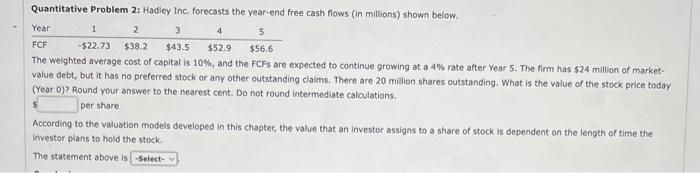

Basic Stock Valuation: Free Cash Flow Valuation Model The recognition that dividends are dependent on earnings, so a reliable dividend forecast is based on an underlying forecast of the firm's future sales, costs and capital requirements, has led to an alternative stock valuation approach, known as the free cash flow valuation model. The market value of a firm is equal to the present value of its expected future free cash flows: Marketvalueofcompany=(1+WCCC1FCFI1+(1+WACO2FCF1++(1+WCC2FCF Free cash flows are generally forecasted for 5 to 10 years, after which it is assumed that the final forecasted free cash flow will grow at some long-run constant rate. Once the firm reaches its horizon date, when cash flows begin to grow at a constant rate, the equation to calculate the continuing value of the firm at that date is: Horizonvalue=VCompanat=N=FCFN+1/(WACCgFCF) Discount the free cash flows back at the firm's weighted average cost of capital to arrive at the value of the firm today. Once the value of the firm is calculated, the market value of debt and preferred are subtracted to arrive at the market value of equity. The market value of equity is divided by the number of common shares outstanding to estimate the firm's intrinsic per-share value. We present 2 examples of the free cash flow valuation model. In the first problem, we assume that the fimm is a mature company so its free cash flows grow at a constant rate. In the second problem, we assume that the firm has a period of nonconstant growth. Quantitative Problem 2: Hadicy Inc. forecasts the year-end free cash flows (in millons) shown below. The weighted average cost of capital is 10%, and the FCFs are expected to continue growing at a 4% rate after Year 5 . The firm has $24 million of marketvalue debt, but it has no preferred stock or any other outstanding dalms. There are 20 milion shares outstanding. What is the value of the stock price today (Year 0)? Round your answer to the nearest cent. Do not round intermediate calculations. per share According to the valuation models developed in this chapter, the value that an investor assigns to a share of stock is dependent on the length of time the investor plans to hold the steck. The statement above is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts