Question: PLEASE HELLPP X=7 x=7 1. Pound/dollar currency pair's value changed from 1x.18/$ to 15.x3/S. a. Is this an appreciation or depreciation for dollar? Why? b.

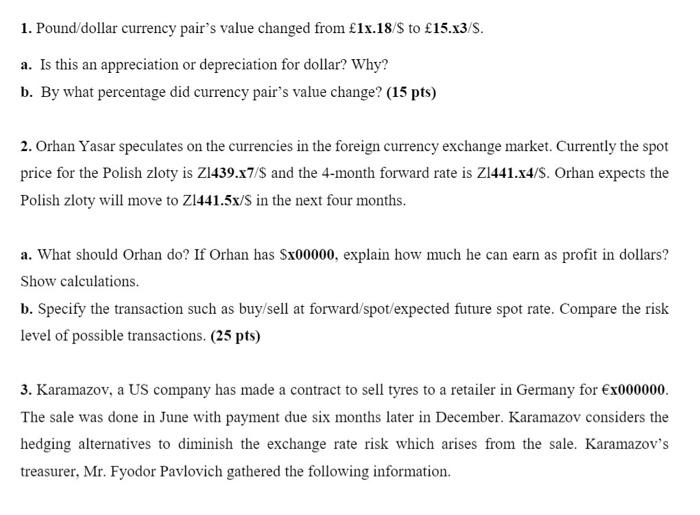

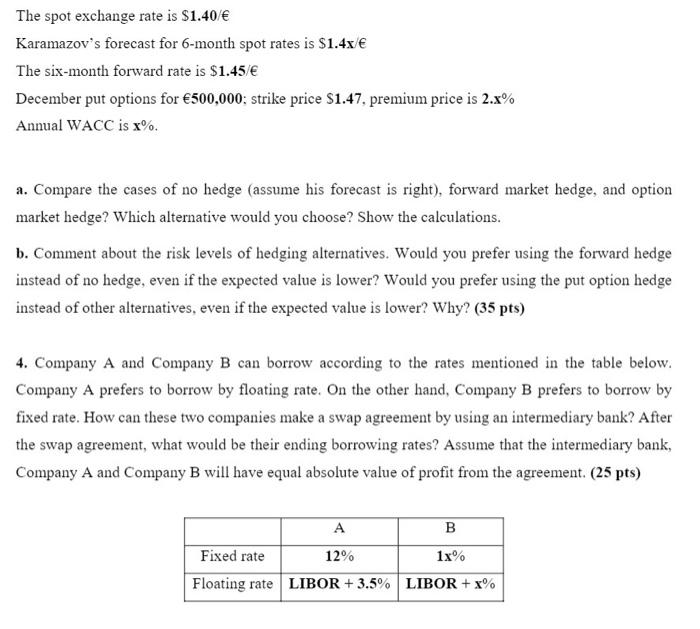

1. Pound/dollar currency pair's value changed from 1x.18/$ to 15.x3/S. a. Is this an appreciation or depreciation for dollar? Why? b. By what percentage did currency pair's value change? (15 pts) 2. Orhan Yasar speculates on the currencies in the foreign currency exchange market. Currently the spot price for the Polish zloty is Z1439.x7/$ and the 4-month forward rate is 21441.x4/S. Orhan expects the Polish zloty will move to Z1441.5x/S in the next four months. a. What should Orhan do? If Orhan has Sx00000, explain how much he can earn as profit in dollars? Show calculations. b. Specify the transaction such as buy sell at forward/spot/expected future spot rate. Compare the risk level of possible transactions. (25 pts) 3. Karamazov, a US company has made a contract to sell tyres to a retailer in Germany for x000000. The sale was done in June with payment due six months later in December. Karamazov considers the hedging alternatives to diminish the exchange rate risk which arises from the sale. Karamazov's treasurer, Mr. Fyodor Pavlovich gathered the following information. The spot exchange rate is $1.40 Karamazov's forecast for 6-month spot rates is $1.4x The six-month forward rate is $1.45/ December put options for 500,000: strike price $1.47, premium price is 2.8% Annual WACC is x%. a. Compare the cases of no hedge (assume his forecast is right), forward market hedge, and option market hedge? Which alternative would you choose? Show the calculations. b. Comment about the risk levels of hedging alternatives. Would you prefer using the forward hedge instead of no hedge, even if the expected value is lower? Would you prefer using the put option hedge instead of other alternatives, even if the expected value is lower? Why? (35 pts) 4. Company A and Company B can borrow according to the rates mentioned in the table below. Company A prefers to borrow by floating rate. On the other hand, Company B prefers to borrow by fixed rate. How can these two companies make a swap agreement by using an intermediary bank? After the swap agreement, what would be their ending borrowing rates? Assume that the intermediary bank, Company A and Company B will have equal absolute value of profit from the agreement. (25 pts) B Fixed rate 12% 1x% Floating rate LIBOR + 3.5% LIBOR + x% 1. Pound/dollar currency pair's value changed from 1x.18/$ to 15.x3/S. a. Is this an appreciation or depreciation for dollar? Why? b. By what percentage did currency pair's value change? (15 pts) 2. Orhan Yasar speculates on the currencies in the foreign currency exchange market. Currently the spot price for the Polish zloty is Z1439.x7/$ and the 4-month forward rate is 21441.x4/S. Orhan expects the Polish zloty will move to Z1441.5x/S in the next four months. a. What should Orhan do? If Orhan has Sx00000, explain how much he can earn as profit in dollars? Show calculations. b. Specify the transaction such as buy sell at forward/spot/expected future spot rate. Compare the risk level of possible transactions. (25 pts) 3. Karamazov, a US company has made a contract to sell tyres to a retailer in Germany for x000000. The sale was done in June with payment due six months later in December. Karamazov considers the hedging alternatives to diminish the exchange rate risk which arises from the sale. Karamazov's treasurer, Mr. Fyodor Pavlovich gathered the following information. The spot exchange rate is $1.40 Karamazov's forecast for 6-month spot rates is $1.4x The six-month forward rate is $1.45/ December put options for 500,000: strike price $1.47, premium price is 2.8% Annual WACC is x%. a. Compare the cases of no hedge (assume his forecast is right), forward market hedge, and option market hedge? Which alternative would you choose? Show the calculations. b. Comment about the risk levels of hedging alternatives. Would you prefer using the forward hedge instead of no hedge, even if the expected value is lower? Would you prefer using the put option hedge instead of other alternatives, even if the expected value is lower? Why? (35 pts) 4. Company A and Company B can borrow according to the rates mentioned in the table below. Company A prefers to borrow by floating rate. On the other hand, Company B prefers to borrow by fixed rate. How can these two companies make a swap agreement by using an intermediary bank? After the swap agreement, what would be their ending borrowing rates? Assume that the intermediary bank, Company A and Company B will have equal absolute value of profit from the agreement. (25 pts) B Fixed rate 12% 1x% Floating rate LIBOR + 3.5% LIBOR + x%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts