Question: PLEASE HELP 1. 2. 3. 4. ! Required information The following information applies to the questions displayed below) Martinez Company's relevant range of production is

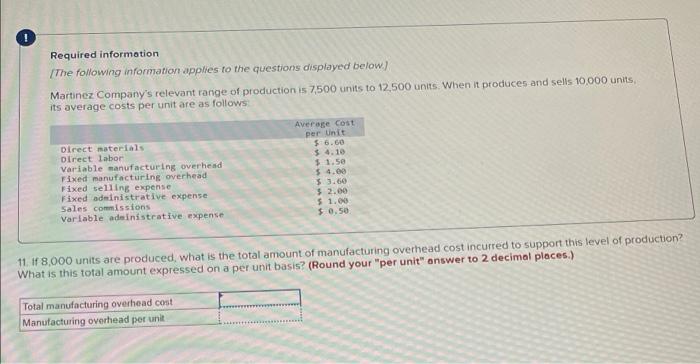

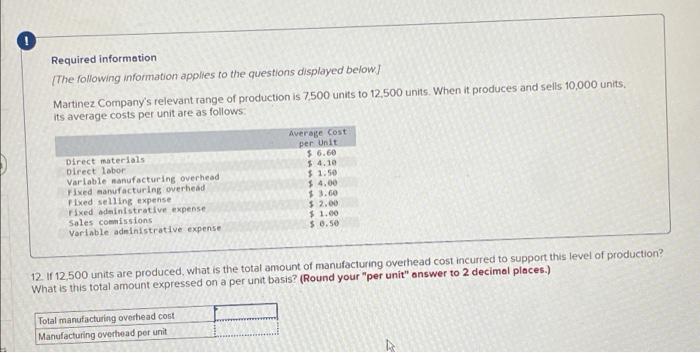

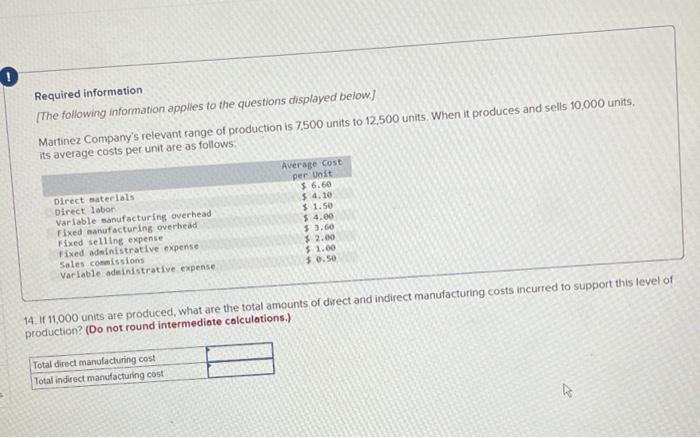

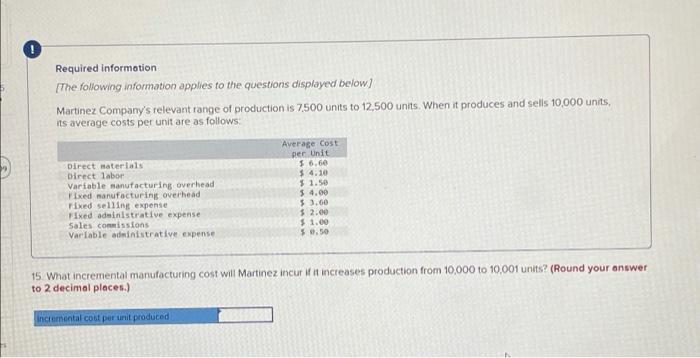

! Required information The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units its average costs per unit are as follows Direct materials Direct labor Variable sanufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average cost per Unit 56.60 $4.10 $ 1.5e $4.00 $ 3.60 $ 2.00 $ 1.00 $0.50 11. if 8,000 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production? What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost Manufacturing overhead per unit Required information The following information applies to the questions displayed below! Martinez Company's relevant range of production is 7500 units to 12,500 units. When it produces and sells 10,000 units. its average costs per unit are as follows: Direct materials Direct labor Varlable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average cost per Unit $.6.60 $4.10 $ 1.50 $ 4.00 $ 3.60 $ 2.00 $ 1.00 $ 0.50 12. 12,500 units are produced, what is the total amount of manufacturing overhead cost incurred to support this level of production What is this total amount expressed on a per unit basis? (Round your "per unit" answer to 2 decimal places.) Total manufacturing overhead cost Manufacturing overhead per unit 0 Required information The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7,500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows Direct materials Direct labor Variable sanufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average cost per Unit $ 6.60 5.4.10 $1.50 $ 4.00 $ 3.60 $ 2.00 $ 1.00 $ 0.50 14. f 11.000 units are produced, what are the total amounts of direct and indirect manufacturing costs incurred to support this level of production? (Do not round intermediate calculations.) Total direct manufacturing cost Total indirect manufacturing cost A Required information [The following information applies to the questions displayed below) Martinez Company's relevant range of production is 7.500 units to 12,500 units. When it produces and sells 10,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average cost per Unit 56.60 $ 4.10 $ 1.50 $ 4.00 $ 3.60 $ 2.00 $ 1.00 5.0.50 15. What incremental manufacturing cost will Martinez incur if it increases production from 10,000 to 10,001 units? (Round your answer to 2 decimal places.) incremental cost per unit produced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts