Question: please help 1. 2. Transaction Analysis and Adjustments For each of the following unrelated situations, determine the financial statement effect using the Transaction Analysis Template:

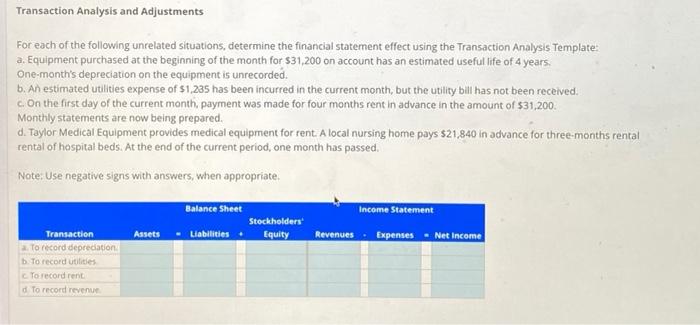

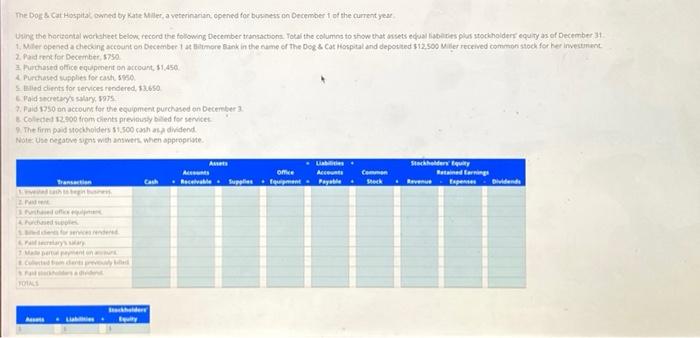

Transaction Analysis and Adjustments For each of the following unrelated situations, determine the financial statement effect using the Transaction Analysis Template: a. Equipment purchased at the beginning of the month for $31,200 on account has an estimated useful life of 4 years. One-month's depreciation on the equipment is unrecorded. b. An estimated utilities expense of $1,235 has been incurred in the current month, but the utility bill has not been received. c. On the first day of the current month, payment was made for four months rent in advance in the amount of $31,200. Monthly statements are now being prepared. d. Taylor Medical Equipment provides medical equipment for rent. A local nursing home pays $21,840 in advance for three-months rental rental of hospital beds. At the end of the current period, one month has passed. Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Stockholders Transaction Assets Equity Revenues Expenses Net Income a. To record depreciation. b. To record utilities c. To record rent. d. To record revenue. - Liabilities The Dog & Cat Hospital, owned by Kate Miller, a veterinarian, opened for business on December 1 of the current year Using the horizontal worksheet below, record the following December transactions Total the columns to show that assets equal liabilities plus stockholders equity as of December 31. 1. Miller opened a checking account on December 1 at Biltmore Bank in the name of The Dog & Cat Hospital and deposited $12,500 Miller received common stock for her investment 2. Paid rent for December, $750 3 Purchased office equipment on account, $1,450 & Purchased supplies for cash, 5950 5. Billed clients for services rendered, 13.650 6.Faid secretary's salary, 1975 7. Paid $750 on account for the equipment purchased on December 3. 8 Collected $2,900 from clients previously billed for services 9. The firm paid stockholders $1.500 cash as a dividend Note: Use negative signs with answers, when appropriate. Assets Stockholders Equity bilities Receivable Supplies fquipment Payable office Common Cash Transaction tach to P Purchased office equipmare Purchased supplies Beddents for services rendered Pa selary's salary 7 Male pertul pepent on Cullected to dents prevoy bad Falsa didend TOTALS Lib. Equity Retained Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts