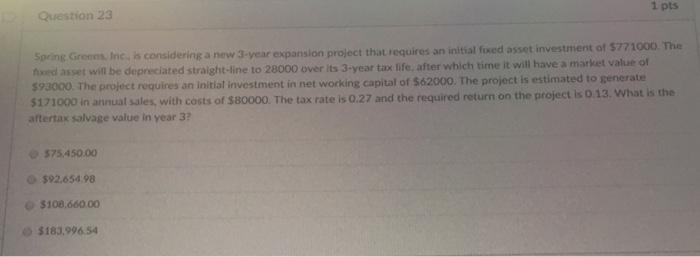

Question: please help 1 pts Question 23 Spring Groom Inc. is considering a new 3-year expansion project that requires an initial foxed asset investment of $771000.

1 pts Question 23 Spring Groom Inc. is considering a new 3-year expansion project that requires an initial foxed asset investment of $771000. The ed asset will be depreciated straight-line to 28000 over its 3-year tax life, after which time it will have a market value of $93000. The project requires an initial investment in net working capital of 562000. The project is estimated to generate 5171000 in annual sales, with costs of $80000. The tax rate is 0.27 and the required return on the project is 0.13. What is the afterta salvage value in year 3? 575.450.00 $92.654.98 3108,660.00 $183.996 54

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts