Question: please help 10 Whether to continue purchase brushes to be distributed or to begin manufacturing them internally? 11 How big an investment can you make

please help

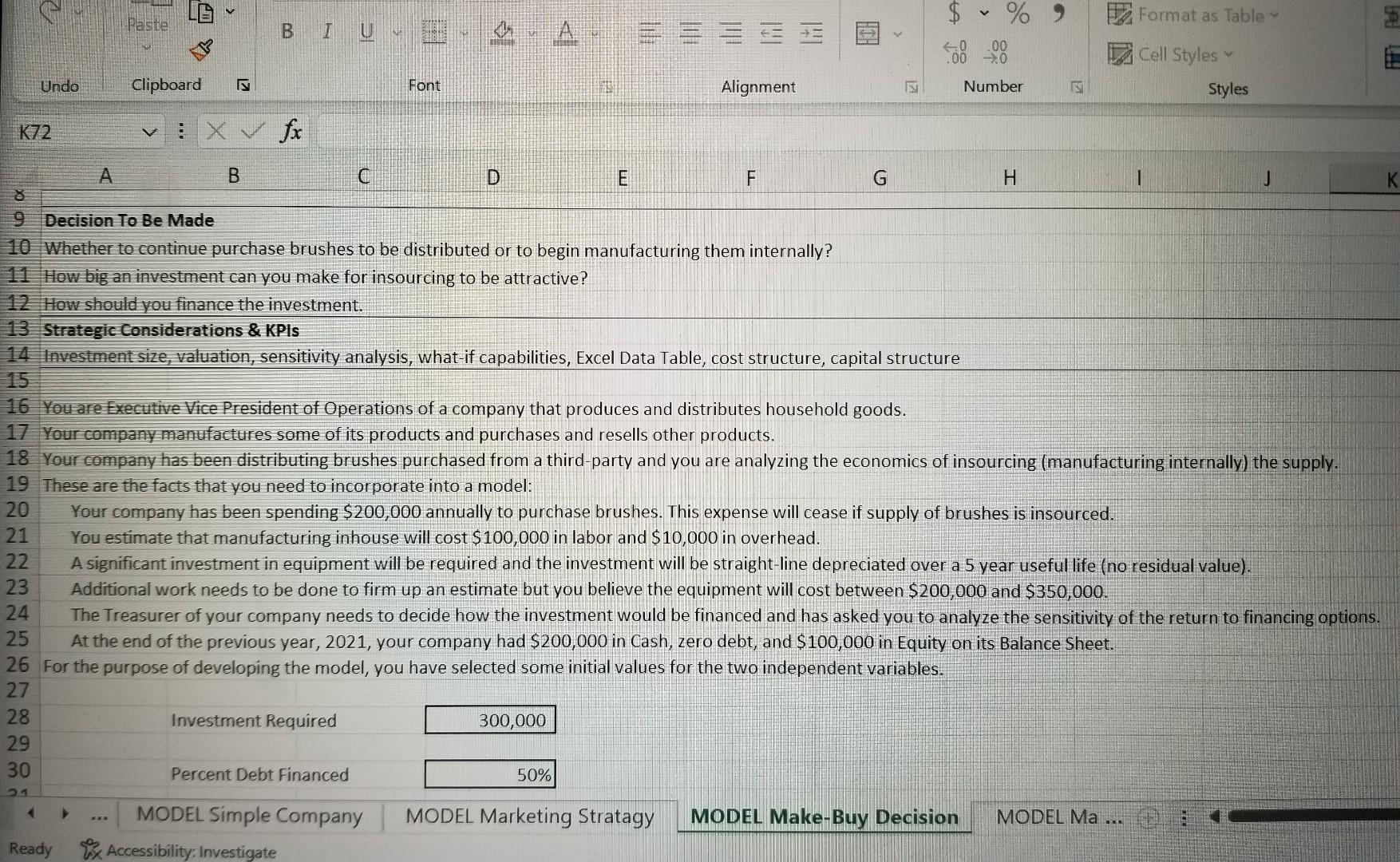

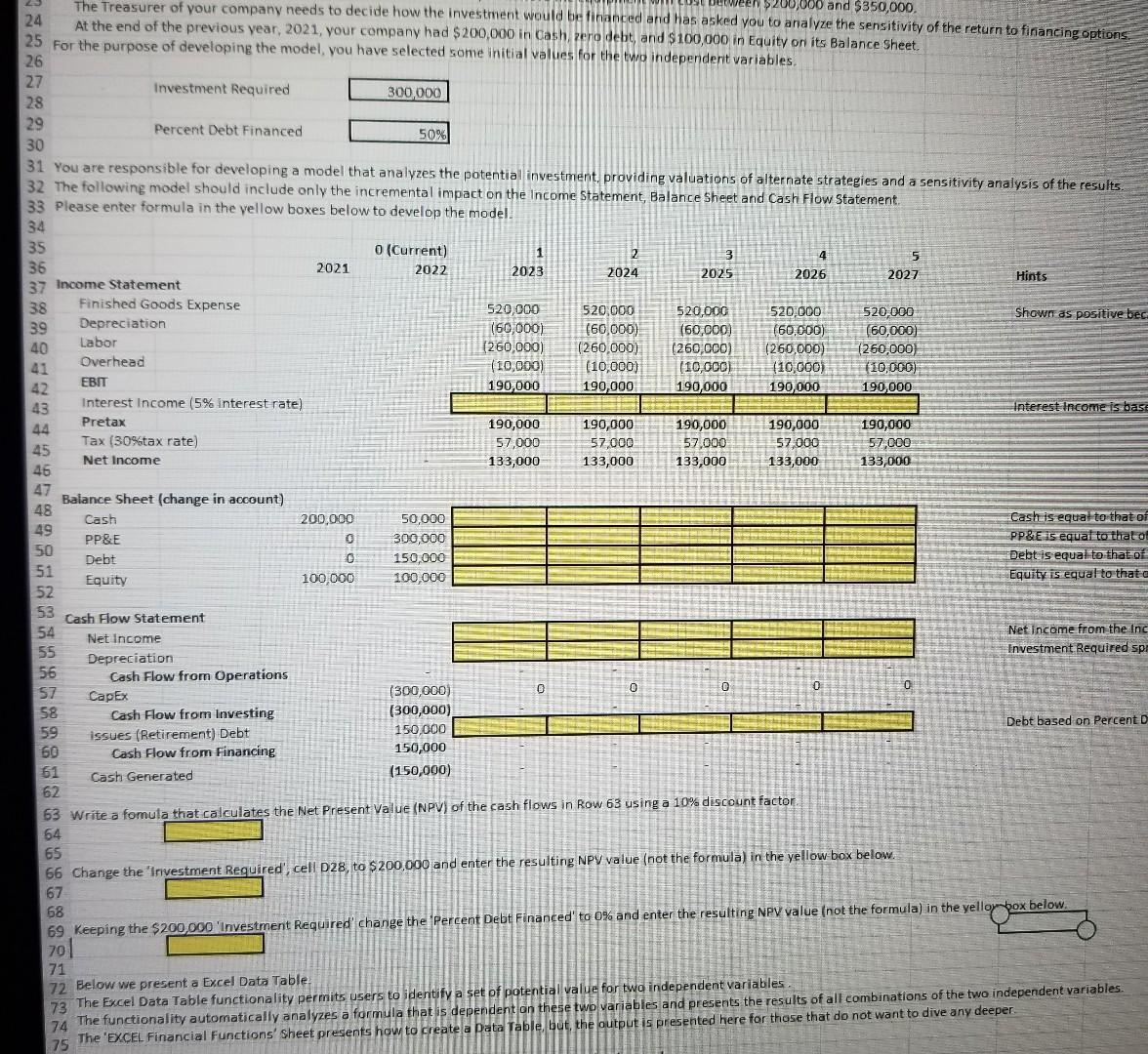

10 Whether to continue purchase brushes to be distributed or to begin manufacturing them internally? 11 How big an investment can you make for insourcing to be attractive? 12 How should vou finance the investment. Strategic Considerations \& KPis 4 Investment size, valuation, sensitivity analysis, what-if capabilities, Excel Data Table, cost structure, capital structure Youare Executive Vice President of Operations of a company that produces and distributes household goods. Your company manufactures some of its products and purchases and resells other products. Your company has been distributing brushes purchased from a third-party and you are analyzing the economics of insourcing (manufacturing internally) the supply. These are the facts that you need to incorporate into a model: Your company has been spending $200,000 annually to purchase brushes. This expense will cease if supply of brushes is insourced. You estimate that manufacturing inhouse will cost $100,000 in labor and $10,000 in overhead. A significant investment in equipment will be required and the investment will be straight-line depreciated over a 5 year useful life (no residual value). Additional work needs to be done to firm up an estimate but you believe the equipment will cost between $200,000 and $350,000. The Treasurer of your company needs to decide how the investment would be financed and has asked you to analyze the sensitivity of the return to financing options. At the end of the previous year, 2021, your company had $200,000 in Cash, zero debt, and $100,000 in Equity on its Balance Sheet. For the purpose of developing the model, you have selected some initial values for the two independent variables. The Treasurer of your company needs to decide how the investment would be financed and has asked you to analyze the sensitivity of the return to financing options. At the end of the previous year, 2021, your company had $200,000 in Cash, zero debt, and $100,000 in Equity on its Balance Sheet. For the purpose of developing the model, you have selected some initial values for the two independent variables. You are responsible for developing a model that analyzes the potentia investment, providing valuations of alternate strategies and a sensitivity analysis of the results. The following model should include only the incremental impact on the Income statement, Balance Sheet and Cash Flow statement. Please enter formula in the yellow boxes below to develop the model. 10 Whether to continue purchase brushes to be distributed or to begin manufacturing them internally? 11 How big an investment can you make for insourcing to be attractive? 12 How should vou finance the investment. Strategic Considerations \& KPis 4 Investment size, valuation, sensitivity analysis, what-if capabilities, Excel Data Table, cost structure, capital structure Youare Executive Vice President of Operations of a company that produces and distributes household goods. Your company manufactures some of its products and purchases and resells other products. Your company has been distributing brushes purchased from a third-party and you are analyzing the economics of insourcing (manufacturing internally) the supply. These are the facts that you need to incorporate into a model: Your company has been spending $200,000 annually to purchase brushes. This expense will cease if supply of brushes is insourced. You estimate that manufacturing inhouse will cost $100,000 in labor and $10,000 in overhead. A significant investment in equipment will be required and the investment will be straight-line depreciated over a 5 year useful life (no residual value). Additional work needs to be done to firm up an estimate but you believe the equipment will cost between $200,000 and $350,000. The Treasurer of your company needs to decide how the investment would be financed and has asked you to analyze the sensitivity of the return to financing options. At the end of the previous year, 2021, your company had $200,000 in Cash, zero debt, and $100,000 in Equity on its Balance Sheet. For the purpose of developing the model, you have selected some initial values for the two independent variables. The Treasurer of your company needs to decide how the investment would be financed and has asked you to analyze the sensitivity of the return to financing options. At the end of the previous year, 2021, your company had $200,000 in Cash, zero debt, and $100,000 in Equity on its Balance Sheet. For the purpose of developing the model, you have selected some initial values for the two independent variables. You are responsible for developing a model that analyzes the potentia investment, providing valuations of alternate strategies and a sensitivity analysis of the results. The following model should include only the incremental impact on the Income statement, Balance Sheet and Cash Flow statement. Please enter formula in the yellow boxes below to develop the model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts