Question: Please Help 13. Which accounts are affected when the inventory account is adjusted at year end when the physical account is $ 45,000 and general

Please Help

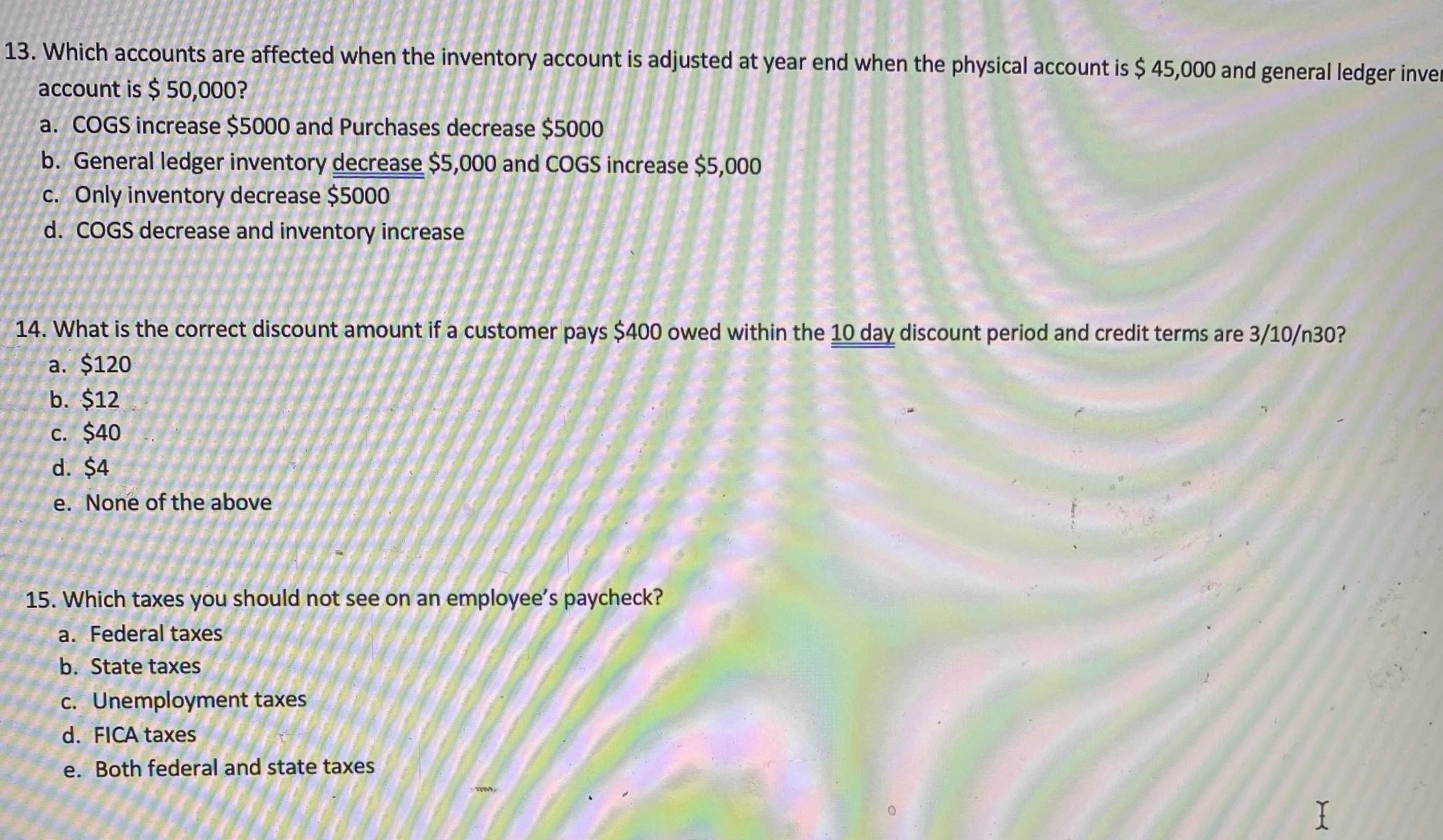

13. Which accounts are affected when the inventory account is adjusted at year end when the physical account is $ 45,000 and general ledger inve account is $ 50,000? a. COGS increase $5000 and Purchases decrease $5000 b. General ledger inventory decrease $5,000 and COGS increase $5,000 c. Only inventory decrease $5000 d. COGS decrease and inventory increase 14. What is the correct discount amount if a customer pays $400 owed within the 10 day discount period and credit terms are 3/1030? a. $120 b. $12 c. $40 d. $4 e. None of the above 15. Which taxes you should not see on an employee's paycheck? a. Federal taxes b. State taxes c. Unemployment taxes d. FICA taxes e. Both federal and state taxes 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts