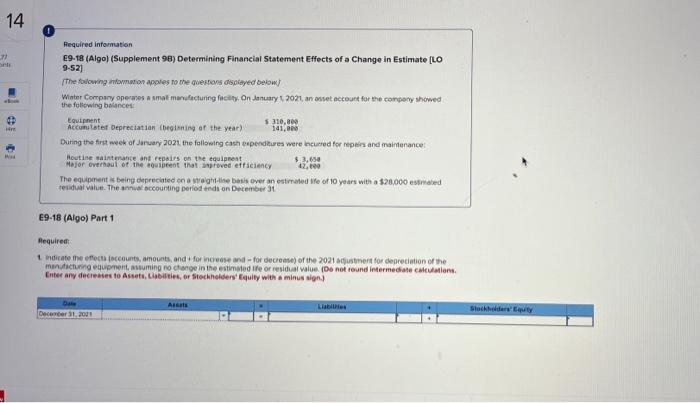

Question: please help!! 14 27 Required information E9-18 (Algo) (Supplement 98) Determining Financial Statement Effects of a Change in Estimate (LO 9-521 The following applies to

14 27 Required information E9-18 (Algo) (Supplement 98) Determining Financial Statement Effects of a Change in Estimate (LO 9-521 The following applies to the questions displayed below! Winter Company operates a mot manufacturing facity on January 2021, an ovet account for the company showed the following balances Equipment $310.000 Accumulater Depreciation beginning of the year) 141,000 During the first week of January 202, the following cash expenditures were incurred for men and maintenance Houtine maintenance and repairs on the equipment $ 3,650 Major over out of the soient that proved triciency 42,00 The event being cated on white basis over an estimated te of 10 years with a $20,000 ested residual value. The annual accounting period and on December 31 E9-18 (Algo) Part 1 Required indicate the effect accounts, amounts and for increase and for decrease of the 2021 adjustment for depreciation of the manufacturing equipment, assuming no change in the estimated life or residual value (Do not round Intermediate clation Enter any decreases to Assets, birties, or Stockholders' Equity with a minus sign) Art Labies Stockholm December 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts