Question: please help 14. A US FI is acting as a hedger when it: a goes short on Euro and long on Yen. b. buys or

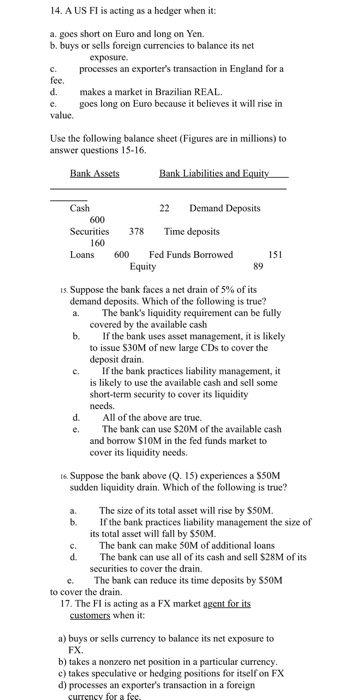

14. A US FI is acting as a hedger when it: a goes short on Euro and long on Yen. b. buys or sells foreign currencies to balance its net exposure c. processes an exporter's transaction in England for a fee. d. makes a market in Brazilian REAL. e goes long on Euro because it believes it will rise in value. Use the following balance sheet (Figures are in millions) to answer questions 15-16. Bank Assets Bank Liabilities and Equity 22 Demand Deposits Cash 600 Securities 160 Loans 378 Time deposits 151 600 Fed Funds Borrowed Equity 89 IS. Suppose the bank faces a net drain of 5% of its demand deposits. Which of the following is true? a. The bank's liquidity requirement can be fully covered by the available cash b. If the bank uses asset management, it is likely to issue S30M of new large CDs to cover the deposit drain. If the bank practices liability management, it is likely to use the available cash and sell some short-term security to cover its liquidity needs. All of the above are true. The bank can use $20M of the available cash and borrow $IOM in the fed funds market to cover its liquidity needs. 16Suppose the bank above (Q. 15) experiences a $50M sudden liquidity drain. Which of the following is true? The size of its total asset will rise by S5OM. b. If the bank practices liability management the size of its total asset will fall by SSOM. C. The bank can make SOM of additional loans d. The bank can use all of its cash and sell $28M of its securities to cover the drain. e. The bank can reduce its time deposits by SSOM to cover the drain. 17. The FI is acting as a FX market agent for its customers when it: a) buys or sells currency to balance its net exposure to FX b) takes a nonzero net position in a particular currency. c) takes speculative or hedging positions for itself on FX d) processes an exporter's transaction in a foreign CUITCncy for a fee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts