Question: Please Help #14 Required information Problem 10-6A Record equity transactions and prepare the stockholders' equity section (LO10-2, 10-3, 10- 4, 10-5, 10-7) [The following information

![information applies to the questions displayed below.] Major League Apparel has two](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/671869122da8c_00967186911b2647.jpg)

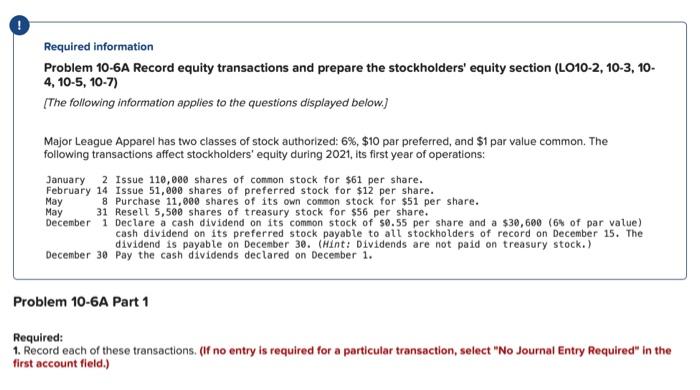

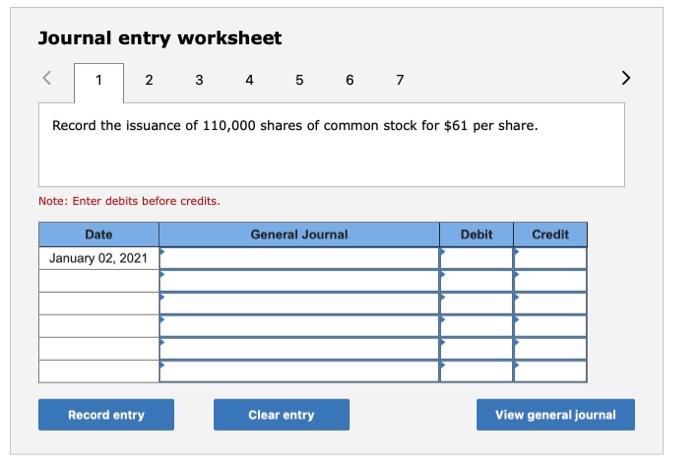

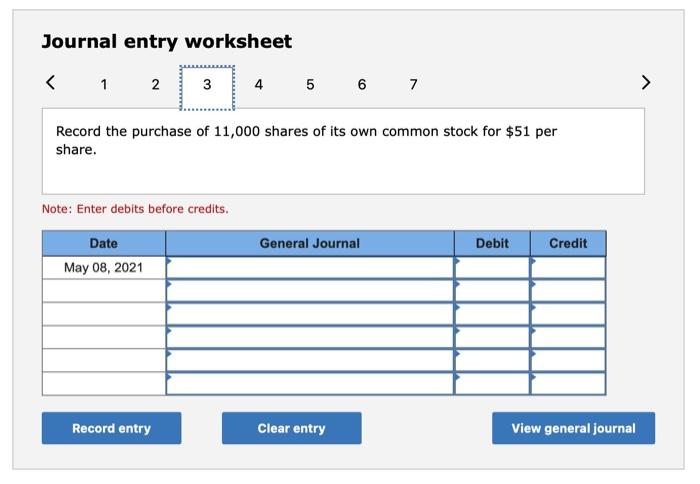

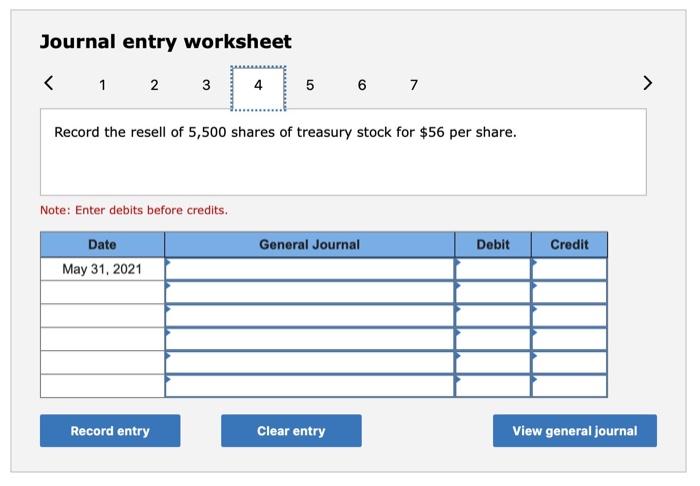

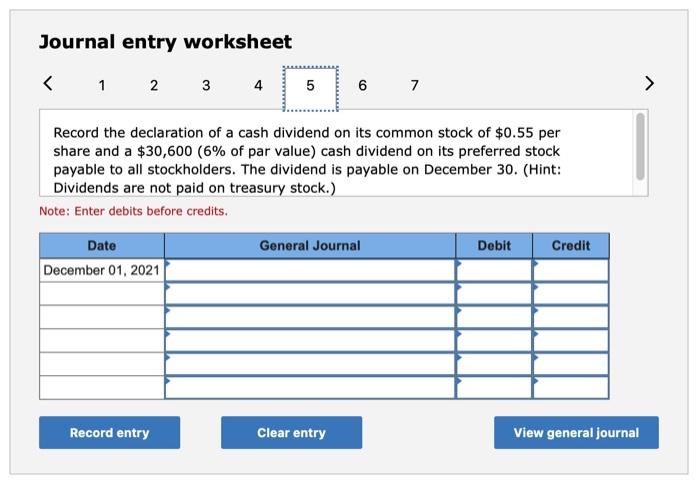

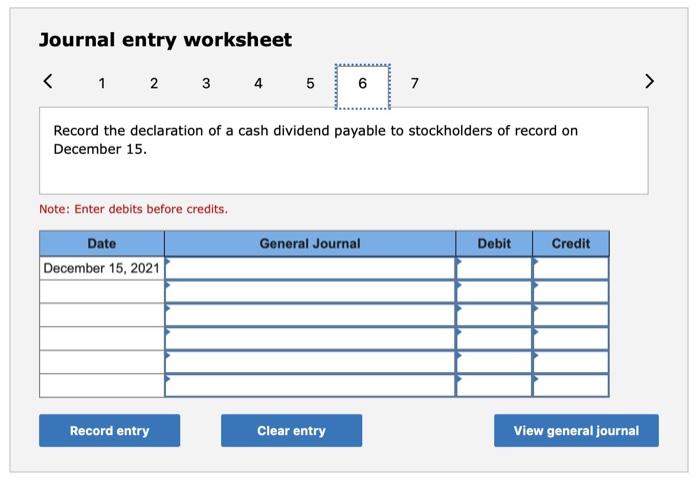

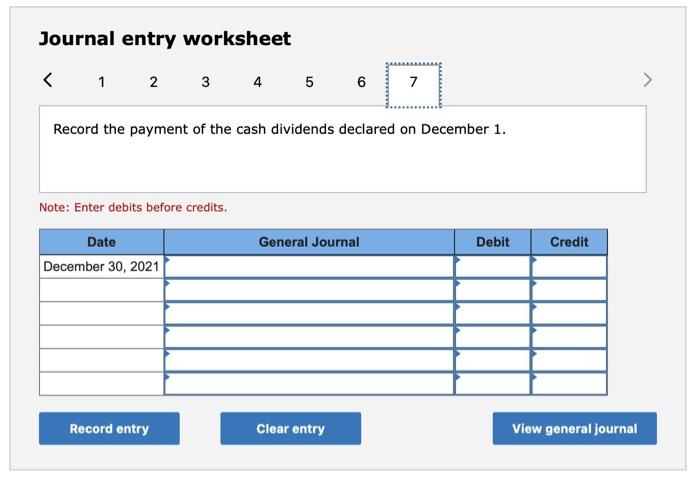

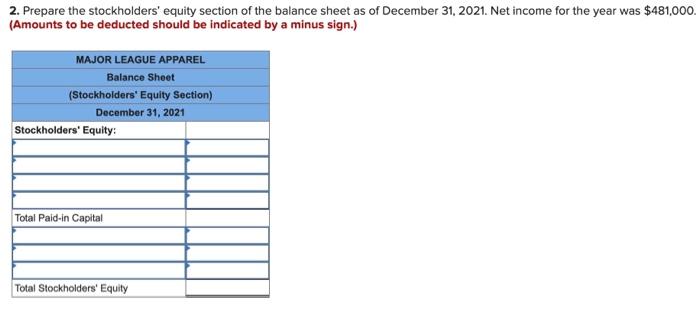

Required information Problem 10-6A Record equity transactions and prepare the stockholders' equity section (LO10-2, 10-3, 10- 4, 10-5, 10-7) [The following information applies to the questions displayed below.] Major League Apparel has two classes of stock authorized: 6%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations: January 2 Issue 110,000 shares of common stock for $61 per share. February 14 Issue 51,000 shares of preferred stock for $12 per share. 8 May May 31 December 1 Purchase 11,000 shares of its own common stock for $51 per share. Resell 5,500 shares of treasury stock for $56 per share. Declare a cash dividend on its common stock of $0.55 per share and a $30,600 (6% of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. Problem 10-6A Part 1 Required: 1. Record each of these transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required" in the first account field.) Journal entry worksheet 1 2 3 Record the issuance of 110,000 shares of common stock for $61 per share. Note: Enter debits before credits. Date January 02, 2021 Record entry 4 5 6 7 General Journal Clear entry Debit Credit View general journal Journal entry worksheet Journal entry worksheet Journal entry worksheet 1 2 Date May 31, 2021 3 Note: Enter debits before credits. Record the resell of 5,500 shares of treasury stock for $56 per share. Record entry 4 5 General Journal Clear entry Debit Credit View general journal Journal entry worksheet 1 2 3 Date December 01, 2021 4 Record entry 5 Record the declaration of a cash dividend on its common stock of $0.55 per share and a $30,600 (6% of par value) cash dividend on its preferred stock payable to all stockholders. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. 6 General Journal Clear entry 7 Debit Credit View general journal Journal entry worksheet 1 2 3 Note: Enter debits before credits. Date December 15, 2021 4 5 Record the declaration of a cash dividend payable to stockholders of record on December 15. Record entry 6 General Journal Clear entry 7 Debit Credit View general journal Journal entry worksheet 1 2 3 Note: Enter debits before credits. Record the payment of the cash dividends declared on December 1. Date December 30, 2021 4 5 6 Record entry General Journal 7 Clear entry Debit Credit View general journal 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. Net income for the year was $481,000. (Amounts to be deducted should be indicated by a minus sign.) MAJOR LEAGUE APPAREL Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' Equity: Total Paid-in Capital Total Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts