Question: Please Help !!! (15 Points) Take a look at the Two-Stage Dividend Discount Model (DDM) example from the text and answer the following questions: Exhibit

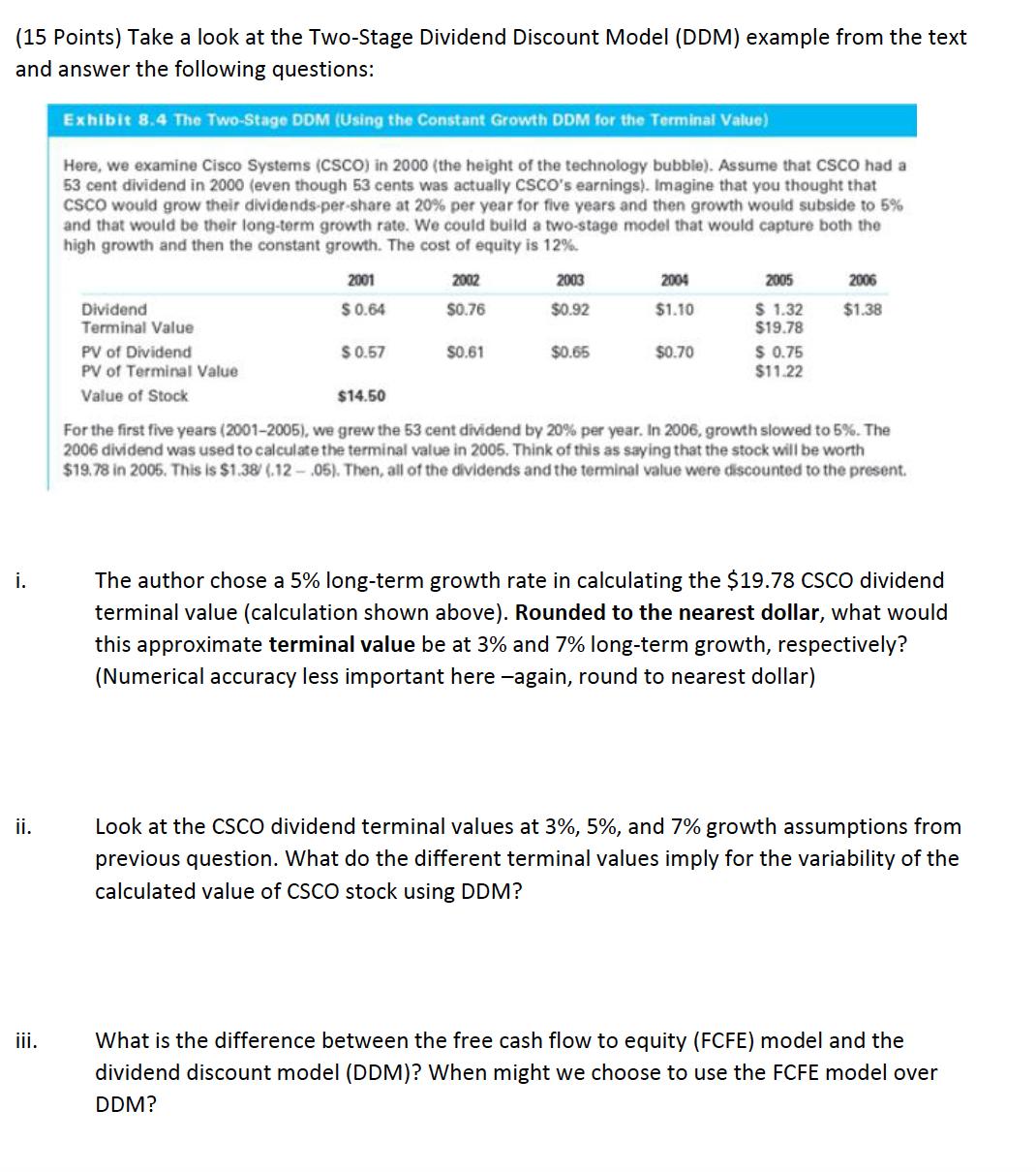

(15 Points) Take a look at the Two-Stage Dividend Discount Model (DDM) example from the text and answer the following questions: Exhibit 8.4 The Two-Stage DDM (Using the Constant Growth DDM for the Terminal Value) Here, we examine Cisco Systems (CSCO) in 2000 (the height of the technology bubble). Assume that CSCO had a 53 cent dividend in 2000 (even though 53 cents was actually CSCO's earnings). Imagine that you thought that CSCO would grow their dividends-per-share at 20% per year for five years and then growth would subside to 5% and that would be their long-term growth rate. We could build a two-stage model that would capture both the high growth and then the constant growth. The cost of equity is 12%. 2001 2002 2003 2004 Dividend $0.64 $0.76 $0.92 $1.10 Terminal Value 2005 $ 1.32 $19.78 2006 $1.38 PV of Dividend $0.57 $0.61 $0.65 $0.70 $ 0.75 PV of Terminal Value $11.22 Value of Stock $14.50 For the first five years (2001-2005), we grew the 53 cent dividend by 20% per year. In 2006, growth slowed to 5%. The 2006 dividend was used to calculate the terminal value in 2005. Think of this as saying that the stock will be worth $19.78 in 2005. This is $1.38/ (.12-.05). Then, all of the dividends and the terminal value were discounted to the present. i. The author chose a 5% long-term growth rate in calculating the $19.78 CSCO dividend terminal value (calculation shown above). Rounded to the nearest dollar, what would this approximate terminal value be at 3% and 7% long-term growth, respectively? (Numerical accuracy less important here -again, round to nearest dollar) ii. Look at the CSCO dividend terminal values at 3%, 5%, and 7% growth assumptions from previous question. What do the different terminal values imply for the variability of the calculated value of CSCO stock using DDM? iii. What is the difference between the free cash flow to equity (FCFE) model and the dividend discount model (DDM)? When might we choose to use the FCFE model over DDM?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts