Question: please help 1odule exercise Covered interest arbitrage and IRP exercise Suppose an investor has $2,000,000 and can choose to nvest in U.S. securities for one

please help

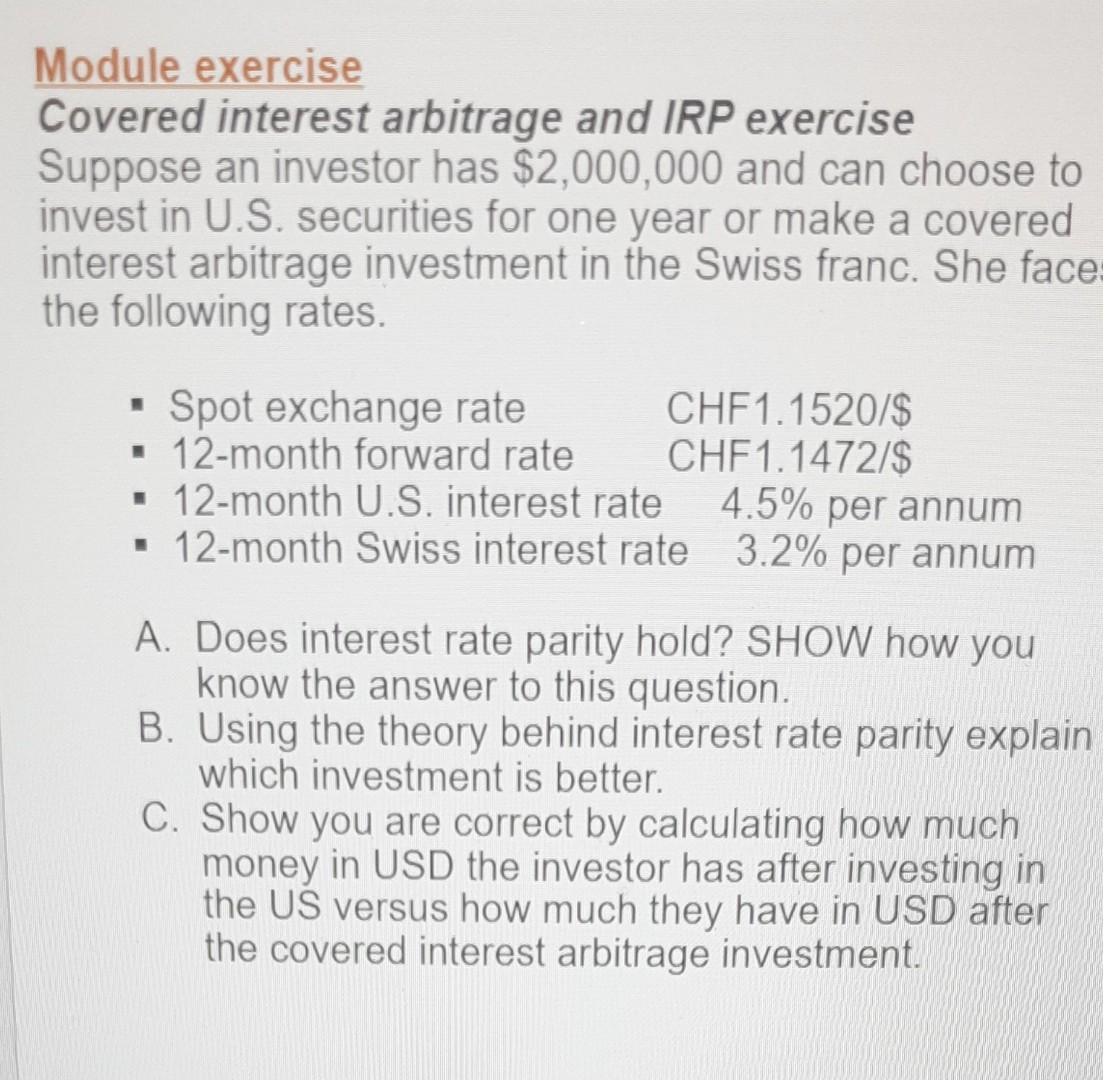

1odule exercise Covered interest arbitrage and IRP exercise Suppose an investor has $2,000,000 and can choose to nvest in U.S. securities for one year or make a covered nterest arbitrage investment in the Swiss franc. She face he following rates. - Spot exchange rate CHF1.1520/$ - 12-month forward rate CHF1.1472/\$ - 12-month U.S. interest rate 4.5% per annum - 12-month Swiss interest rate 3.2% per annum A. Does interest rate parity hold? SHOW how you know the answer to this question. B. Using the theory behind interest rate parity explain which investment is better. C. Show you are correct by calculating how much money in USD the investor has after investing in the US versus how much they have in USD after the covered interest arbitrage investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts