Question: Please help 2, 4, 5 I only 30 min. What tax-related items does Kroger report on its Income Statement for the period ended February 3,

Please help 2, 4, 5 I only 30 min.

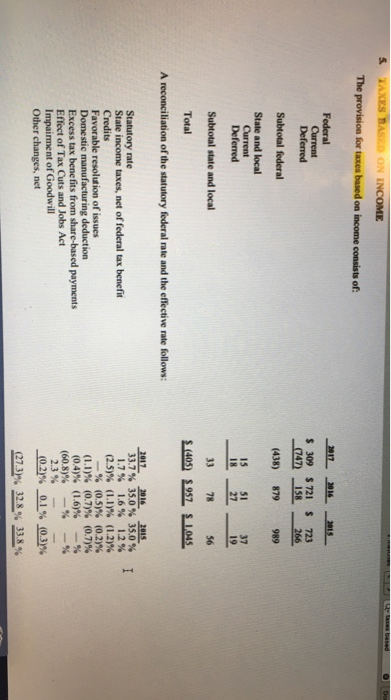

What tax-related items does Kroger report on its Income Statement for the period ended February 3, 2018? Does Kroger's tax expense during this period increase or decrease income? 2. Kroger provides the detail underlying the tax-related financial statement accounts you list above in Footnote 5. Use Footnote 5 to answer the questions below. 4. What is the total income tax expense amount you reported in question two above comprised of for the period ended February 3, 2018? In other words, the total amount is equal to the sum of several different items. What are those items? 5. Federal S 309 $721 S 723 (74 158266 (438) 879 989 Deferred Subtotal federal State and local Current Deferred 15 51 18 27 Subtotal state and local 33 78 56 Total 405) $ 957 S 1.045 A reconciliation of the statutory federal rate and the effective rate follows -2017_ 16-2015 State income taxes, net of federal tax benefit Credits Favorable resolution of issues Domestic manufacturing deduction Excess tax benefits from share-based payments Effect of Tax Cuts and Jobs Act Impairment of Goodwill Other changes, net 1.7% -% (0.4)% 1.6% 1.2% (0.5)% (0.2)% (1.6)% -% (60.8)%-%-% (02)% 0.1%,0.3)% (273% 32.8% 33.8% 5. Give your best shot at preparing Kroger's summary journal entry to record income tax expense for the period ended February 3, 2018. I'll give you a hint-because you are preparing a summary entry, there are only three lines in the journal entry. What tax-related items does Kroger report on its Income Statement for the period ended February 3, 2018? Does Kroger's tax expense during this period increase or decrease income? 2. Kroger provides the detail underlying the tax-related financial statement accounts you list above in Footnote 5. Use Footnote 5 to answer the questions below. 4. What is the total income tax expense amount you reported in question two above comprised of for the period ended February 3, 2018? In other words, the total amount is equal to the sum of several different items. What are those items? 5. Federal S 309 $721 S 723 (74 158266 (438) 879 989 Deferred Subtotal federal State and local Current Deferred 15 51 18 27 Subtotal state and local 33 78 56 Total 405) $ 957 S 1.045 A reconciliation of the statutory federal rate and the effective rate follows -2017_ 16-2015 State income taxes, net of federal tax benefit Credits Favorable resolution of issues Domestic manufacturing deduction Excess tax benefits from share-based payments Effect of Tax Cuts and Jobs Act Impairment of Goodwill Other changes, net 1.7% -% (0.4)% 1.6% 1.2% (0.5)% (0.2)% (1.6)% -% (60.8)%-%-% (02)% 0.1%,0.3)% (273% 32.8% 33.8% 5. Give your best shot at preparing Kroger's summary journal entry to record income tax expense for the period ended February 3, 2018. I'll give you a hint-because you are preparing a summary entry, there are only three lines in the journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts