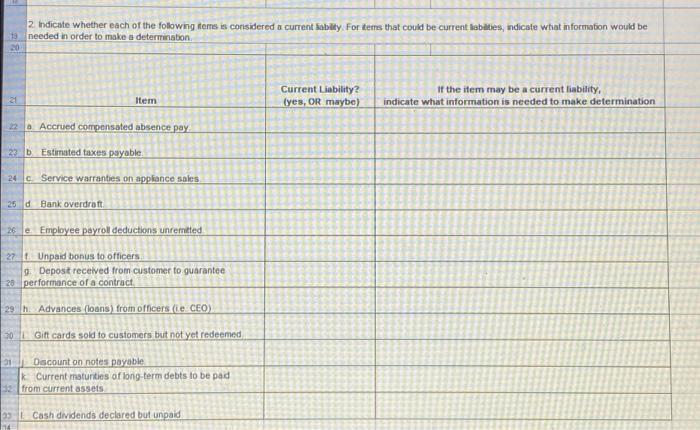

Question: please help 2 Indicate whether each of the following items is considered a current ability for tems that could be current abilities, indicate what information

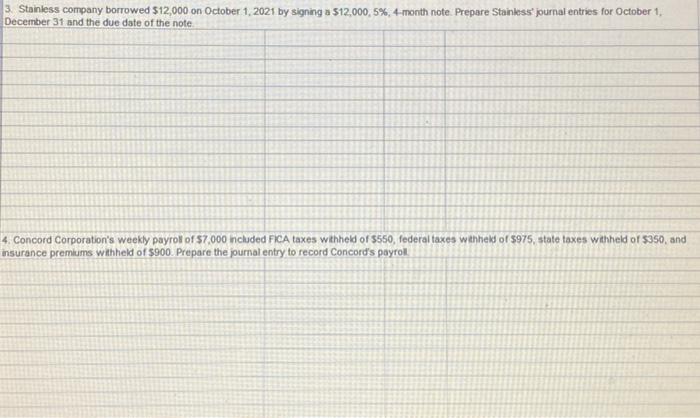

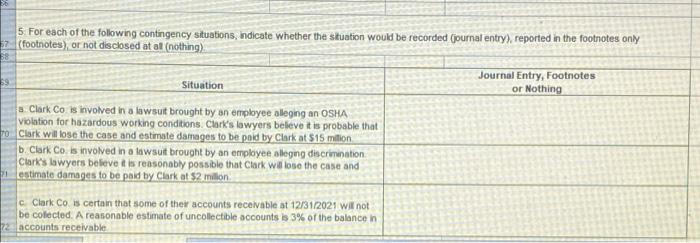

2 Indicate whether each of the following items is considered a current ability for tems that could be current abilities, indicate what information would be 19. needed in order to make a determination 20 Hem Current Liability? tyes, OR maybe) If the item may be a current liability, indicate what information is needed to make determination 220 Accrued compensated absence pay 23 Estimated taxes payable 24 c Service warranties on appkance sales 25 d Bank overdraft 26 e Employee payrol deductions unremitted 27 Unpaid bonus to officers Depost received from customer to guarantee 28 performance of a contract 23 h: Advances (loans) from officers (ie CEO) 301 Gift cards sold to customers but not yet redeemed 21 Discount on notes payable k Current maturities of long-term debts to be pad s from current assets 23 I Cash dividends declared but unpaid 3 Stainless company borrowed 512,000 on October 1, 2021 by signing a 512,000, 5%, 4-month note. Prepare Stainless journal entries for October 1, December 31 and the due date of the note 4. Concord Corporation's weekly payroll of $7,000 included FICA taxes withheld of 5550, federal taxes withheld of $975, state taxes withheld of $350, and insurance premiums withheld of $900. Prepare the journal entry to record Concord's payroll 59 5. For each of the following contingency situations, indicate whether the situation would be recorded (journal entry), reported in the footnotes only 7 (footnotes) or not disclosed at al(nothing) Journal Entry, Footnotes Situation or Nothing a Clark Co is involved in a lawsuit brought by an employee aleging an OSHA violation for hazardous working conditions. Clark's lawyers believe it is probable that ro Clark will lose the case and estimate damages to be paid by Clark at S15 million b. Clark Co. is involved in a lawsuit brought by an employee sleging discrimination Clark's lawyers believe it is reasonably possible that Clark we lose the case and estimate damages to be paid by Clark at $2 million c Clark Co is certain that some of the accounts receivable at 12/31/2021 will not be colected. A reasonable estimate of uncollectible accounts is 3% of the balance in accounts receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts