Question: Please, help 2a and 2b Thank You, Please, help with section 2a and 2b. Thank You, Absorption and variable costing income statements for two months

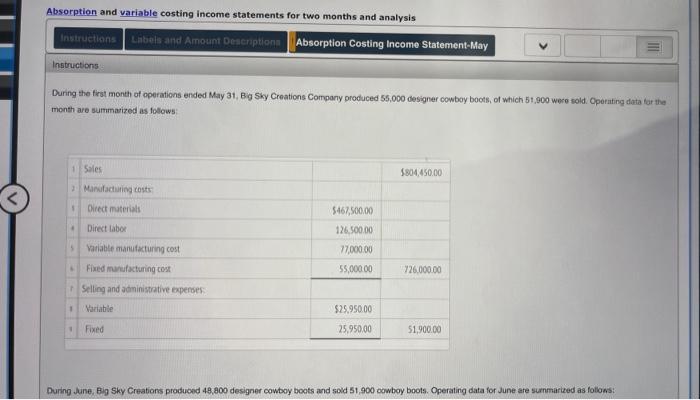

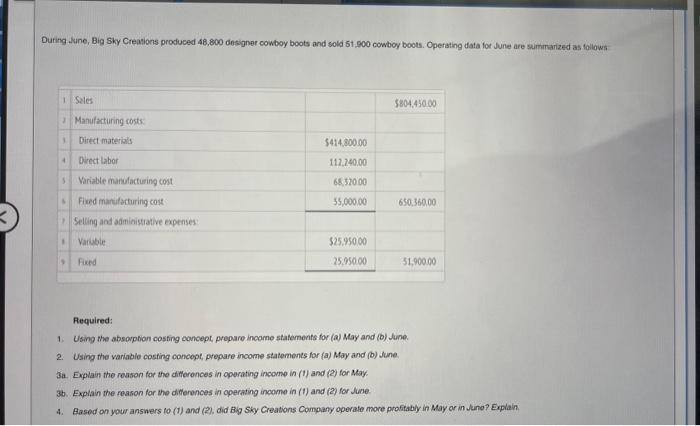

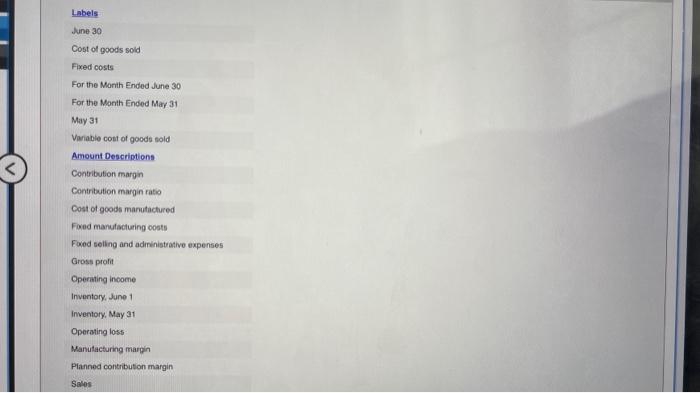

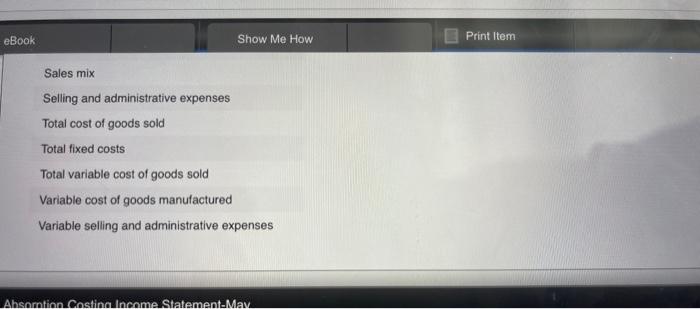

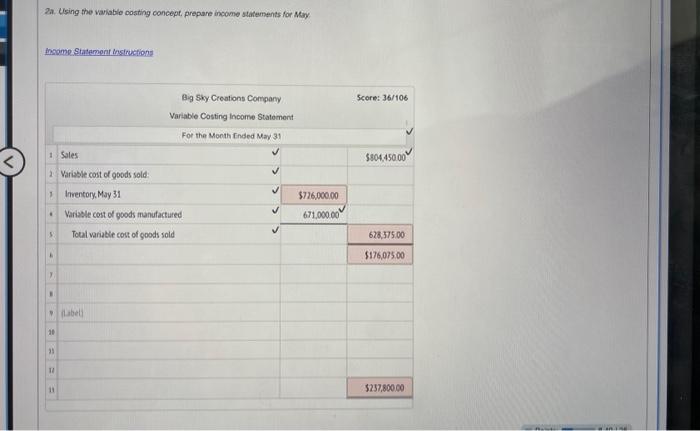

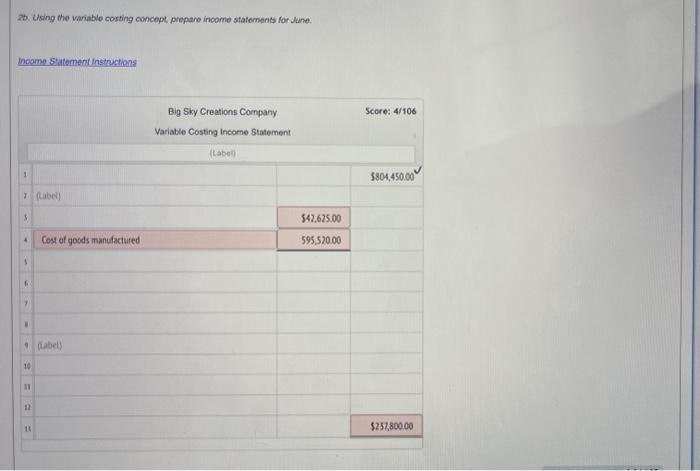

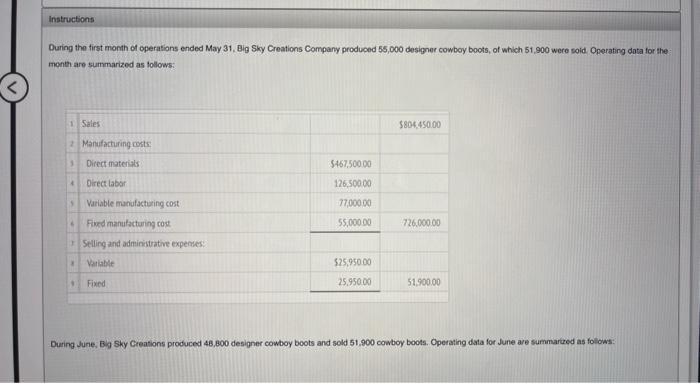

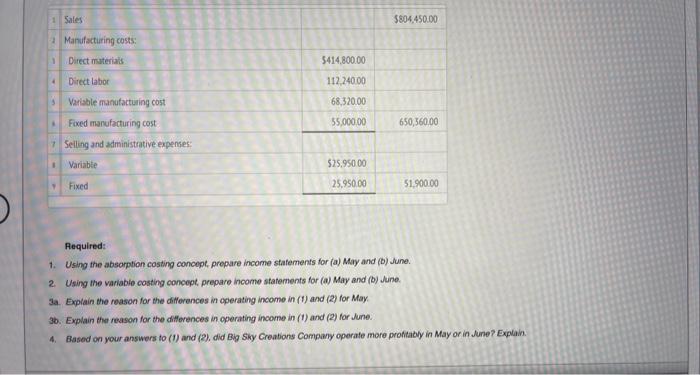

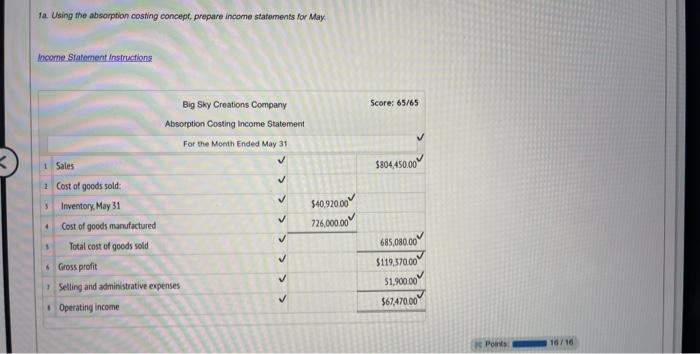

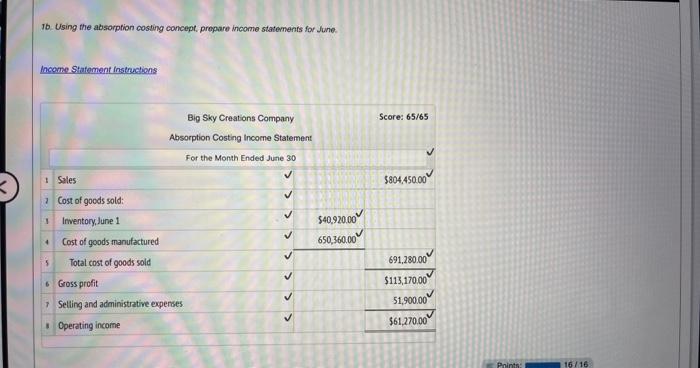

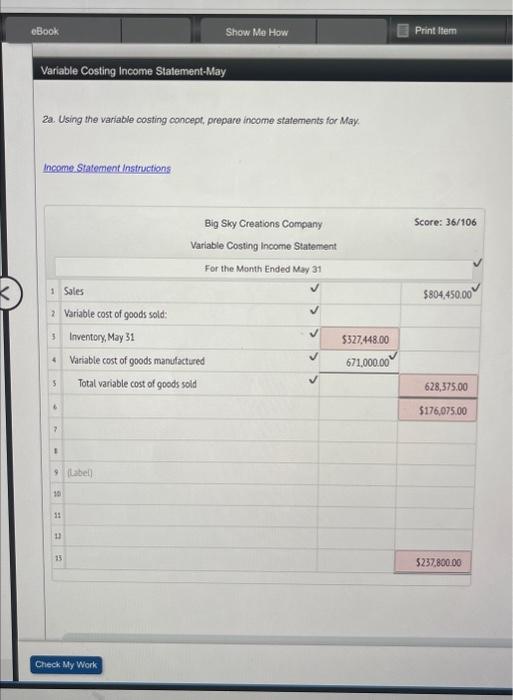

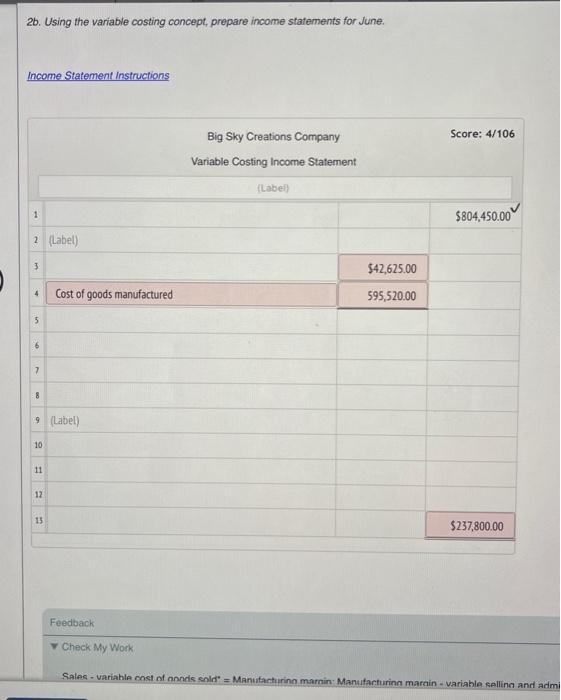

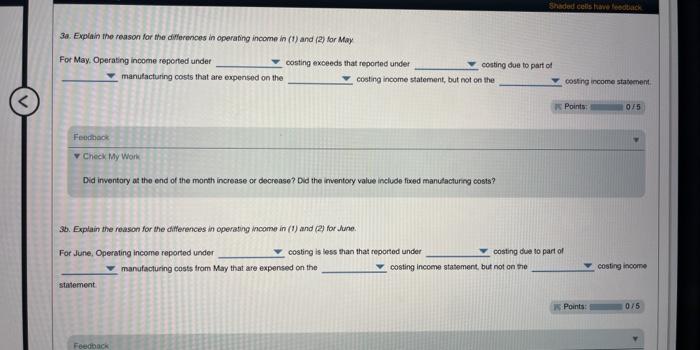

Absorption and variable costing income statements for two months and analysis Instructions During the first month of operations ended May 31, Big Siy Creations Compony produced 55,000 designer cowboy boots, of which 5 t,900 were sold. Opefating data far the month are summatized as follows: During dune, Big Sky Creations produced 48,800 dosigner cowboy boots and sold 51,900 cowboy boots. Operating data for June are suimararized as followi Required: 1. Using the absorption costing concept, prepare incorne statements for (a) May and (b) dune. 2. Using the variable cosfing concept, prepare income statemonts for (a) May and (b) June. 3a. Explain the reason for the differences in operating income in (1) and (2) for May? 36. Explain the reason for the diferences in operating income in (1) and (2) for June. 4. Aasod on your answers po (1) and (2), did Big Siy Creations Company operate more profitably in May or in vune? Explain. Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variabie cost of goode sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manutactured Foed manutacturing oosts Foved seling and adininistrative expenses Gross profit Operating income Inventory, June 1 inventory, May 31 Operating loss Manutacturing marpin Planned contribution margin sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses 2a. Ulsing the variablo costing concept, prepare income statements for Mtiy fmeame. Statemont instructions 2b. Uising the variable costing concept preparo income statoments for June. Ouring the tirst month of operations ended May 31, Big Shy Creations Company produced 55,000 designer cowboy boots, of which 51,900 were soid Operating data for the: month are summarized as follows: During June, Big Sky Creations produced 48,800 designer cowboy boots and sold 51,900 cowboy boots. Operating data for June are summarued as folows: Required: 1. Using the absorption costing concept, prepare income stafements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) June. 3a. Explain the reason for the ditferences in operating income in (1) and (2) for May. 3b. Explain the reason for the dillevences in operating income in (1) and (2) for dune. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profiably in May or in Jume? Explain. Labels and Amount Descriptions Labels June 30 Cost of goods sold Fixed costs For the Month Ended June 30 For the Month Ended May 31 May 31 Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Cost of goods manufactured Fixed manufacturing costs Fixed selling and administrative expenses Gross profit Operating income Inventory, June 1 Inventory. May 31 Operating loss Manutacturing margin Planned contrabtion margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost ot goods soid Check My Work Gross profit Operating income Inventory, June 1 Inventory, May 31 Operating loss Manufacturing margin Planned contribution margin Sales Sales mix Selling and administrative expenses Total cost of goods sold Total fixed costs Total variable cost of goods sold Variable cost of goods manufactured Variable selling and administrative expenses Absorption Costing Income Statement-May 1a. Using the absorption costing concept, prepare income statoments for May. Incorme Sfatement Instructions 16. Using the absorption costing concept, propare income statements for June. fncome Statement instructions 2a. Using the variable costing concept, prepare income statements for May, Income Statement Instructions 2b. Using the variable costing concept, prepare income statements for June. 3a. Explain the reason for the diWerences in eperafing income in (t) and (2) tar May For May. Operating inpome reperted under costing exceeds that reported under. costing due to part of manufacturing costs that are expensed on the costing income statement, but not on the costing income staternert. Feedapok Check My Work Did inventary at the end of the month increase or docrease? Did the imventory value include fixed manudacturing costs? 36. Explain the reason for the differences in operating income in (I) and (2) for Aune. For June. Operating income reported under costing is less than that repored under costing due so part of manufacturing costs irom May that are expensed on the costing income stasement, but not on the statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts