Question: please help 2x. A Simillion loan commitment has an up-front fee of 10 basis points (BP) and a backend fee of 30 bp on the

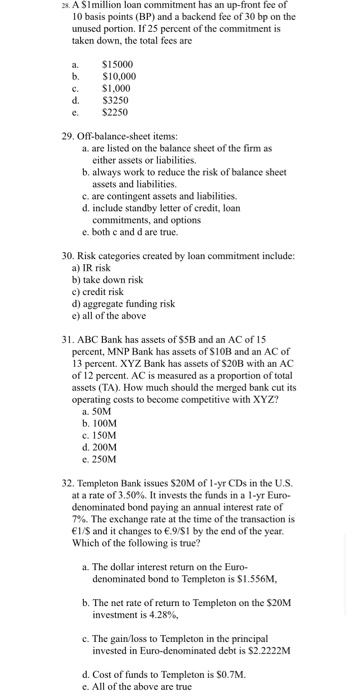

2x. A Simillion loan commitment has an up-front fee of 10 basis points (BP) and a backend fee of 30 bp on the unused portion. If 25 percent of the commitment is taken down, the total fees are a. b. c. d. e. S15000 $10,000 S1.000 S3250 S2250 29. Off-balance-sheet items: a. are listed on the balance sheet of the firm as either assets or liabilities. b. always work to reduce the risk of balance sheet assets and liabilities. c. are contingent assets and liabilities. d. include standby letter of credit, loan commitments, and options e. both c and d are true. 30. Risk categories created by loan commitment include: a) IR risk b) take down risk c) credit risk d) aggregate funding risk c) all of the above 31. ABC Bank has assets of $5B and an AC of 15 percent, MNP Bank has assets of $10B and an AC of 13 percent. XYZ Bank has assets of S20B with an AC of 12 percent. AC is measured as a proportion of total assets (TA). How much should the merged bank cut its operating costs to become competitive with XYZ? a. SOM b. 100M c. 150M d. 200M e. 250M 32. Templeton Bank issues $20M of 1-yr CDs in the U.S. at a rate of 3.50%. It invests the funds in a 1-yr Euro- denominated bond paying an annual interest rate of 7%. The exchange rate at the time of the transaction is 1/S and it changes to .9/81 by the end of the year. Which of the following is true? a. The dollar interest return on the Euro- denominated bond to Templeton is $1.556M, b. The net rate of return to Templeton on the $20M investment is 4.28%, c. The gain/loss to Templeton in the principal invested in Euro-denominated debt is $2.2222M d. Cost of funds to Templeton is S0.7M. c. All of the above are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts