Question: please help 3. A bond with exactly nine years remaining until maturity offers a 4% coupon rate with annual coupons. The bond, with a yield-to-maturity

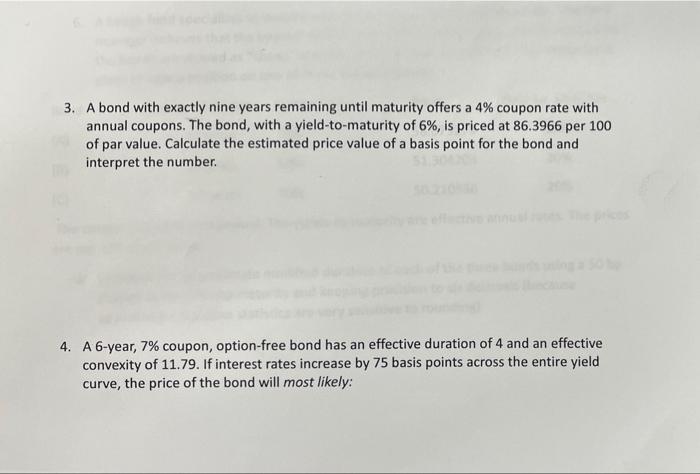

3. A bond with exactly nine years remaining until maturity offers a 4% coupon rate with annual coupons. The bond, with a yield-to-maturity of 6%, is priced at 86.3966 per 100 of par value. Calculate the estimated price value of a basis point for the bond and interpret the number 4. A 6-year, 7% coupon, option-free bond has an effective duration of 4 and an effective convexity of 11.79. If interest rates increase by 75 basis points across the entire yield curve, the price of the bond will most likely

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts