Question: please help 3. Colonel Forbin and Prince Caspian are equal partners in an accrual-method, calendar-year partnership. Pursuant to the partnership agreement, Colonel Forbin performs managerial

please help

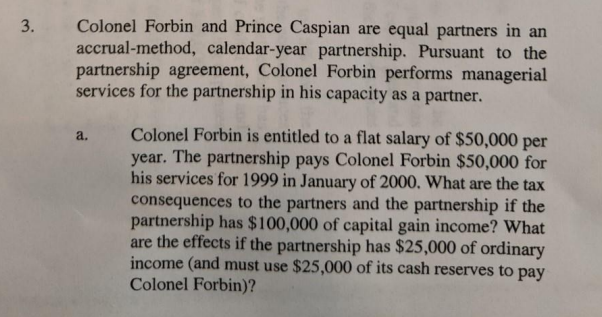

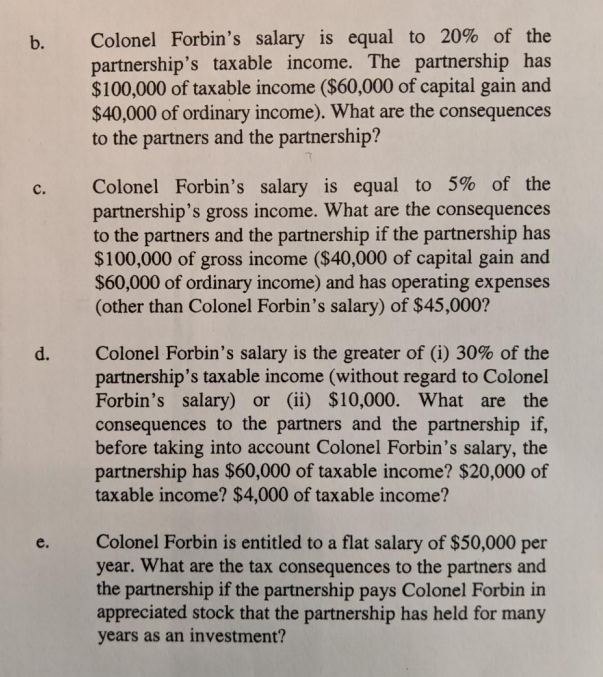

3. Colonel Forbin and Prince Caspian are equal partners in an accrual-method, calendar-year partnership. Pursuant to the partnership agreement, Colonel Forbin performs managerial services for the partnership in his capacity as a partner. a. Colonel Forbin is entitled to a flat salary of $50,000 per year. The partnership pays Colonel Forbin $50,000 for his services for 1999 in January of 2000. What are the tax consequences to the partners and the partnership if the partnership has $100,000 of capital gain income? What are the effects if the partnership has $25,000 of ordinary income (and must use $25,000 of its cash reserves to pay Colonel Forbin)? b. Colonel Forbin's salary is equal to 20% of the partnership's taxable income. The partnership has $100,000 of taxable income ($60,000 of capital gain and $40,000 of ordinary income). What are the consequences to the partners and the partnership? c . Colonel Forbin's salary is equal to 5% of the partnership's gross income. What are the consequences to the partners and the partnership if the partnership has $100,000 of gross income ($40,000 of capital gain and $60,000 of ordinary income) and has operating expenses (other than Colonel Forbin's salary) of $45,000? d. Colonel Forbin's salary is the greater of (i) 30% of the partnership's taxable income (without regard to Colonel Forbin's salary) or (ii) $10,000. What are the consequences to the partners and the partnership if, before taking into account Colonel Forbin's salary, the partnership has $60,000 of taxable income? $20,000 of taxable income? $4,000 of taxable income? e. Colonel Forbin is entitled to a flat salary of $50,000 per year. What are the tax consequences to the partners and the partnership if the partnership pays Colonel Forbin in appreciated stock that the partnership has held for many years as an investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts