Question: PLEASE HELP 3 dov 00 BELL V Op 0 3 | - 9 jearate 66 BE 1111111111111 O agreed upon date. rocar os at a

PLEASE HELP

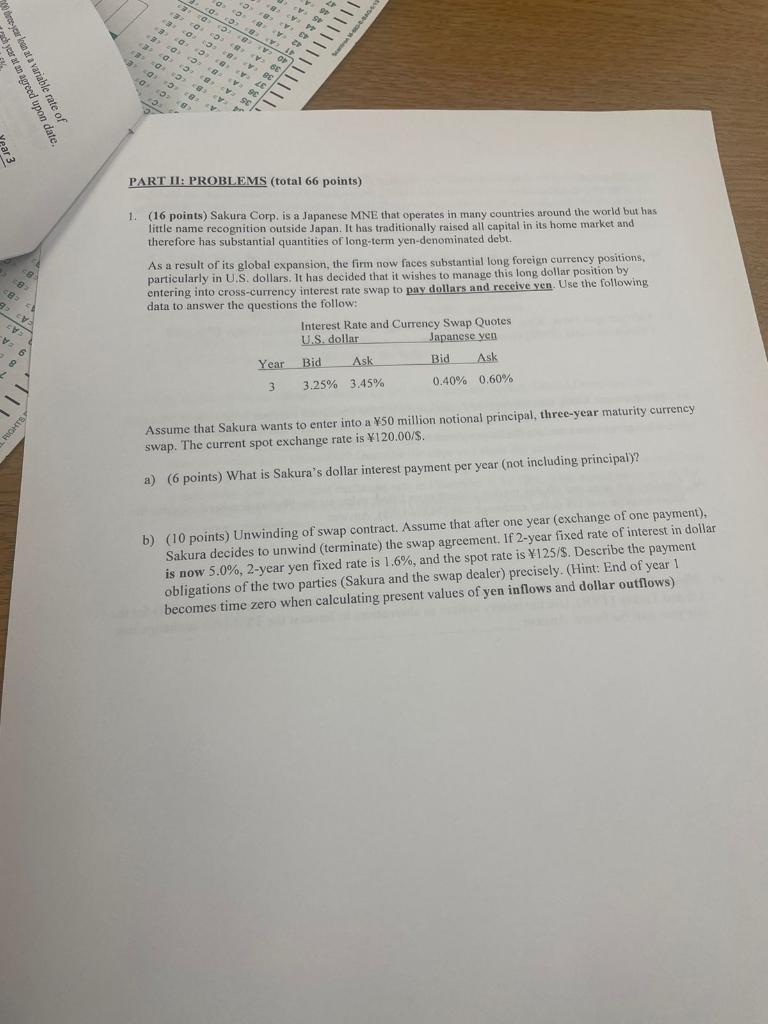

3 dov 00 BELL V Op 0 3 | - 9 jearate 66 BE 1111111111111 O agreed upon date. rocar os at a variable rate of 38 @y 02 CV 20 SI 96 PART II: PROBLEMS (total 66 points) 1. (16 points) Sakura Corp. is a Japanese MNE that operates in many countries around the world but has little name recognition outside Japan. It has traditionally raised all capital in its home market and therefore has substantial quantities of long-term yen-denominated debt. As a result of its global expansion, the firm now faces substantial long foreign currency positions, particularly in U.S. dollars. It has decided that it wishes to manage this long dollar position by entering into cross-currency interest rate swap to pay dollars and receive yen. Use the following data to answer the questions the follow: Interest Rate and Currency Swap Quotes U.S. dollar Japanese yen VA CV V 6 8 Year Bid Ask Bid Ask 0.40% 0.60% 3 3.25% 3.45% RICHTE Assume that Sakura wants to enter into a 50 million notional principal, three-year maturity currency swap. The current spot exchange rate is 120.00/S. a) (6 points) What is Sakura's dollar interest payment per year (not including principal)? b) (10 points) Unwinding of swap contract. Assume that after one year (exchange of one payment). Sakura decides to unwind (terminate) the swap agreement. If 2-year fixed rate of interest in dollar is now 5.0%, 2-year yen fixed rate is 1.6%, and the spot rate is 125/S. Describe the payment obligations of the two parties (Sakura and the swap dealer) precisely. (Hint: End of year 1 becomes time zero when calculating present values of yen inflows and dollar outflows) 3 dov 00 BELL V Op 0 3 | - 9 jearate 66 BE 1111111111111 O agreed upon date. rocar os at a variable rate of 38 @y 02 CV 20 SI 96 PART II: PROBLEMS (total 66 points) 1. (16 points) Sakura Corp. is a Japanese MNE that operates in many countries around the world but has little name recognition outside Japan. It has traditionally raised all capital in its home market and therefore has substantial quantities of long-term yen-denominated debt. As a result of its global expansion, the firm now faces substantial long foreign currency positions, particularly in U.S. dollars. It has decided that it wishes to manage this long dollar position by entering into cross-currency interest rate swap to pay dollars and receive yen. Use the following data to answer the questions the follow: Interest Rate and Currency Swap Quotes U.S. dollar Japanese yen VA CV V 6 8 Year Bid Ask Bid Ask 0.40% 0.60% 3 3.25% 3.45% RICHTE Assume that Sakura wants to enter into a 50 million notional principal, three-year maturity currency swap. The current spot exchange rate is 120.00/S. a) (6 points) What is Sakura's dollar interest payment per year (not including principal)? b) (10 points) Unwinding of swap contract. Assume that after one year (exchange of one payment). Sakura decides to unwind (terminate) the swap agreement. If 2-year fixed rate of interest in dollar is now 5.0%, 2-year yen fixed rate is 1.6%, and the spot rate is 125/S. Describe the payment obligations of the two parties (Sakura and the swap dealer) precisely. (Hint: End of year 1 becomes time zero when calculating present values of yen inflows and dollar outflows)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts