Question: please help 3. Project Selection (Financial models) (3 pts.) ( Even Cash Flows (1 pt.) A company plans invest $10 million in a project. The

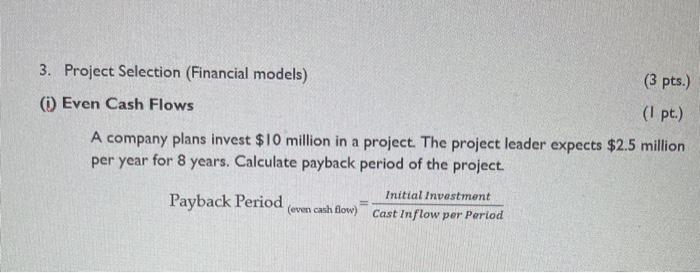

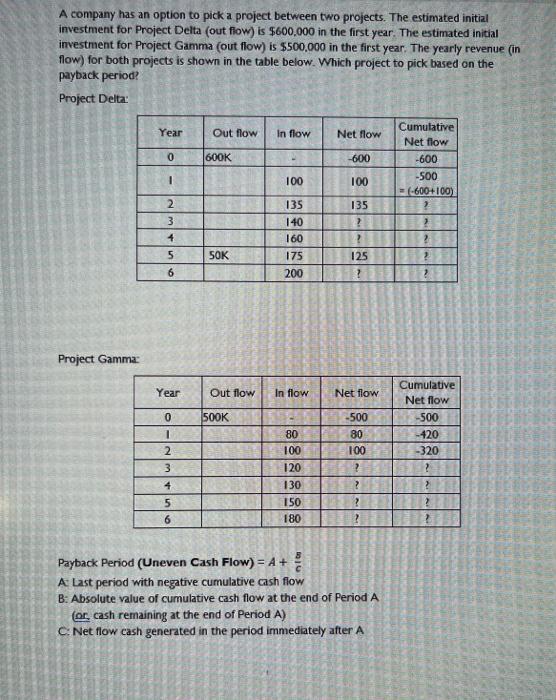

3. Project Selection (Financial models) (3 pts.) ( Even Cash Flows (1 pt.) A company plans invest $10 million in a project. The project leader expects $2.5 million per year for 8 years. Calculate payback period of the project. Payback Period (even cash flow) Initial Investment Cast Inflow per Period A company has an option to pick a project between two projects. The estimated initial investment for Project Delta (out flow) is $600.000 in the first year. The estimated initial investment for Project Gamma (out flow) is $500,000 in the first year. The yearly revenue (in flow) for both projects is shown in the table below. Which project to pick based on the payback period? Project Delta: Year Out flow In flow Net flow 0 600K -600 Cumulative Net flow -600 -500 (-600+100) 1 100 100 135 2 3 4 ? 135 140 160 175 200 SOK 5 6 125 ? Project Gamma Year Out flow In now In flow Net flow 500K 0 1 Cumulative Net flow -500 -420 -320 2 2 3 4 -500 80 100 2 ? ? ? 80 100 120 130 150 180 ? 5 6 Payback Period (Uneven Cash Flow) = A + A Last period with negative cumulative cash flow B: Absolute value of cumulative cash flow at the end of Period A (or, cash remaining at the end of Period A) CNet flow cash generated in the period immediately after A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts