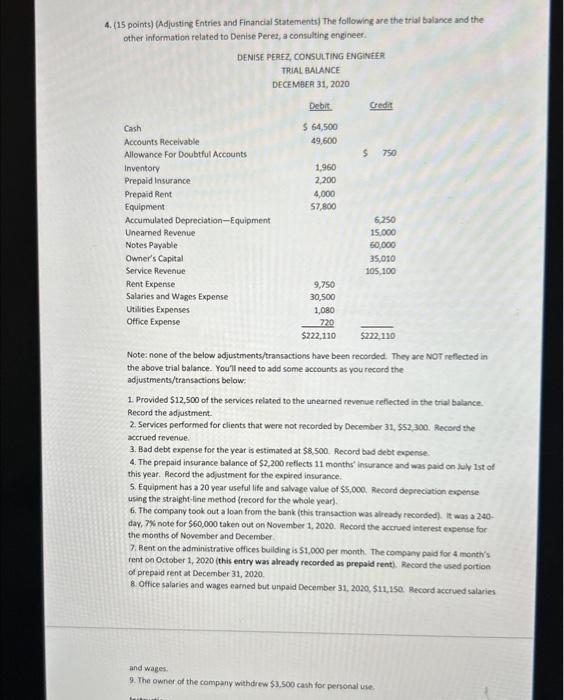

Question: please help! :( 4. (15 points) (Adjusting Entries and Financial Statements) The following are the trial balance and the other information related to Denise Perez,

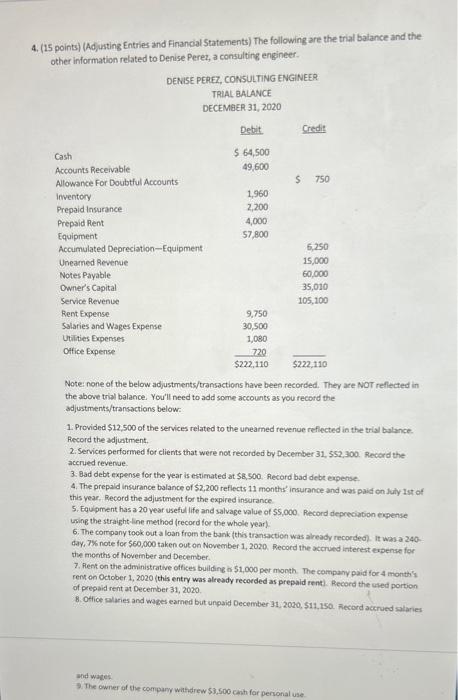

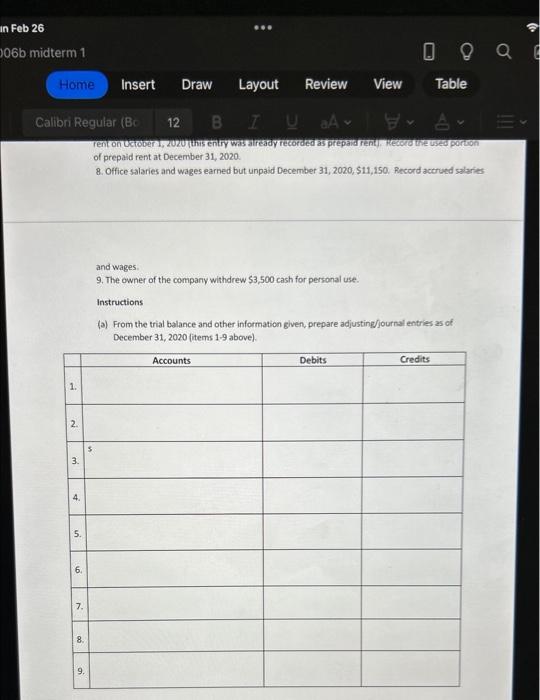

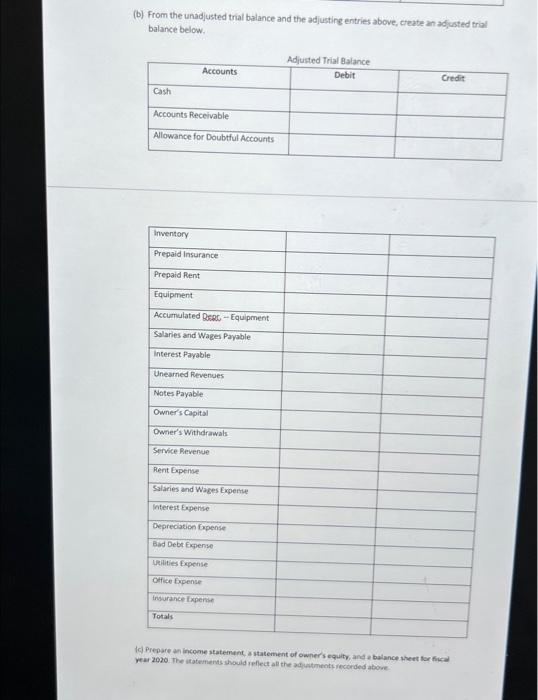

4. (15 points) (Adjusting Entries and Financial Statements) The following are the trial balance and the other information related to Denise Perez, a consulting engineer. Note: none of the below adjustments/transactions have been recorded. They are Nor reflected in the above trial balance. You'll need to add some accounts as you record the adjustments/transactions below: 1. Provided $12,500 of the services related to the unearned revenue reflected in the trual balance: Record the adjustment. 2. Services performed for clients that were not recorded by December 31, 552,300. Record the accrued revenue. 3. Bad debt expense for the year is estimated at $8,500. Record bad debt eapense. 4. The prepaid insurance balance of $2,200 retlects 11 months' insarance and was paid on laly 1st of this year. Record the adjustment for the expired insurance. 5. Equipment has a 20 year useful life and salvage value of $5,000. Record depreciution expense using the straight-line method (record for the whole year). 6. The company took out a loan from the bank (this transaction wat already reconded). it was a 240 day, 7% note for $60,000 taken out on November 1, 2020. Aecond the accrued intereit expense for the months of November and December 7. Rent on the administrative offices building is $1,000 per month. The company paid for 4 month's. rent on October 1, 2020 (this entry was already recorded as prepaid rent). Record the used portion. of prepaid rent at December 31,2020. 8 Office salaries and wages eamed but ungaid December 31,2020,511,150. Record accrued salaries and wages. 9. The owner of the company withdiew $3,500 cash for personal vee. 4. (15 points) (Ad,usting Entries and Financial Statements) The following are the trial balance and the other information related to Denise Perez, a consulting engineer. Note: none of the below adjustments/transactions have been recorded. They are NoT reflected in the above trial balance. You'll need to add some accounts as you record the adjustments/transactions below: 1. Provided $12,500 of the services related to the unearned revenoe refiected in the trial balance. Fecord the adjuatment. 2. Services performed for clients that were not recorded by December 31, 552,300. Record the acerued revervie. 3. 8ad debt expense for the year is estimated at $8,900. Fecord bad debt expense 4. The prepald insurance balance of $2,200 reflects 11 months' insurance and was paid en luly 1 ist of this year, Record the adjustment for the expired insurance. 5. Equipment has a 20 year useful life and salvage value of $5,000. Record depreciabion expense. using the straight-line method (record for the whole year). 6. The corrpany tock out a loan from the bank (this transactich was already recorded). it was a 240 day, 7 K note for $60,000 taken out on November 1, 2020. Record the accrued interest espense for the months of November and December. 7. Flent on the administrative offices building a$1,000 per month. The company paid for 4 monthis. rens on October 1, 2020 (this entry was already recoeded as prepaid renti. Record the uled portion of prepaid rent at December 31,2020. 8. Otlice alacies and wakes eamed but unpaid December 31, 2020, 511,150. necord actrued salaries and wages. 7. The owner of the compary wathdrew $3,500 caith for perional use. rent on Uctober 1, 20207 this entry wits already fecorded as prepaid rent, . Medord the used portion of prepaid rent at December 31, 2020. 8. Office salaries and wages earned but unpaid December 31, 2020, \$11,250. fecord accrued salaries and wages. 9. The owner of the company withdrew $3,500 cash for personal use. Instructions (a) From the trial balance and other information given, prepare adjusting/journal entries as of December 31,2020 (items 1.9 above). (b) From the unadjusted trial balance and the adjustirg entries above, create an adjusted trial balance below. 1c) Prepare an income statement, astatement of owners equity, and e balance sheet for fice Year 2020 . The itatements should reflect all the adjentments recorded above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts