Question: PLEASE HELP! 4 part question Canvas Question 11 7.5 pts The Nola Corporation has a standard costing system in which variable snowball manufacturing overhead is

PLEASE HELP! 4 part question

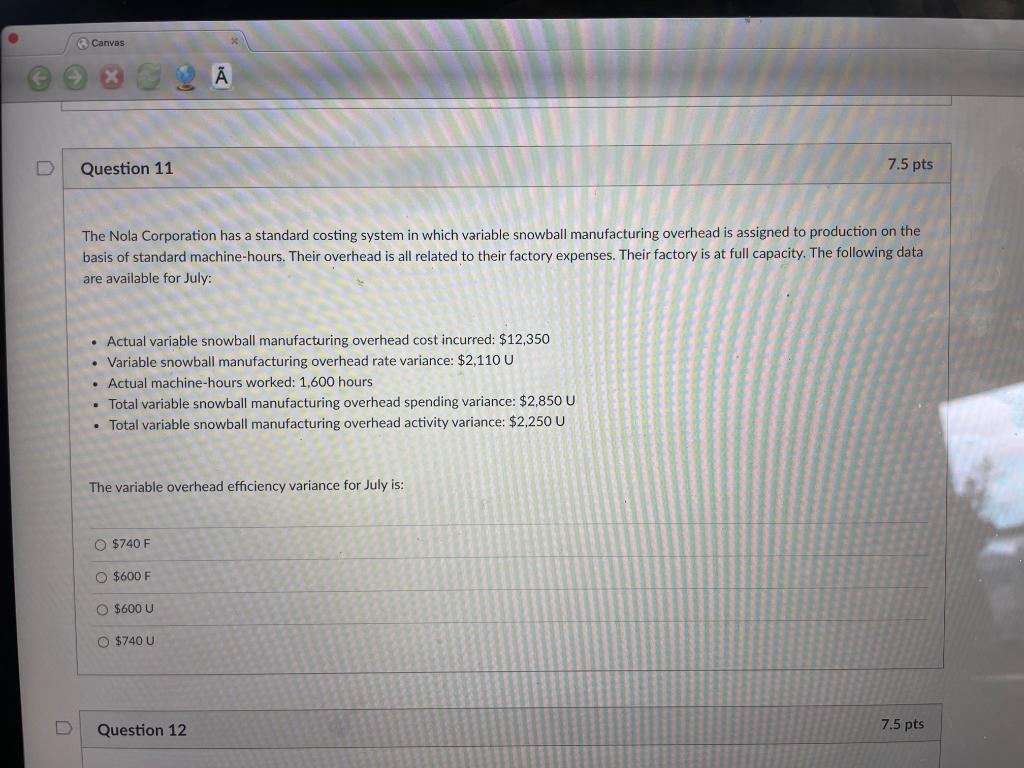

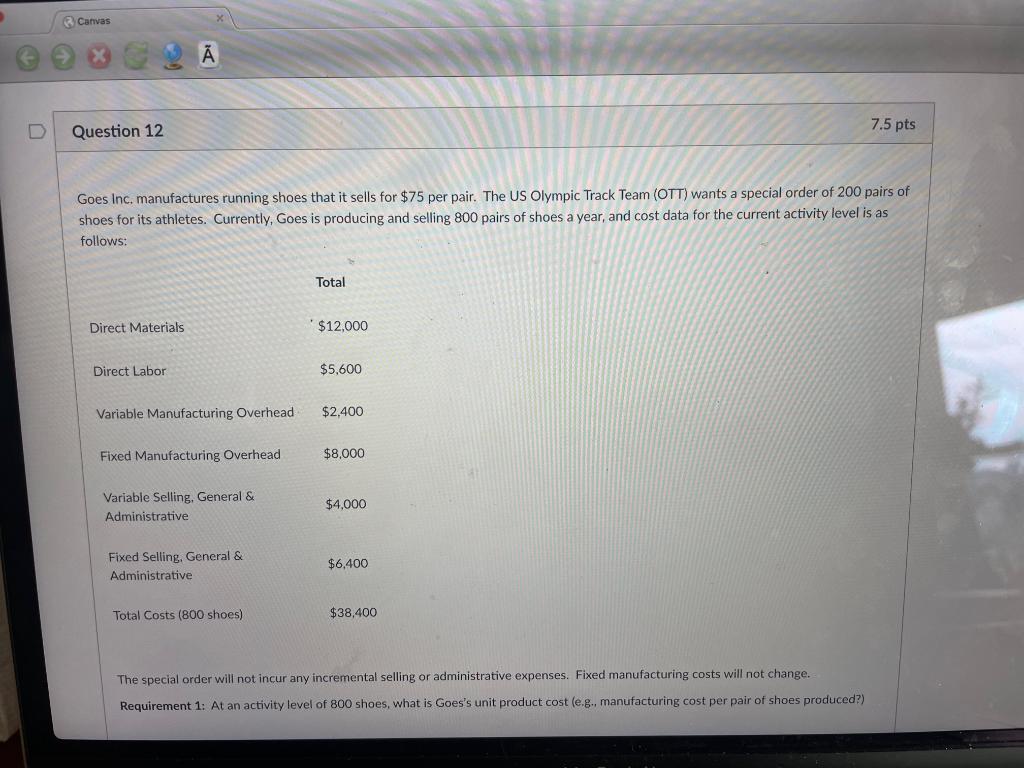

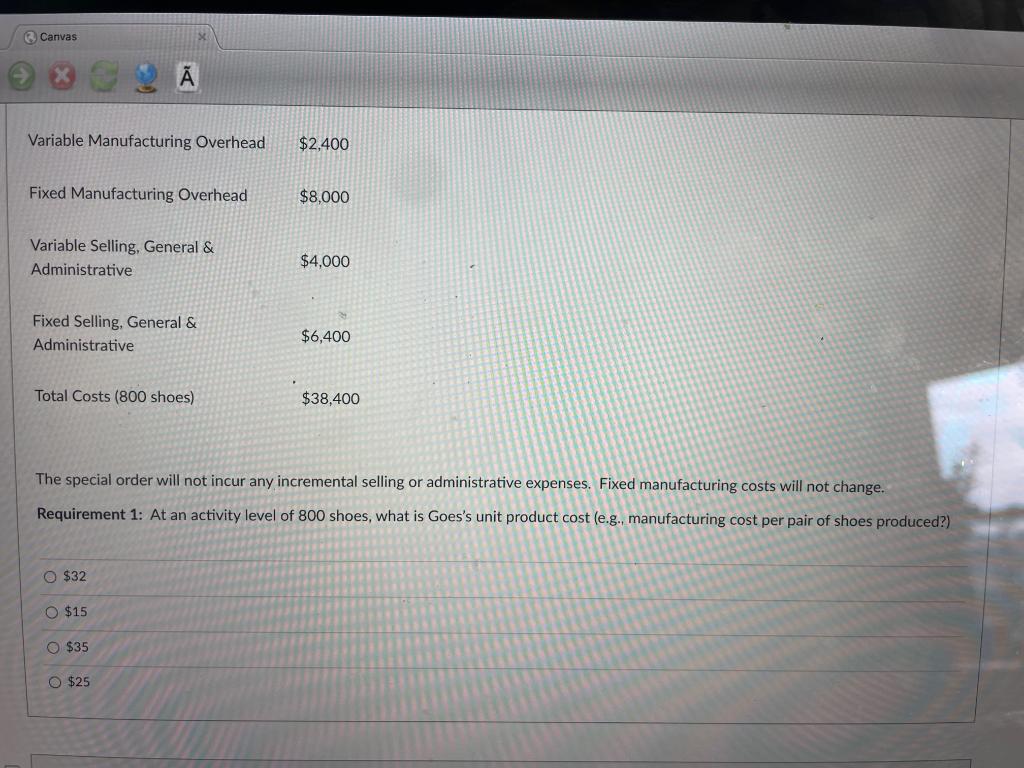

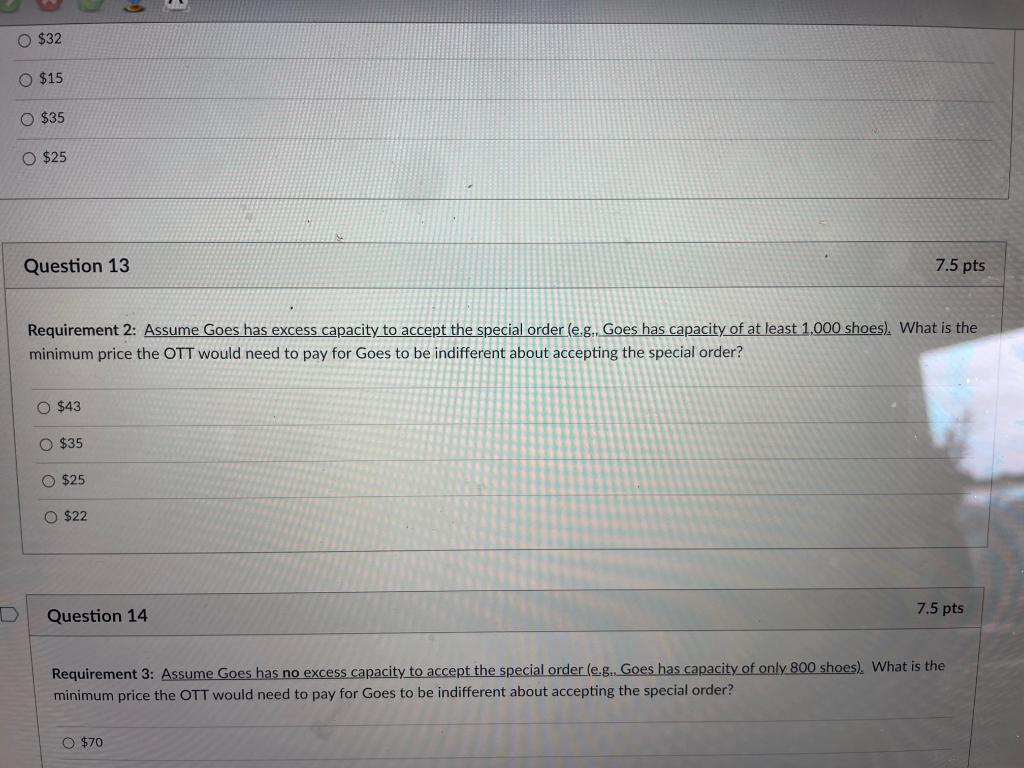

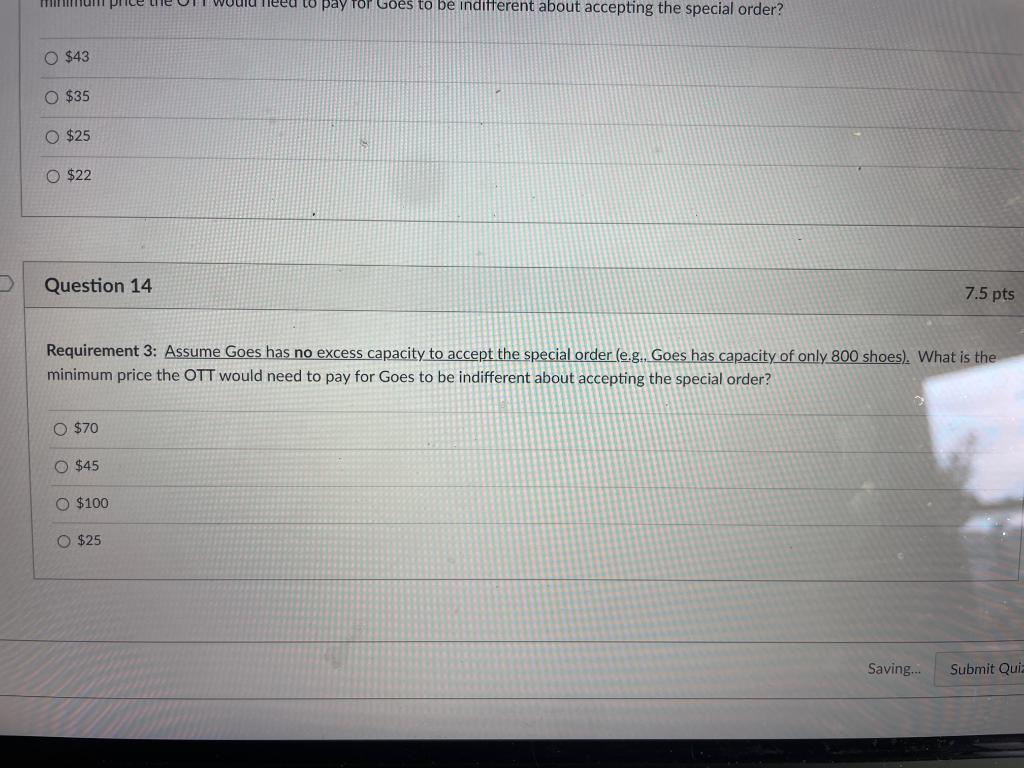

Canvas Question 11 7.5 pts The Nola Corporation has a standard costing system in which variable snowball manufacturing overhead is assigned to production on the basis of standard machine-hours. Their overhead is all related to their factory expenses. Their factory is at full capacity. The following data are available for July: Actual variable snowball manufacturing overhead cost incurred: $12,350 Variable snowball manufacturing overhead rate variance: $2,110 U Actual machine-hours worked: 1,600 hours Total variable snowball manufacturing overhead spending variance: $2,850 U Total variable snowball manufacturing overhead activity variance: $2,250 U The variable overhead efficiency variance for July is: O O $740 F $600 F $600 U $740 U Question 12 7.5 pts Canvas A D Question 12 7.5 pts Goes Inc, manufactures running shoes that it sells for $75 per pair. The US Olympic Track Team (OTT) wants a special order of 200 pairs of shoes for its athletes. Currently, Goes is producing and selling 800 pairs of shoes a year, and cost data for the current activity level is as follows: Total Direct Materials $12,000 Direct Labor $5,600 Variable Manufacturing Overhead $2,400 Fixed Manufacturing Overhead $8,000 Variable Selling, General & Administrative $4,000 Fixed Selling. General & Administrative $6,400 Total Costs (800 shoes) $38,400 The special order will not incur any incremental selling or administrative expenses. Fixed manufacturing costs will not change. Requirement 1: At an activity level of 800 shoes, what is Goes's unit product cost (e.g. manufacturing cost per pair of shoes produced?) Canvas Variable Manufacturing Overhead $2,400 Fixed Manufacturing Overhead $8,000 Variable Selling, General & Administrative $4,000 Fixed Selling, General & Administrative $6,400 Total Costs (800 shoes) $38,400 The special order will not incur any incremental selling or administrative expenses. Fixed manufacturing costs will not change. Requirement 1: At an activity level of 800 shoes, what is Goes's unit product cost (e.g., manufacturing cost per pair of shoes produced?) $32 O $15 $35 O $25 $32 O $15 oooo O $35 O $25 Question 13 7.5 pts Requirement 2: Assume Goes has excess capacity to accept the special order (e.g., Goes has capacity of at least 1,000 shoes). What is the minimum price the OTT would need to pay for Goes to be indifferent about accepting the special order? O $43 $35 $25 O $22 Question 14 7.5 pts Requirement 3: Assume Goes has no excess capacity to accept the special order (e.g. Goes has capacity of only 800 shoes). What is the minimum price the OTT would need to pay for Goes to be indifferent about accepting the special order? O $70 milliu price to pay Top Goes to be indifferent about accepting the special order? O $43 O $35 $25 O $22 Question 14 7.5 pts Requirement 3: Assume Goes has no excess capacity to accept the special order (e.g., Goes has capacity of only 800 shoes). What is the minimum price the OTT would need to pay for Goes to be indifferent about accepting the special order? O $70 $45 0 $100 O $25 Saving... Submit Quiz

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts