Question: please help 4. Your client, a government employee, would like to reduce his taxes. He is trying to decide whether he should contribute $5,000 to

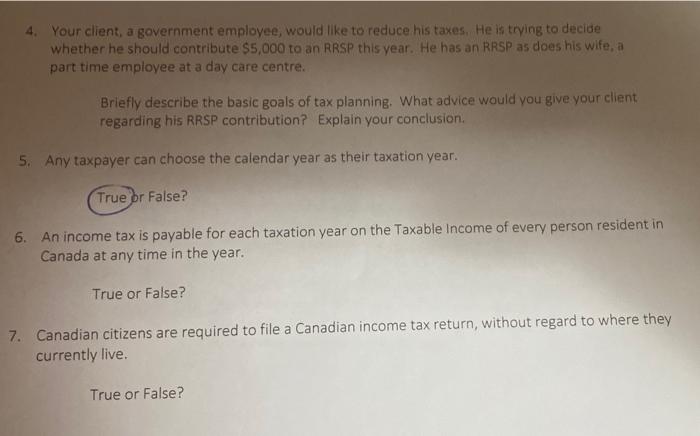

4. Your client, a government employee, would like to reduce his taxes. He is trying to decide whether he should contribute $5,000 to an RRSP this year. He has an RRSP as does his wife, a part time employee at a day care centre. Briefly describe the basic goals of tax planning. What advice would you give your client regarding his RRSP contribution? Explain your conclusion 5. Any taxpayer can choose the calendar year as their taxation year. True or False? 6. An income tax is payable for each taxation year on the Taxable income of every person resident in Canada at any time in the year. True or False? 7. Canadian citizens are required to file a Canadian income tax return, without regard to where they currently live. True or False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts