Question: Please help. 5 6 7 8 9 10 11 Fairview Shore Lawn and Garden Maintenance provides two general outdoor services: lawn maintenance and garden maintenance.

Please help.

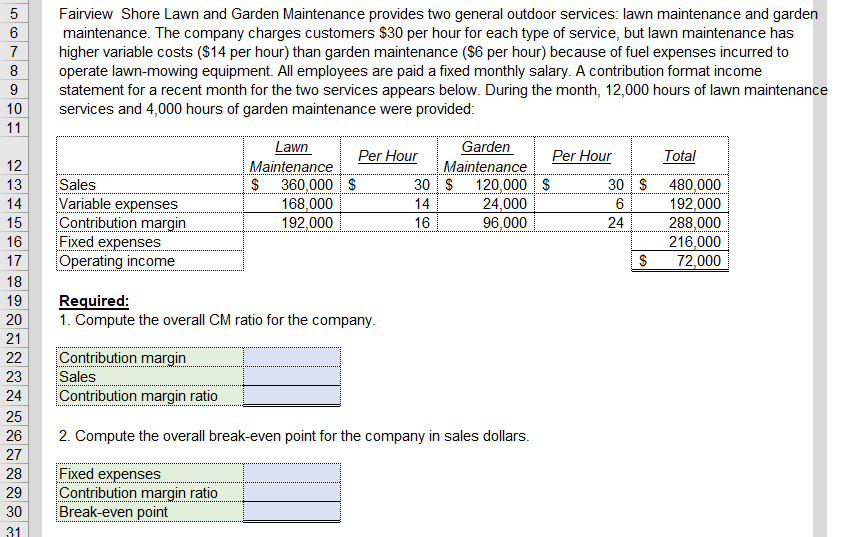

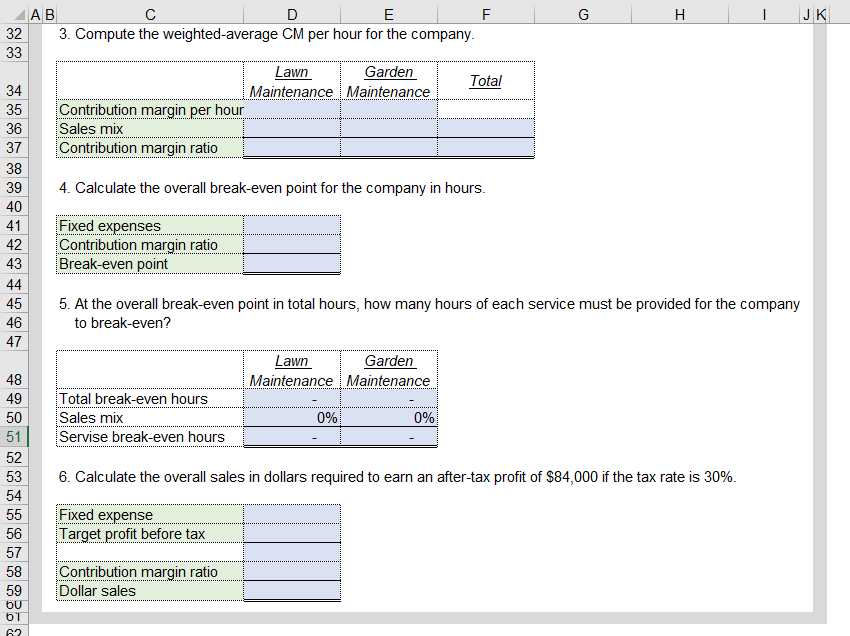

5 6 7 8 9 10 11 Fairview Shore Lawn and Garden Maintenance provides two general outdoor services: lawn maintenance and garden maintenance. The company charges customers $30 per hour for each type of service, but lawn maintenance has higher variable costs ($14 per hour) than garden maintenance ($6 per hour) because of fuel expenses incurred to operate lawn-mowing equipment. All employees are paid a fixed monthly salary. A contribution format income statement for a recent month for the two services appears below. During the month, 12,000 hours of lawn maintenance services and 4,000 hours of garden maintenance were provided: Total Sales Variable expenses Contribution margin Fixed expenses Operating income Lawn Garden Per Hour Per Hour Maintenance Maintenance $ 360,000 $ 30$ 120,000 $ 30$ 168,000 14 24,000 6 192,000 16 96,000 24 480,000 192,000 288,000 216,000 72,000 $ Required: 1. Compute the overall CM ratio for the company. 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Contribution margin Sales Contribution margin ratio 2. Compute the overall break-even point for the company in sales dollars. Fixed expenses Contribution margin ratio Break-even point - AB D E F H JK 32 3. Compute the weighted average CM per hour for the company. 33 Lawn Garden Total 34 Maintenance Maintenance 35 Contribution margin per hour 36 Sales mix 37 Contribution margin ratio 38 39 4. Calculate the overall break-even point for the company in hours. 40 41 Fixed expenses 42 Contribution margin ratio 43 Break-even point 44 45 5. At the overall break-even point in total hours, how many hours of each service must be provided for the company 46 to break-even? 47 Lawn Garden 48 Maintenance Maintenance 49 Total break-even hours 50 Sales mix 0% 0% 51 Servise break-even hours 52 6. Calculate the overall sales in dollars required to earn an after-tax profit of $84,000 if the tax rate is 30%. 54 55 Fixed expense 56 Target profit before tax 57 58 Contribution margin ratio 59 Dollar sales 53 OU 61 62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts