Question: please help 7. The Inventory account is used in each of the following except the entry to record A) goods purchased on account. B) the

please help

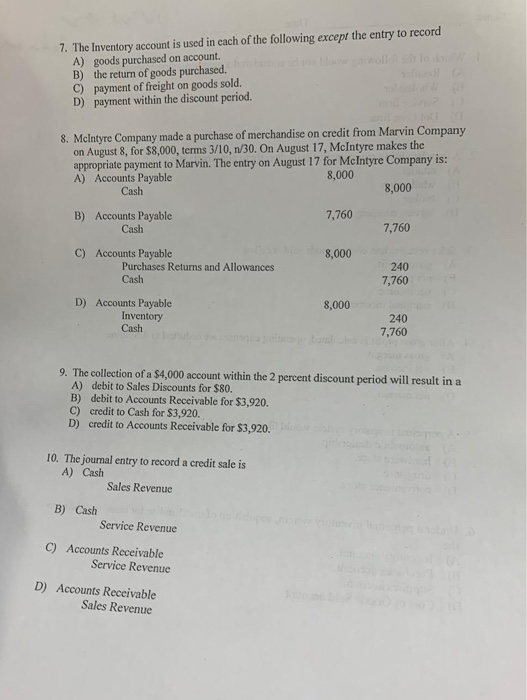

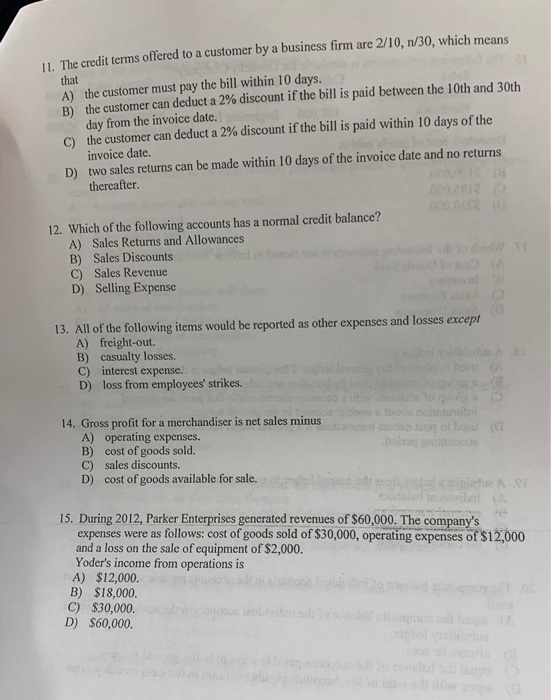

please help 7. The Inventory account is used in each of the following except the entry to record A) goods purchased on account. B) the return of goods purchased. C) payment of freight on goods sold. D) payment within the discount period. 8. Mclntyre Company made a purchase of merchandise on credit from Marvin Company on August 8, for $8,000, terms 3/10, n/30. On August 17, McIntyre makes the appropriate payment to Marvin. The entry on August 17 for McIntyre Company is: A) Accounts Payable 8,000 8,000 Cash 7,760 B) Accounts Payable Cash 7,760 C) Accounts Payable 8,000 240 7,760 Purchases Returns and Allowances Cash D) Accounts Payable Inventory Cash 8,000 240 7,760 9. The collection of a $4,000 account within the 2 percent discount period will result in a A) debit to Sales Discounts for $80. B) debit to Accounts Receivable for $3,920. C) credit to Cash for $3,920, D) credit to Accounts Receivable for $3,920. 10. The journal entry to record a credit sale is A) Cash Sales Revenue B) Cash Service Revenue C) Accounts Receivable Service Revenue D) Accounts Receivable Sales Revenue 11. The credit terms offered to a customer by a business firm are 2/10, n/30, which means that A) the customer must pay the bill within 10 days B) the customer can deduct a 2% discount if the bill is paid between the 10th and 30th day from the invoice date. C) the customer can deduct a 2% discount if the bill is paid within 10 days of the invoice date. D) two sales returns can be made within 10 days of the invoice date and no returns thereafter. c02012 12. Which of the following accounts has a normal credit balance? A) Sales Returns and Allowances B) Sales Discounts C) Sales Revenue D) Selling Expense LA 13. All of the following items would be reported as other expenses and losses except A) freight-out. B) casualty losses. C) interest expense. D) loss from employees' strikes. nnoh 14. Gross profit for a merchandiser is net sales minus A) operating expenses. B) cost of goods sold. C) sales discounts. D) cost of goods available for sale. boi ni hvib (A 15. During 2012, Parker Enterprises generated revenues of $60,000. The company's expenses were as follows: cost of goods sold of $30,000, operating expenses of $12,000 and a loss on the sale of equipment of $2,000. Yoder's income from operations is A) $12,000. B) $18,000. C) $30,000. D) $60,000. oeniyb ld

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts