Question: Please help 7. Valuing semiannual coupon bonds Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the

Please help

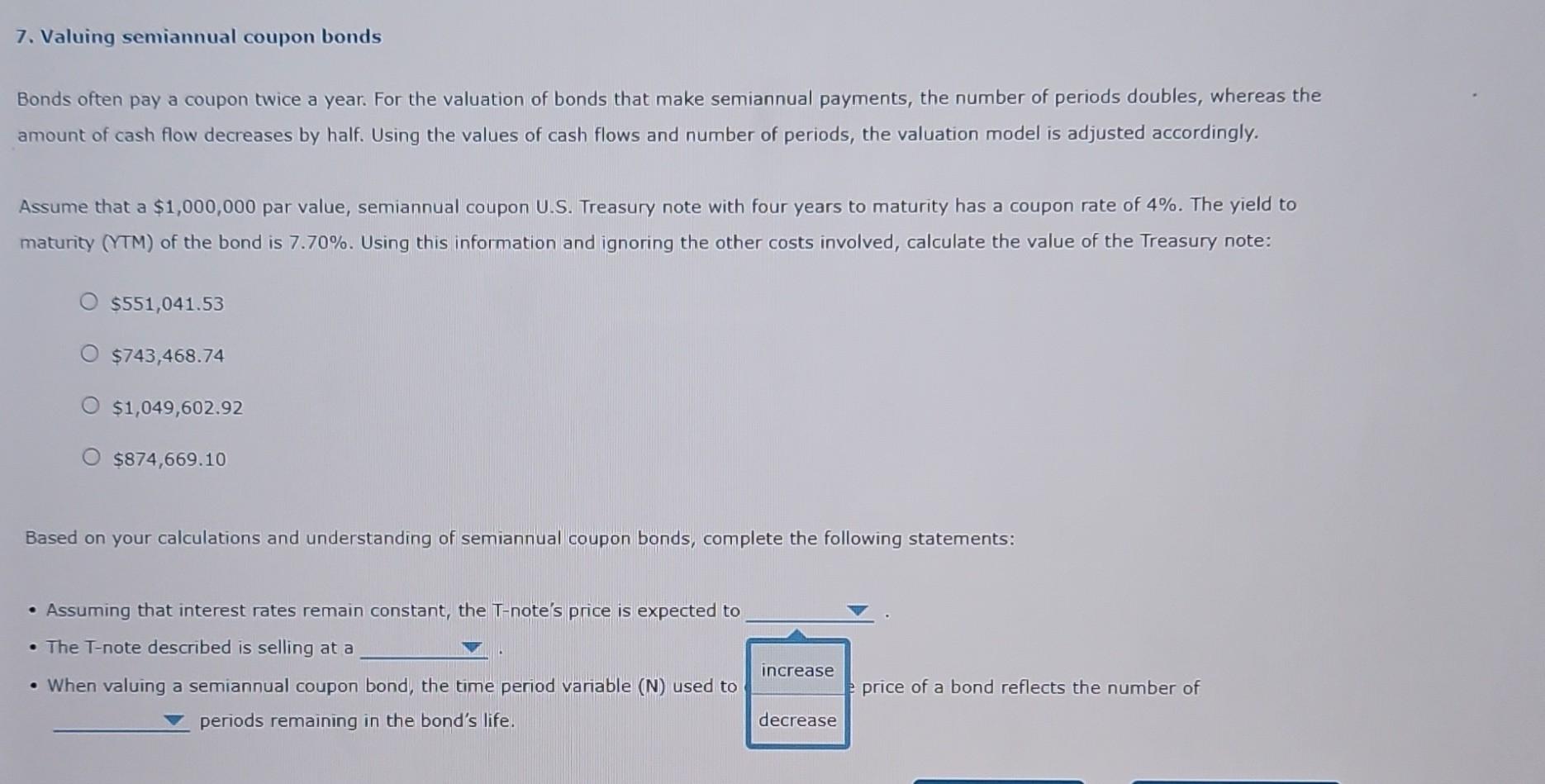

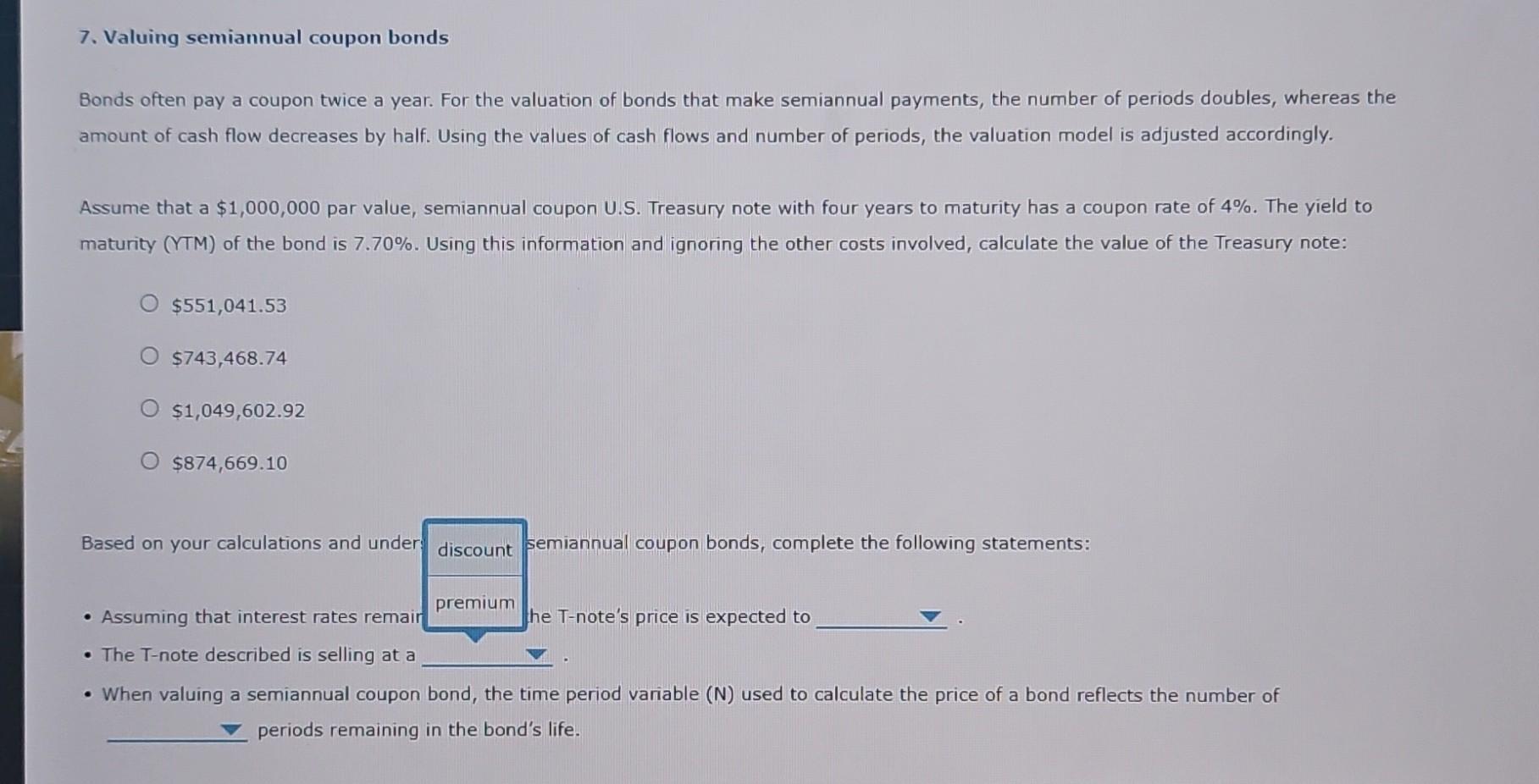

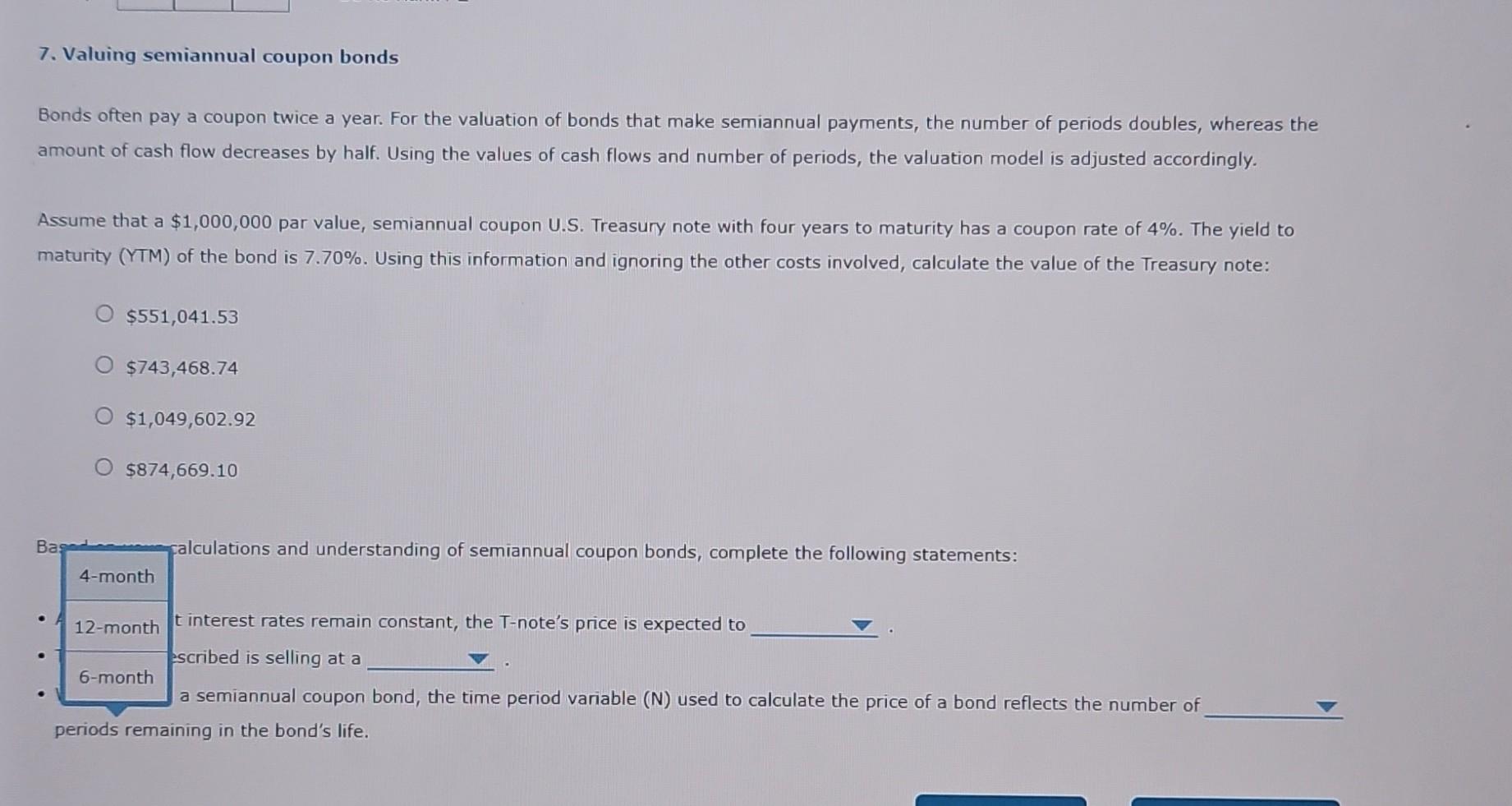

7. Valuing semiannual coupon bonds Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon U.S. Treasury note with four years to maturity has a coupon rate of 4%. The yield to maturity (VTM) of the bond is 7.70%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $551,041.53$743,468.74$1,049,602.92$874,669.10 Based on your calculations and understanding of semiannual coupon bonds, complete the following statements: - Assuming that interest rates remain constant, the T-note's price is expected to - The T-note described is selling at a - When valuing a semiannual coupon bond, the time period variable (N) used to price of a bond reflects the number of periods remaining in the bond's life. 7. Valuing semiannual coupon bonds Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon U.S. Treasury note with four years to maturity has a coupon rate of 4%. The yield to maturity (YTM) of the bond is 7.70%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $551,041.53$743,468.74$1,049,602.92$874,669.10 Based on your calculations and under - Assuming that interest rates remair - The T-note described is selling at a ;emiannual coupon bonds, complete the following statements: he T-note's price is expected to he T-note's price is expected to - When valuing a semiannual coupon bond, the time period variable ( N ) used to calculate the price of a bond reflects the number of periods remaining in the bond's life. 7. Valuing semiannual coupon bonds Bonds often pay a coupon twice a year. For the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. Using the values of cash flows and number of periods, the valuation model is adjusted accordingly. Assume that a $1,000,000 par value, semiannual coupon U.S. Treasury note with four years to maturity has a coupon rate of 4%. The yield to maturity (YTM) of the bond is 7.70%. Using this information and ignoring the other costs involved, calculate the value of the Treasury note: $551,041.53$743,468.74$1,049,602.92$874,669.10 B alculations and understanding of semiannual coupon bonds, complete the following statements: interest rates remain constant, the T-note's price is expected to scribed is selling at a a semiannual coupon bond, the time period variable (N) used to calculate the price of a bond reflects the number of periods remaining in the bond's life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts