Question: please help! 8. Rani recently took out a $50,000 secured line of credit. The rate is 2.75% compounded semi- annually above the Bank of Canada

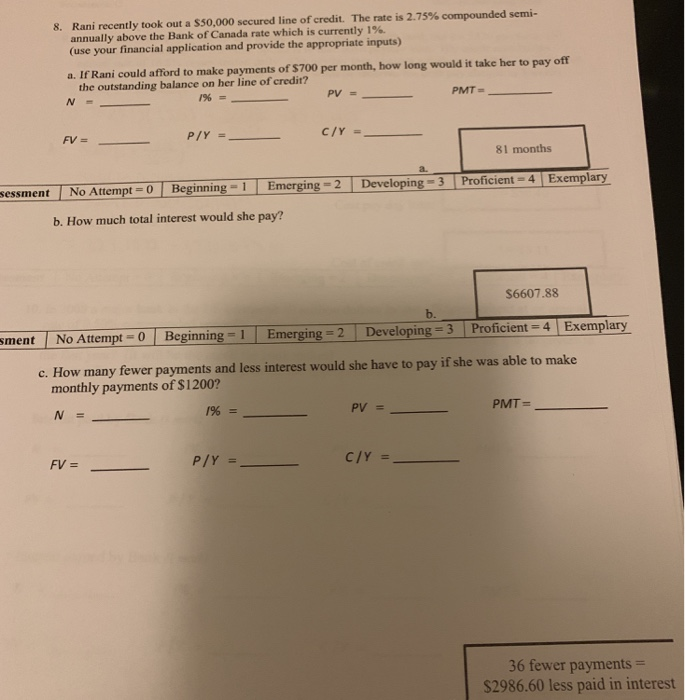

8. Rani recently took out a $50,000 secured line of credit. The rate is 2.75% compounded semi- annually above the Bank of Canada rate which is currently 1%. (use your financial application and provide the appropriate inputs) a. If Rani could afford to make payments of $700 per month, how long would it take her to pay off the outstanding balance on her line of credit? 1% = PV = PMT N = FV = P/Y = c/Y = 81 months Developing - 3 Beginning - 1 Emerging - 2 Proficient = 4 Exemplary No Attempt =0 sessment b. How much total interest would she pay? $6607.88 b. sment No Attempt = 0 Beginning = 1 Emerging = 2 Developing = 3 Proficient = 4 Exemplary c. How many fewer payments and less interest would she have to pay if she was able to make monthly payments of $1200? N 1% = PV = PMT= E FV = P/Y = C/Y = 36 fewer payments $2986.60 less paid in interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts