Question: Please help! a. A British company is considering replacing one of its machines. It has identified two possibilities. The machine that would work best for

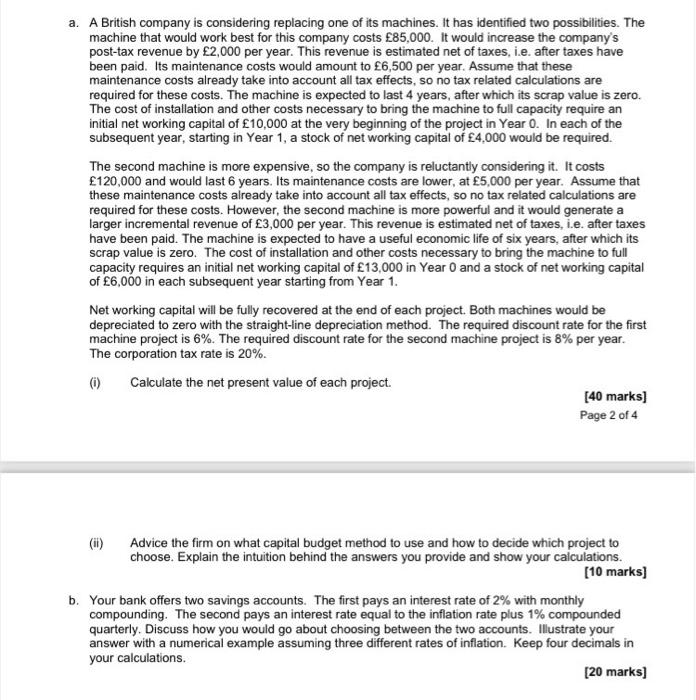

a. A British company is considering replacing one of its machines. It has identified two possibilities. The machine that would work best for this company costs 85,000. It would increase the company's post-tax revenue by 2,000 per year. This revenue is estimated net of taxes, i.e. after taxes have been paid. Its maintenance costs would amount to 6,500 per year. Assume that these maintenance costs already take into account all tax effects, so no tax related calculations are required for these costs. The machine is expected to last 4 years, after which its scrap value is zero. The cost of installation and other costs necessary to bring the machine to full capacity require an initial networking capital of 10,000 at the very beginning of the project in Year 0. In each of the subsequent year, starting in Year 1, a stock of net working capital of 4,000 would be required. The second machine is more expensive, so the company is reluctantly considering it. It costs 120,000 and would last 6 years. Its maintenance costs are lower, at 5,000 per year. Assume that these maintenance costs already take into account all tax effects, so no tax related calculations are required for these costs. However, the second machine is more powerful and it would generate a larger incremental revenue of 3,000 per year. This revenue is estimated net of taxes, i.e. after taxes have been paid. The machine is expected to have a useful economic life of six years, after which its scrap value is zero. The cost of installation and other costs necessary to bring the machine to full capacity requires an initial net working capital of 13,000 in Year and a stock of net working capital of 6,000 in each subsequent year starting from Year 1. Net working capital will be fully recovered at the end of each project. Both machines would be depreciated to zero with the straight-line depreciation method. The required discount rate for the first machine project is 6%. The required discount rate for the second machine project is 8% per year. The corporation tax rate is 20%. 0) Calculate the net present value of each project. [40 marks] Page 2 of 4 (ii) Advice the firm on what capital budget method to use and how to decide which project to choose. Explain the intuition behind the answers you provide and show your calculations. [10 marks) b. Your bank offers two savings accounts. The first pays an interest rate of 2% with monthly compounding. The second pays an interest rate equal to the inflation rate plus 1% compounded quarterly. Discuss how you would go about choosing between the two accounts. Illustrate your answer with a numerical example assuming three different rates of inflation. Keep four decimals in your calculations. [20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts