Question: please help A capital project will require a firm to spend $393,000 purchase and install new equipment, which will be depreciated on a straight line

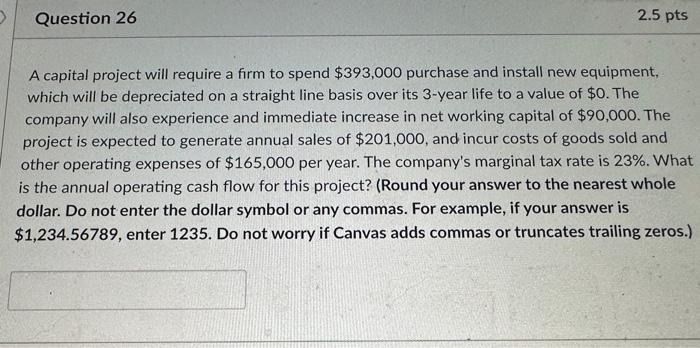

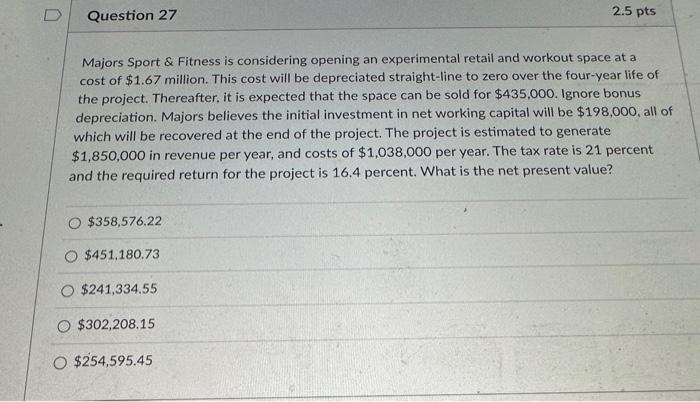

A capital project will require a firm to spend $393,000 purchase and install new equipment, which will be depreciated on a straight line basis over its 3 -year life to a value of $0. The company will also experience and immediate increase in net working capital of $90,000. The project is expected to generate annual sales of $201,000, and incur costs of goods sold and other operating expenses of $165,000 per year. The company's marginal tax rate is 23%. What is the annual operating cash flow for this project? (Round your answer to the nearest whole dollar. Do not enter the dollar symbol or any commas. For example, if your answer is $1,234.56789, enter 1235 . Do not worry if Canvas adds commas or truncates trailing zeros.) Majors Sport \& Fitness is considering opening an experimental retail and workout space at a cost of $1.67 million. This cost will be depreciated straight-line to zero over the four-year life of the project. Thereafter, it is expected that the space can be sold for $435,000. Ignore bonus depreciation. Majors believes the initial investment in net working capital will be $198,000, all of which will be recovered at the end of the project. The project is estimated to generate $1,850,000 in revenue per year, and costs of $1,038,000 per year. The tax rate is 21 percent and the required return for the project is 16.4 percent. What is the net present value? $358,576.22 $451,180.73 $241,334.55 $302,208.15 $254,595.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts