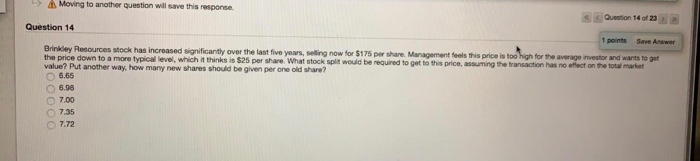

Question: please help A Moving to another question will save this response. Question 14 of 230 Question 14 1 points Save Answer Brinkley Resources stock has

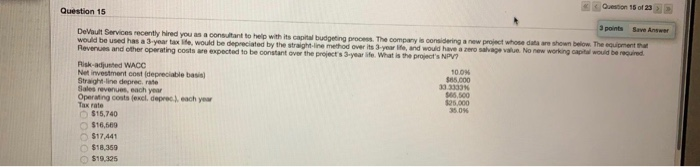

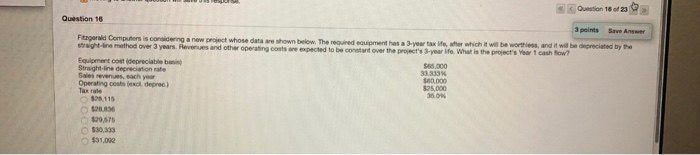

A Moving to another question will save this response. Question 14 of 230 Question 14 1 points Save Answer Brinkley Resources stock has increased significantly over the last five years, selling now for $175 per share. Management feels this price is too high for the average investor and wants to get the price down to a more typical level, which it thinks is $25 per share. What stock splt would be required to get to this price, assuming the transaction has no effect on the total market value? Put another way. how many new shares should be given per one old share? O6.65 6.98 O 7.00 7.35 7.72 Question 15 of 23 Question 15 3 points DeVault Services recently hired you as a consultant to help with its capital budgeting process. The company is considering a new project whose data are shown below The equipment that would be used has a 3-year tax ife, would be depreciated by the straght-ine method over its 3-year ife, and would have a zero savage value. No new working capital would be regured Revenues and other operating costs are expected to be constant over the project's 3-year ife. What is the project's NPV? Save Answer Risk-adjusted WACC Net investment cost (depreciable basis) Straight-line deprec. rate Sales revenues, each year Operating costs (excl, deprec), each year Tax rate O $15,740 10.0% $85,000 33.3333% $66.500 $25,000 35.0% $16,669 $17,441 $18,359 $19,325 Question 16 of 23 Question 16 3 points Save Answen Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax ife, after which it will be worthless, and it will be depreciated by the straight-ine method over 3 years. Revenues and other operating costs awe expected to be conetant over the project's 3-year ife. What is the project's Year 1 cash fow?" Equipment cost (depreciable bais Straight-line depreciation rate l evenues, each year $65,000 33.333% $60.000 $25,000 35.0% costs (excl deprec) Tax rate O$28.115 O s28.836 O $29,57 O $30,333 n $31.092 A Moving to another question will save this response. Question 14 of 230 Question 14 1 points Save Answer Brinkley Resources stock has increased significantly over the last five years, selling now for $175 per share. Management feels this price is too high for the average investor and wants to get the price down to a more typical level, which it thinks is $25 per share. What stock splt would be required to get to this price, assuming the transaction has no effect on the total market value? Put another way. how many new shares should be given per one old share? O6.65 6.98 O 7.00 7.35 7.72 Question 15 of 23 Question 15 3 points DeVault Services recently hired you as a consultant to help with its capital budgeting process. The company is considering a new project whose data are shown below The equipment that would be used has a 3-year tax ife, would be depreciated by the straght-ine method over its 3-year ife, and would have a zero savage value. No new working capital would be regured Revenues and other operating costs are expected to be constant over the project's 3-year ife. What is the project's NPV? Save Answer Risk-adjusted WACC Net investment cost (depreciable basis) Straight-line deprec. rate Sales revenues, each year Operating costs (excl, deprec), each year Tax rate O $15,740 10.0% $85,000 33.3333% $66.500 $25,000 35.0% $16,669 $17,441 $18,359 $19,325 Question 16 of 23 Question 16 3 points Save Answen Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax ife, after which it will be worthless, and it will be depreciated by the straight-ine method over 3 years. Revenues and other operating costs awe expected to be conetant over the project's 3-year ife. What is the project's Year 1 cash fow?" Equipment cost (depreciable bais Straight-line depreciation rate l evenues, each year $65,000 33.333% $60.000 $25,000 35.0% costs (excl deprec) Tax rate O$28.115 O s28.836 O $29,57 O $30,333 n $31.092

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts