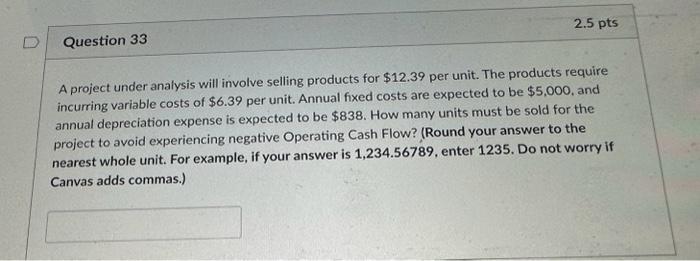

Question: please help A project under analysis will involve selling products for $12.39 per unit. The products require incurring variable costs of $6.39 per unit. Annual

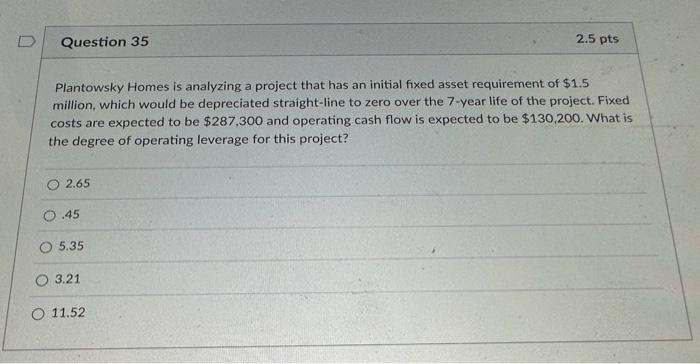

A project under analysis will involve selling products for $12.39 per unit. The products require incurring variable costs of $6.39 per unit. Annual fixed costs are expected to be $5,000, and annual depreciation expense is expected to be $838. How many units must be sold for the project to avoid experiencing negative Operating Cash Flow? (Round your answer to the nearest whole unit. For example, if your answer is 1,234.56789, enter 1235 . Do not worry if Canvas adds commas.) Plantowsky Homes is analyzing a project that has an initial fixed asset requirement of $1.5 million, which would be depreciated straight-line to zero over the 7 -year life of the project. Fixed costs are expected to be $287,300 and operating cash flow is expected to be $130,200. What is the degree of operating leverage for this project? 2.65 .45 5.35 3.21 11.52

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts