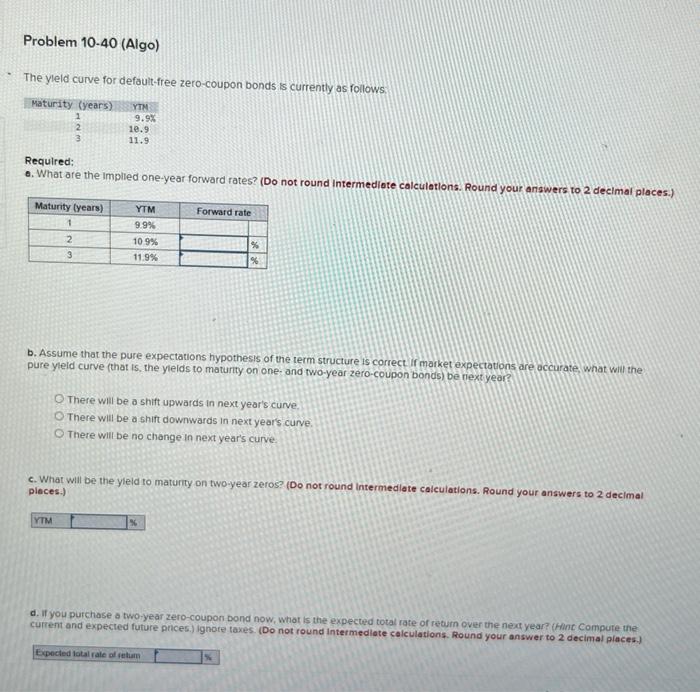

Question: please help a through e The yleld curve for defauttree zero-coupon bonds is currently as follows. Required: Q. What are the implied one-year forward rates?

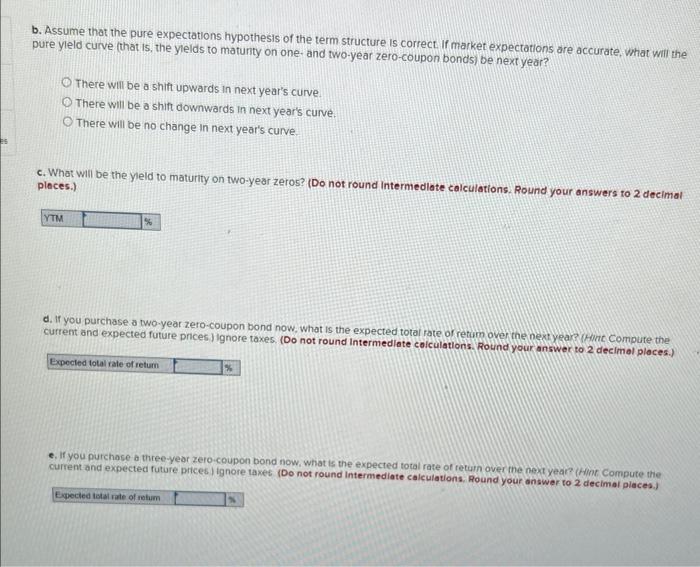

The yleld curve for defauttree zero-coupon bonds is currently as follows. Required: Q. What are the implied one-year forward rates? (Do not round Intermediote calculetions. Round your answers to 2 decimal places.) b. Assume that the pure expectations hypothesis of the term structure is correct if market expectations are occurate what will the pure yleld curve (that is, the yleids to maturity on one- and two-year zero-coupon bonds) be nextyear? There will be a shift upwards in next year's curve. There will be a shif downwards in next year's curve. There will be no change in next year's curve. c. What will be the yleld to maturity on two-year zeros? (Do not round intermedlete calculations. Round your answers to 2 decimal pleces.) d. If you purchase a two-year zero-coupon Dond now, whot is the expected total rate of return over the next year? (Hhint Compute the current and expected future pnces.) ignore taxes. (Do not round Intermedlete calculations. Round your answer to 2 decimal places.) b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, what will the pure yleld curve (that is, the ylelds to matunty on one- and two-year zero-coupon bonds) be next year? There will be a shift upwards in next year's curve. There will be a shift downwards in next year's curve. There will be no change in next year's curve. c. What will be the yeld to maturity on two-year zeros? (Do not round Intermedlate calculations. Round your answers to 2 decimal pleces.) d. If you purchase a two-year zero-coupon bond now, what is the expected total rate of retam over the nextycar? (Hinc compure the current and expected future prices) ignore taxes, (Do not round intermediate colculations. Round your answer to 2 decimal places.) e, If you putchase a three-year zero-coupon bond now, what is the expected total rate of retuin over the next year? (Hint. Compute the current and expected future prices) ignore taxet (Do not round intermediate calculations. Pound your answar to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts