Question: Please help. ACC406 Waren Sports Supply QB-Class Assignment before chapter 9 ICON BAR: Home My Company MemRpts Chart of Accounts Make General Journal Entry (transaction

Please help.

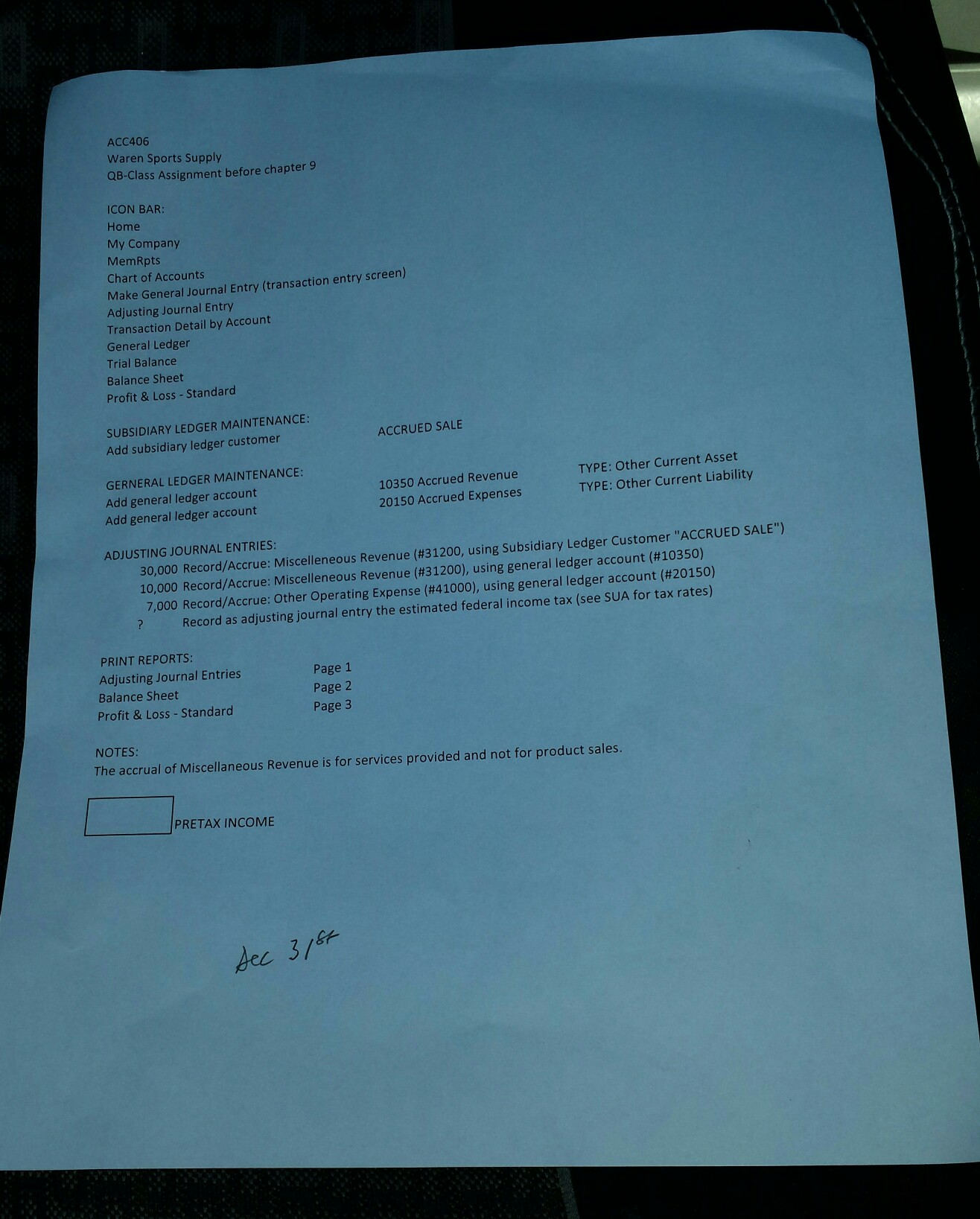

ACC406 Waren Sports Supply QB-Class Assignment before chapter 9 ICON BAR: Home My Company MemRpts Chart of Accounts Make General Journal Entry (transaction entry screen) Adjusting Journal Entry Transaction Detail by Account General Ledger Trial Balance Balance Sheet Profit & Loss Standard SUBSIDIARY LEDGER MAINTENANCE: Add subsidiary ledger customer ACCRUED SALE GERNERAL LEDGER MAINTENANCE Add general ledger account Add general ledger account 10350 Accrued Revenue 20150 Accrued Expenses TYPE: Other Current Asset TYPE: Other Current Liability ADJUSTING JOURNAL ENTRIES 30,000 Record/Accrue: Miscelleneous Revenue (#31200, using Subsidiary Ledger Customer "ACCRUED SALE") 10,000 Record/Accrue: Miscelleneous Revenue (#31200), using general ledger account 7,000 Record/Accrue: Other Operating Expense (#41000), using general ledger account (#20150) (#10350) Record as adjusting journal entry the estimated federal income tax (see SUA for tax rates) PRINT REPORTS: Adjusting Journal Entries Balance Sheet Profit & Loss Standard Page 1 Page 2 Page 3 NOTES: The accrual of Miscellaneous Revenue is for services provided and not for product sales. PRETAX INCOME ACC406 Waren Sports Supply QB-Class Assignment before chapter 9 ICON BAR: Home My Company MemRpts Chart of Accounts Make General Journal Entry (transaction entry screen) Adjusting Journal Entry Transaction Detail by Account General Ledger Trial Balance Balance Sheet Profit & Loss Standard SUBSIDIARY LEDGER MAINTENANCE: Add subsidiary ledger customer ACCRUED SALE GERNERAL LEDGER MAINTENANCE Add general ledger account Add general ledger account 10350 Accrued Revenue 20150 Accrued Expenses TYPE: Other Current Asset TYPE: Other Current Liability ADJUSTING JOURNAL ENTRIES 30,000 Record/Accrue: Miscelleneous Revenue (#31200, using Subsidiary Ledger Customer "ACCRUED SALE") 10,000 Record/Accrue: Miscelleneous Revenue (#31200), using general ledger account 7,000 Record/Accrue: Other Operating Expense (#41000), using general ledger account (#20150) (#10350) Record as adjusting journal entry the estimated federal income tax (see SUA for tax rates) PRINT REPORTS: Adjusting Journal Entries Balance Sheet Profit & Loss Standard Page 1 Page 2 Page 3 NOTES: The accrual of Miscellaneous Revenue is for services provided and not for product sales. PRETAX INCOME

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts