Question: please help accounting asap:) Depreciation by Three Methods, Partial Years Perdue Company purchased equipment on April 1 for $49,950. The equipment was expected to have

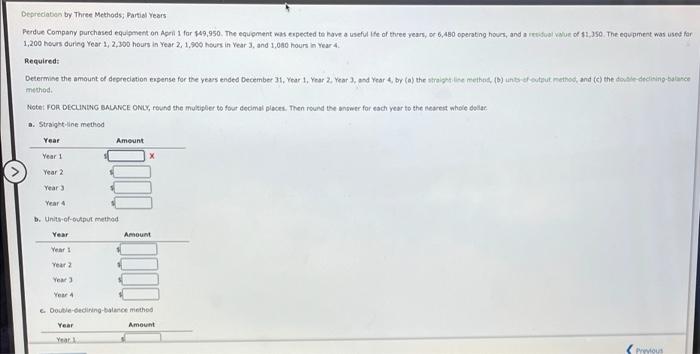

Depreciation by Three Methods, Partial Years Perdue Company purchased equipment on April 1 for $49,950. The equipment was expected to have a useful ife of three years, of 6,480 operating hours, and arout Of 51,350 The equpment was used for 1,200 hours during Year 1,2,300 hours in Year 2, 1,900 hours in Year, and 1,080 hours Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2 Year), and Year 4, by (a) the straight line method. (D) uns un sitout method, and (c) the date declan-balance method Note: FOR DECLINING BALANCE ONLY, round the multipler to four decimal places. The round the antwer for each year to the nearest whole dollar a. Straight-line method Year Amount Year 1 Year 2 Year Year b. Unitrof-output method Year Amount Year Year 2 Yout Year 4 Double-dining balance method Year Amount Year smo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts