Question: please help. ACCT 3003 Combined anos 5022 Help Save & Connect HW 7 (Chapter 5) CH 4 5 points On January 1, 2021, The Barrett

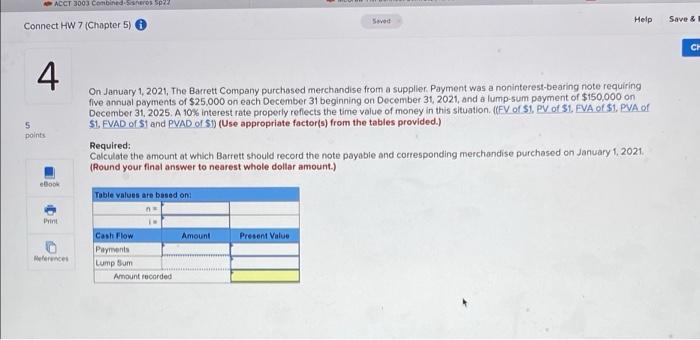

ACCT 3003 Combined anos 5022 Help Save & Connect HW 7 (Chapter 5) CH 4 5 points On January 1, 2021, The Barrett Company purchased merchandise from a supplier. Payment was a noninterest-bearing note requiring five annual payments of $25,000 on each December 31 beginning on December 31, 2021, and a lump sum payment of $150,000 on December 31, 2025. A 10% interest rate properly reflects the time value of money in this situation. (CEV of si. PV of $1. EVA of $1. PVA of $1. FVAD of S1 and PVAD of $1] (Use appropriate factor(s) from the tables provided.) Required: Calculate the amount at which Barrett should record the note payable and corresponding merchandise purchased on January 1, 2021. (Round your final answer to nearest whole dollar amount.) . Table values are based on Amount Present Value Merce Cash Flow Payments Lump Sum Amount recorded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts