Question: please help adjusting entries for interest im not sure if my work is correct Adjusting Entries for interest 3 and 4. These notri are desenbed

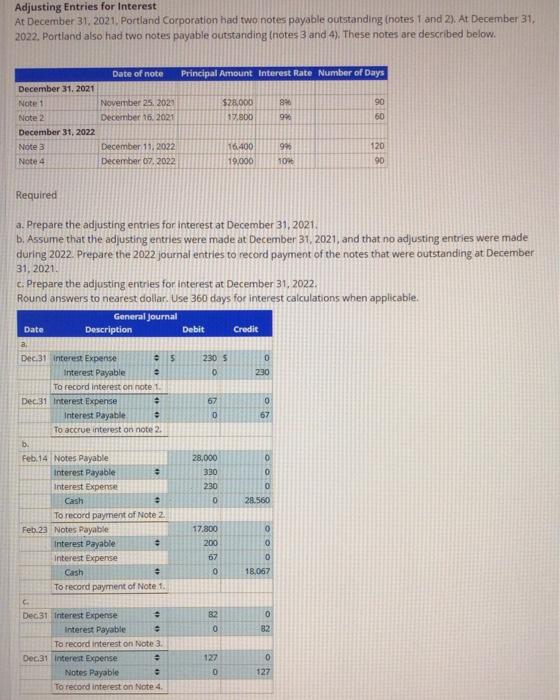

Adjusting Entries for interest 3 and 4. These notri are desenbed below: Propinted a. Phepare the atyasting entiner for interest at cecember 31,2021 . Priment of the notes that were toutuanding at Decinber 31,2021 C. Prepase the atiating entipes for ieterest at Deceniber 31,2022 Alound answers te neareut dellar use 300 don far interest calcilations when applicable. Adjusting Entries for Interest At December 31, 2021, Portland Corporation had two notes payable outstanding (notes 1 and 2). At December 31, 2022. Portland also had two notes payable outstanding (notes 3 and 4). These notes are described below. Required a. Prepare the adjusting entries for interest at December 31, 2021. b. Assume that the adjusting entries were made at December 31, 2021, and that no adjusting entries were made during 2022. Prepare the 2022 journal entries to record payment of the notes that were outstanding at December 31,2021 c. Prepare the adjusting entries for interest at December 31, 2022. Round answers to nearest dollar. Use 360 days for interest calculations when applicable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts